Meta’s ‘year of efficiency’ pays dividends

“This was a good quarter for business,” declared Meta founder and CEO Mark Zuckerberg on the company’s second quarter earnings call. “In addition to our core products performing well, I think we have the most exciting roadmap ahead that I’ve seen in a while.”

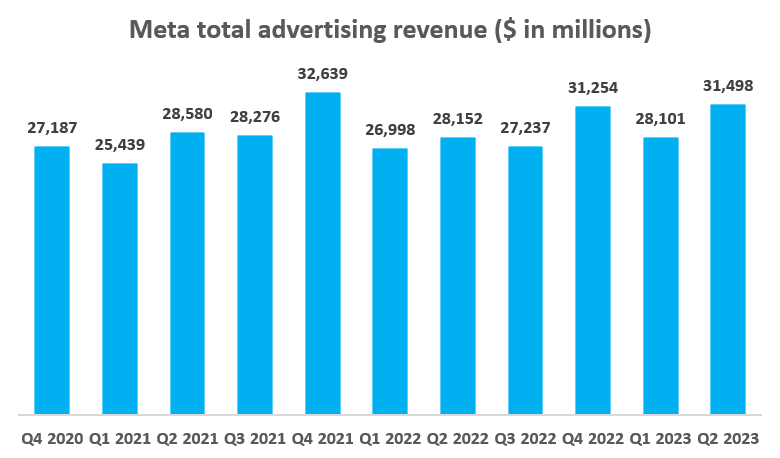

Meta’s self-proclaimed “year of efficiency” has resulted in strong financial results. Following a setback in 2022 that led to significant cost-cutting measures, including over 10,000 layoffs, in the first half of 2023, the social media and tech company reported 11% revenue growth year-on-year to £32bn in its second quarter earnings. Profit jumped 16% to £7.8bn; overall ad revenue grew 12% year-on-year to £31.5bn.

Zuckerberg pointed to optimism about growth for Instagram Reels and Threads, as well as “ground-breaking AI products in the pipeline” and the scheduled launch of its newest VR headset, the Meta Quest 3, in the fall of this year.

Last week, Meta open sourced its Llama 2 large-language AI model, allowing the public to access and use it to create ChatGPT-like chatbots, upsetting the status quo of the nascent AI market.

Analysis: ‘Back to basics’ pays dividends

Meta’s return to strong growth is evidence that the company’s ‘back to basics’ strategy laid out at the start of the year has helped right what was not long ago a wobbly ship. Whereas Meta’s emphasis on the metaverse throughout 2022 (including renaming the company from Facebook to Meta) backfired, the return in 2023 to addressing advertisers’ concerns over the company’s more established products has wooed the market. Shares of Meta have risen 147% year-to-date.

Meanwhile, Meta’s Reality Labs unit, which develops its metaverse products, lost an additional $3.7bn during the second quarter against just $276m in sales. Since the beginning of 2022, the unit has lost more than $21bn.

“The two technological waves that we’re riding are AI in the near-term and the Metaverse over the longer-term,” said Zuckerberg as he outlined the company’s product roadmap. Jumping on the AI hype train is savvy given investors’ keen interest in that market this year. Meta is deploying AI to aid in content discovery on its platforms, as well as monetisation tools and ad products. Says Zuckerberg, “Almost all our advertisers are using at least one of our AI-driven products.”

However, Meta is still well-positioned for future growth in virtual reality should it take off; Apple’s new Apple Vision Pro mixed reality headset, set to release next year, is likely to renew interest in the tech, but it will launch at more than three times the price of Meta’s own virtual reality headset, the Meta Quest. Meta’s product would thus likely be more popular among all but the most enthusiastic early Apple adopters.

The company is also positioning itself for growth in a number of areas closer to its initial vision as a social media company. Reels, Instagram’s TikTok clone, would be the main beneficiary of any government action taken against TikTok. Threads, meanwhile, has already taken advantage of Twitter’s (now known as X) tumultuous leadership under Elon Musk. Though Meta isn’t yet leaning heavily into monetising the app, and is still adding basic functionality (just this week Threads added a much-requested chronological feed of only accounts a user follows), early growth has been encouraging to Zuckerberg.

“We saw unprecedented growth out of the gate, and more importantly, we’re seeing more people coming back daily than I’d expected,” he said of the app. Threads broke records in adding over 100 million users within the first week of its release, but reports from third-party data firms have suggested daily usage of the app has dropped 75% in the three weeks since it launched.

“Now we’re focused on retention and improving the basics,” said Zuckerberg. “And then after that, we’ll focus on growing the community to the scale that we think is going to be possible. Only after that are we going to focus on monetisation. We’ve run this playbook many times before with Facebook, Instagram, WhatsApp, Stories, Reels and more. And this is as good of a start as we could have hoped for. So I’m really happy with the path that we’re on here.

“I’m highly confident that we’re going to able to pour enough gasoline on this to help it grow,” he added. “Once we get to the point where it’s at hundreds of millions of people, assuming we can get there, then we’ll worry about monetisation.”