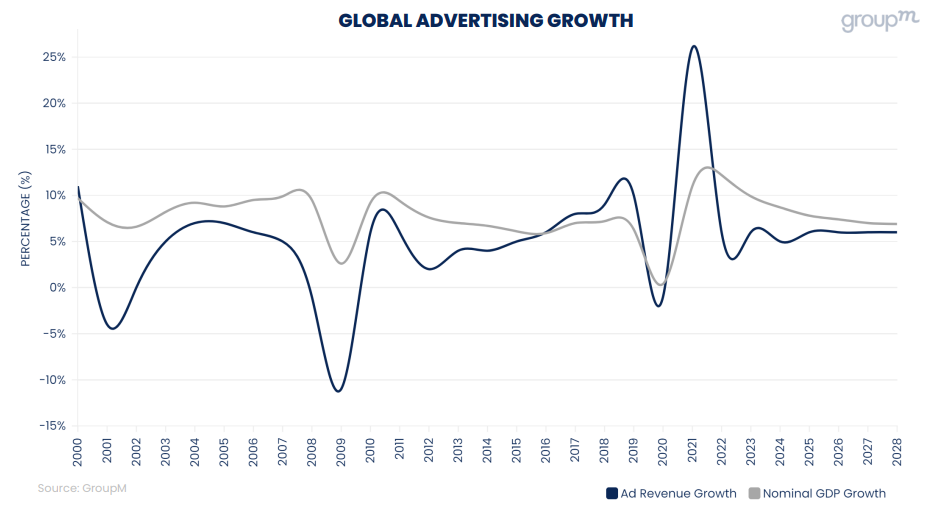

GroupM forecasts 2024 ad revenue slowdown

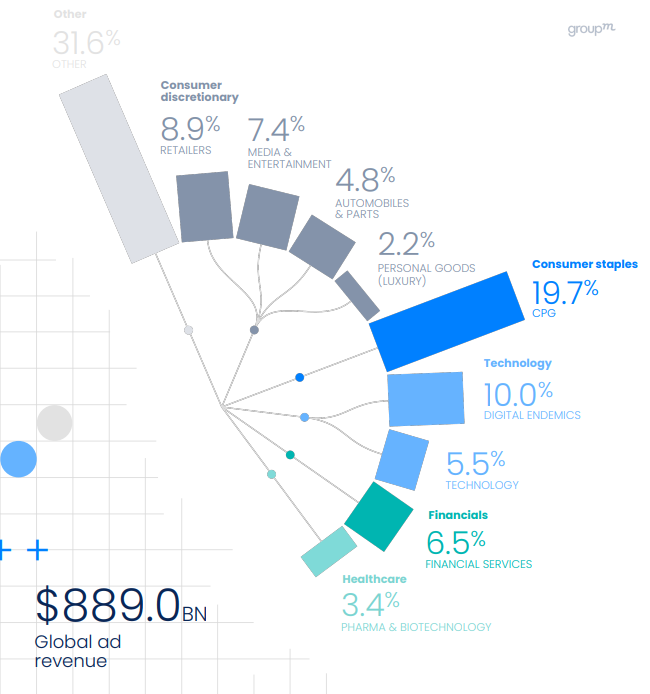

In its latest forecast, GroupM maintained its global ad revenue growth estimate at 5.8% to $889bn in 2023.

WPP’s investment arm now estimates a slight deceleration in growth in 2024 to 5.3%, however, and over the next five years anticipates 5.6% compound annual growth.

The slower expected global rate of growth in 2024 is being attributed to heightened interest rates weighing on business development, as well as uncertainty in the Chinese market.

Next year’s 5.3% growth will be better in real terms, however, as global inflation rates are expected to continue falling.

GroupM’s latest This Year Next Year report, authored by global president of business intelligence Kate Scott-Dawkins, examines and forecasts global and regional ad market outlook. Says Scott-Dawkins, “We’re really expecting a normalisation of growth over time” in the mid-single digits, as compared to the volatile market experienced during and after the Covid-19 pandemic.

UK: ‘Signs point toward higher interest rates for a longer period’

The UK remains the largest advertising market in Europe and also jumped Japan to become the third-largest ad market in the world, behind the US and China.

However, GroupM is clear-eyed about the economic struggles facing the UK market. “Like other economies, the UK faces challenges from rising prices and interest rates. But the effects in the UK are increasingly visible,” the report reads.

It notes that “signs point toward higher interest rates for a longer period,” consumer sentiment in the UK remains “on the cautious side,” and that the UK’s October inflation rate of 4.6% is still “above many similar advanced economies, such as the euro area.”

However, GroupM does not predict a “deep recession” in the UK despite the additional challenges posed by Brexit.

The UK’s ad market has skewed significantly toward what GroupM classifies as “pure-play” digital (inclusive of retail media, social media, and YouTube, but exclusive of digital extensions of traditional media, such as CTV and digital out-of-home).

The UK has the largest share of digital revenues relative to other European countries, with digital expected to account for 82.5% of the total industry ad revenues in the UK in 2024.

Retail media in the UK in particular is leading digital growth; GroupM expects the channel to grow 16.1% in 2024 and exceed TV ad revenues in 2025.

Digital dominance and retail media growth

Breaking the forecast down by medium, pure play digital‘s dominance becomes increasingly apparent globally as well. By 2028, GroupM predicts the digital market will be larger than the entire advertising industry was in 2022.

For 2023, GroupM has upgraded its previous June forecast from 8.4% growth to 9.2% growth.

