GroupM: Global ad market to hit $1tn a year early

Global ad expenditure is now expected to grow 7.8% in 2024 to $989.8bn, according to GroupM’s mid-year update to its This Year Next Year report — a significant uptick from the WPP media group’s previous prediction of 5.3% growth.

“Despite ongoing inflation in many markets, especially in regard to prices for food and shelter, consumer spending has been relatively resilient,” the report said. “And the boom in artificial intelligence products, services and enabling hardware has likely helped boost business investment in spite of incredibly restrictive economic conditions in markets like the US.”

GroupM expects the global ad industry to surpass $1tn in revenue next year — one year earlier than previously forecast.

Looking ahead, it has upwardly revised the forecast compound annual growth rate (CAGR) for the global ad industry through 2029, from 5.6% to 5.9%.

The mid-year forecast paints an increasingly optimistic picture, primarily driven by the strong recovery of China, continued growth in digital adspend and an acceleration in spend in retail media and connected TV (CTV).

Digital (defined as “pure-play” digital, excluding digital extensions of TV, audio, print and OOH) is expected to make up 70.6% of the total ad market in 2024 ($699bn). Last year, the largest five digital companies (Google, Meta, ByteDance, Amazon and Alibaba) accounted for 77.7% of the digital market.

Retail media, the fastest-growing segment of digital, will comprise 15.1% of the ad market this year and is expected to grow to a 17.4% market share by 2029.

Analysis: Big lift from China

The improved performance is largely attributed to a strong upward revision in China’s forecast. GroupM now estimates the country will record $199.4bn in ad revenue in 2024, up from an expected $148.2m in its December forecast.

Gains were driven primarily by growth in digital and OOH.

Podcast: GroupM’s global research chief on the state of the ad market

Chinese companies are also driving significant growth in other markets, with big spenders including Temu and Shein. According to GroupM, 75% of new marketplace sellers in the US in April were China-based, suggesting significant demand from Chinese brands for advertising.

GroupM upgraded its US forecast as well, now anticipating $365.9m in total ad revenue (excluding the impact of political advertising, which the agency expects to otherwise account for 4.1% of total US spend).

In a discussion with The Media Leader, Kate Scott-Dawkins, This Year Next Year author and GroupM’s global head of business intelligence, said: “The whole industry is really driven by the US and China. [They] are so huge that they really impact everything we talk about.”

The two countries combined are currently home to 22 of the top 25 global media sellers.

UK ‘coming out of a funk’

The UK is the world’s fourth-largest ad market, behind the US, China and Japan. GroupM predicts total UK ad revenue to grow by 4.9% to $47.8bn (£37.6bn), an upgrade of 0.3 percentage points from December’s report, although such growth is still slower than the rest of Europe on the whole.

Scott-Dawkins explained that Brexit remains responsible for weighing on UK growth, but things are moving in a relatively more positive direction even if at a slower pace than most of its continental peers.

“Things are more positive now, but I do think the UK, and Germany, are still coming out of a bit of a funk,” she said.

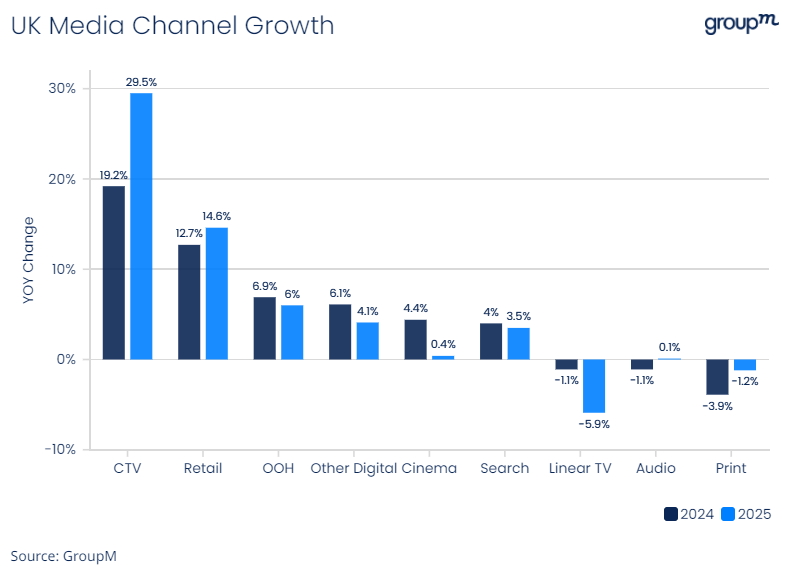

Growth by media channel in the UK is broadly comparable to other markets, with particularly strong growth expected for retail media and CTV, as public-service broadcasters continue to pivot their strategies away from linear.

“Receding inflation, low unemployment rates and improving consumer confidence are positive signals,” the report reads. “However, like many economies in the world, interest rates remain high. This has curbed new-business growth, which has been one of the drivers in advertising growth exceeding GDP growth in prior years.”

Scott-Dawkins does not expect the election year to have a noticeable impact on the ad market, noting that political advertising in the UK is “a small number”.

Regulatory scrutiny

Scott-Dawkins had previously honed in on the increasingly centralised nature of the global ad industry. From 2016 to 2023, Google, Meta, Amazon, ByteDance and Alibaba saw a CAGR of 23%, compared with just 2.1% CAGR for all other ad sellers in the same time frame.

“Advertisers would love to have lots of competition, lots of diversification,” said Scott-Dawkins. “That’s kind of not where we are right now.”

She expressed hope that between regulators stepping in to curtail the increasingly oligopolised digital ad market and the beginnings of a decline in interest rates, new companies should “have more runway to get going than they had previously”, especially if advertisers actively support greater diversification.

Brands should get out of the routine of unquestioningly increasing spend on digital channels that appear to be efficient but come with pitfalls. “Taking a step back and looking at things afresh is going to be very important going forward,” she advised.

This is especially true as the use of AI in advertising is so pervasive. GroupM estimates that 69.5% of total ad revenue this year will be “AI-enabled” (ie. AI is used at some point in the creative or media process) — a figure that is expected to grow to 94.1% by 2029.

In addition, much of the ad content on, say, social media is being shown to consumers in AI-driven feeds, with brands having at times little control over placements.

Meta, Google and Amazon growth suggests further concentration in online ad market

Scott-Dawkins added: “Because advertising is so much a part of the global economy and people’s culture now, it’s very top of mind with regard to regulation and legal cases. Taking a good look at investment and making sure [brands] understand where all that investment is going and be able to answer to that is going to be very, very important.”

She further suggested that brands should seek out “high-impact opportunities”, noting: “Those are vanishing as we’re shifting to all these highly personalised feeds. Prioritising some of those opportunities and investments [is key].”

In particular, Scott-Dawkins expressed confidence that sports will become increasingly important to advertisers for its increasingly rare ability to provide a broad sense of brand-safe community.