Meta: back to basics?

Analysis

After a tough year for Facebook, Instagram and WhatsApp, Mark Zuckerberg is talking less about the metaverse and more about issues closer to advertisers’ hearts.

In its Q4 2022 earnings call, Meta’s CEO Mark Zuckerberg and CFO Susan Li showed a near-term shift in priority away from the metaverse and toward the bread-and-butter interests of advertisers.

Zuckerberg, who outlined his management theme for 2023 as “the year of efficiency”, described the team’s focus as on improving monetisation efficiency for its various platforms, including Facebook, Instagram, WhatsApp, and especially short-form video feature Reels.

The shift that accelerated in 2022 away from social media platforms like Facebook and Instagram being organised solely around people and accounts one follows to recommended content will allow for greater benefits to advertisers, Zuckerberg appeared to suggest. He added that he expects recommended content to grow to encompass 30%-40% of the content shown in users’ Facebook and Instagram feeds by the end of 2023.

Reels plays across Facebook and Instagram more than doubled in 2022, and the social component of people resharing the videos more than doubled on both platforms over the last six months.

However, the current monetisation efficiency of Reels is “much less” than Facebook and Instagram’s Feed. Zuckerberg described the strong user growth in Reels as having created a revenue “bottleneck” wherein the shift in users toward the short-form video platform is causing them to lose money. Four out every 10 of Meta’s advertisers use Reels ads across Facebook and Instagram, and a core interest appears to be to provide better value for them, and thus increased revenue for Meta, moving forward.

Responding to questions from investors, Zuckerberg said that “it’s not clear there’s much strategic advantage” in letting Reels scale further before working on monetisation efficiency. He added: “Our philosophy of building these consumer products, focusing on getting them to hundreds of millions or billions of people and then focusing on monetisation beyond that and bringing that in as a balance is the right approach. It’s served us well.”

Such business strategy has been maligned as leading to “platform death” by some recent critics, despite it being the norm across numerous successful digital platforms for years.

Eschewing favouritism of the metaverse, Zuckerberg described Facebook and Instagram as the “first two pillars of our business” and added that he hopes to bring “messaging online” as the next pillar over the next few years.

Zuckerberg shared optimism about the company’s click-to-message ads, which are ads that direct users into conversations with businesses in Facebook Messenger, Instagram or WhatsApp. He said the feature is currently at a $10bn run rate, and hopes to continue to onboard more businesses to Meta’s other online messaging feature, paid messaging through the WhatsApp Business Platform.

Positive performance

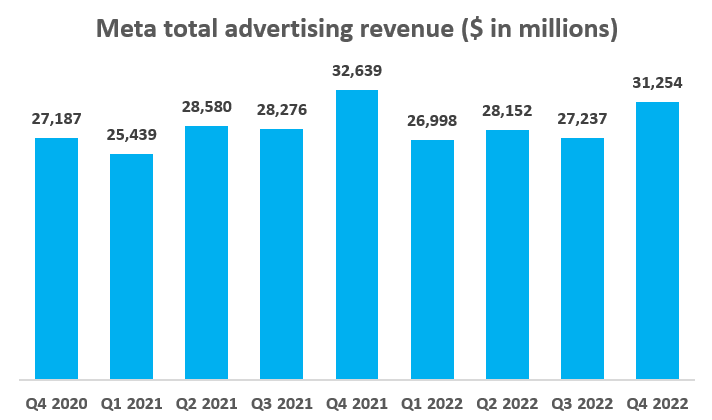

Though Meta reported ad revenues fell 4% year-over-year to $31.2bn, Li added that in constant currency terms, it actually grew 2%. The company ended the year on a relative high note, attaining a 15% quarter-on-quarter jump in ad revenue from Q3 to Q4.

Breaking the numbers down by region, Li said that ad revenue growth was strongest in its “Rest of World” category (+5%), which includes Latin America and Africa. Growth in North America was flat while Asia-Pacific and Europe declined by 3% and 16%, respectively, highlighting the strong regional difference in Europe as the continent continues to see fallout from Russia’s invasion of Ukraine.

Li said Asia-Pacific and Rest of World regions drove growth in the total number of ad impressions served across Meta’s services (+23%); meanwhile the price per ad decreased 22% thanks to impression growth, lower advertiser demand, and foreign currency depreciation.

Commenting on the performance in his newly launched Substack newsletter, former GroupM head of business development Brian Wieser said that “while performance is always pleasing to see, it is rare that marketers define it in the same way that media owners do.”

He added: “It remains safe to say that total industry growth likely drives the overall pool of available budgets, with partially objective and partially subjective factors driving spending into digital channels and more subjective factors driving spending into Meta in particular.”

Objective figures on Meta’s userbase did at least increase in Q4; the number of daily users across Facebook, Instagram, and WhatsApp was the highest its ever been, with Facebook in particular now reaching 2 billion daily actives.

Zuckerberg also said that Meta’s investments in artificial intelligence were already paying off, with advertisers apparently seeing over 20% more conversions in Q4 2022 than in the year prior. Combined with a declining cost per acquisition, this has led to higher returns on ad spend, he argued.

‘Still a pretty volatile macro environment’

Meta’s executives predictably faced questions on the state of the business within the context of the uncertain macroeconomic environment. Major tech players including Facebook, Google, and Snap saw ad revenues decline throughout 2022 as budgets tightened and advertisers pulled spend on some digital platforms while retaining or growing spend in other mediums or competitors like TikTok.

Further adding to their woes, Apple’s new privacy policy has made a dent in the ability for companies like Meta to track users and serve personalised ads.

Li noted that Meta’s Q4 revenue “remained under pressure from weak advertising demand” and that the holiday season fell within its range of performance expectations.

“Trends in online commerce modestly improved for us, which is encouraging, but again, the growth was still negative year-over-year. So overall I think this is still a pretty volatile macro environment,” she added.

Addressing the impact of Apple’s privacy changes, Li said that there is “still certainly an absolute headwind to our revenue number” but that Meta is “making progress in mitigating the impact” by developing new advertiser tools, including formats that bring conversions on site and longer-term AI investments in “privacy-enhancing technologies”.

Li also brushed aside concerns over the European Union Data Protection Commission (DPC) cracking down on Meta’s current privacy practices, saying: “We don’t expect that those decisions are going to affect our ability to provide personalized advertising in the EU.”

The DPC fined Meta nearly €1bn in September of last year and currently has over a dozen open investigations into the company.

Metaverse not necessarily on the backburner

While the primary focus of Meta’s earnings call, including and especially in fielding questions from investors, was on the basics of efficiency for its ads model, the backdrop is still one of a company that is looking to transition more into virtual reality.

Meta’s Q4 expenses were up 22% year-over-year to $25.8bn, $4.28bn of which is dedicated to investment in metaverse development through the company’s Reality Labs department. Over the course of 2022, Reality Labs lost $13.7bn.

Zuckerberg signalled that the investment would lead to the launch of a next generation consumer headset sometime in 2023, which he boasted would act as “the baseline for all headsets going forward, and eventually of course for AR glasses as well.”

Meta’s current virtual reality devices have over 200 apps that have thus far made just $1m in revenue.