Scott-Dawkins noted that the top five global ad sellers are not only digital, but are responsible for the vast majority of the ad industry’s revenue growth over the past seven years. Google, Meta, ByteDance, Amazon and Alibaba grew 25.4% on a compound annual basis from 2016-2022; excluding those companies, the market grew just 0.6% each year.

Meta, which has had a standout year in which it has both significantly cut costs and increased revenue, is on track to make $130bn in ad revenue alone this year.

That means the owner of Facebook and Instagram would account for 15% (nearly one-seventh) of total global ad revenue expected by GroupM.

The report does caution that social media companies including Meta and TikTok are under increasing legal scrutiny, primarily by the US, UK, and EU. Nevertheless, it expects social media ad revenue to grow by 10.5% in 2023 before decelerating to 6.9% growth in 2024.

Retail Media is the smallest segment within digital, but is growing quickly, adding more than $10bn in revenue in 2023 to $119.4bn and forecast to grow 8.3% in 2024. The estimated 2023 revenue figure amounts to a downgrade from GroupM’s June forecast of $125.7bn, driven by factors affecting the Chinese retail media market.

The largest retail media platforms by ecommerce gross merchandise value are dominated by three companies (2 Chinese, 1 American): Alibaba, JD.com, and Amazon. These three were twice the size of the next 17 players combined, which include the likes of Walmart and eBay. The US and China are thus still expected to represent 77.6% of global retail media ad revenue in 2024, though those markets will grow at a slower rate than others.

GroupM anticipates continued strong growth for retail media, and by 2028 it expects global retail media revenue to exceed that of linear TV and CTV combined.

Live sports even more important for linear

TV’s share of the global ad market will fall to 17.9% this year, which GroupM attributes to ad revenue from small- and medium-sized businesses (SMBs) primarily buying digital ads via Meta and Google; in comparison, larger brand advertisers still spend a larger share of their budget on TV.

Global TV ad revenue is expected to remain flat over the next five years, growing just 1.1% on a compound annual basis, with most of that growth driven by CTV (+9.5% on compound annual basis over the next five years). GroupM predicts linear TV ad revenue will fall to its lowest level since 2005 by 2028.

What is keeping linear TV afloat, increasingly, is sports and live events, which are now taking up a larger share of TV viewing. In the US, sports now make up 23.5% of all national TV hours watched, compared to just 14.1% in 2018.

Total streaming video revenue, meanwhile, is “nearing the tipping point” where it will overtake linear revenue as more streamers begin to add ad tier options atop subscription revenues. However, because many streaming consumers prefer paying more for ad-free tiers, and because ad inventory on streaming services is smaller than on linear, GroupM predicts average ad hours for US audiences will fall by 17% in the next four years.

Traditional media: long post-pandemic recoveries

In terms of other mediums, out-of-home (OOH) is forecast to grow 18.1% in 2023 and 14.6% in 2024 — an even faster rate than retail media, albeit from a smaller base — thanks to a resurgence of travel and airport advertising and growth in digital out-of-home (DOOH). However, GroupM notes that the medium is still not expected to surpass pre-pandemic spending levels until 2024 and is not expected to regain its pre-pandemic share of total ad revenue even by 2028.

Audio ad revenue, including from streaming services is expected to decline 2.9% year-on-year in 2023, and GroupM forecasts just 0.4% growth in 2024.

Print, classified by GroupM as encompassing both traditional and digital forms of newspapers and magazines, is expected to decline 4.6% this year and by 3.1% in 2024.

Noting that digital revenues are taking up an increasingly large share of total revenues for news outlets, GroupM now predicts digital revenues will represent more than half of total revenue for the channel by 2028. However, the report hints that publishers are likely to pursue strategies focused increasingly on live events and ecommerce as ways to diversify revenue.

Cinema ad revenue is forecast to grow 14.7% this year before decelerating sharply to 3.4% next year to pass $2.2bn. GroupM does not expect cinema ad revenues to surpass pre-pandemic 2019 levels ($3.0bn) within the next five years.

Globally, GroupM notes that CPG advertisers, which represent the largest group of advertisers with nearly one-fifth (19.7%) of global adspend, have been rewarded for maintaining or growing their media investment amid a downturn in the economy. The shift in business strategy toward viewing advertising as an investment rather than a cost appears to have won out, at least among these brands.

Regionality and the impact of China’s volatility

On China, the report suggests that its volatile economic situation this past year “both helped and hurt the advertising market.”

“Flagging domestic demand in China is a drag on luxury and beauty brand sales there, contributing to advertising growth in China that will be lower than we forecast in June,” it reads. “But that same slow domestic consumer demand has led more China-based companies to seek expansion overseas (see Temu, Shein, TikTok) and Chinese manufacturers to market themselves to international consumers, especially in the US, where demand has remained resilient for most of 2023.”

Scott-Dawkins told reporters she expects a “less robust” economic recovery in China than in other markets.

Sorrell: clients think of Europe for its costs, not its revenues

The fastest-growing market this year and next year will be India (11.2% in 2023 and 12% in 2024), with similarly faster growth in other emerging markets like Mexico, the Philippines, Poland and South Africa.

France, meanwhile, is expected to get a Olympic-sized bump next year — from 3.6% growth in 2023 to 8.3% in 2024 — due to their hosting of the Summer Games.

GroupM’s report does notably exclude political advertising, as it varies greatly year-to-year between elections. In the US, where political ad expenditure is highest, Scott-Dawkins notes in the run-up to the presidential election in November 2024 that $16bn is expected to be spent on political ads alone (this number rises to $17.1bn if including direct mail). US political advertising would be the 10th-largest ad market globally in 2024 on its own.