Meta, Google and Amazon growth suggests further concentration in online ad market

Meta, Alphabet and Amazon each reported earnings this week, with their ad revenues collectively growing more than $17bn year on year in Q4 alone.

Facebook and Instagram owner Meta grew ad revenue by 23.8% year on year to $38.7bn, with growth attributed to investments in AI technology leading to an improved ad-buying experience, as well as increased spend from Chinese retailers.

Such growth was achieved even as the company decreased its headcount by 22% in the past year.

Meta also announced its first-ever dividend payment to shareholders and boasted that its Twitter competitor, Threads, now has 130m monthly active users.

Alphabet saw total ad revenue rise 11% year on year to $65.52bn. Within this, search grew 12.7% and YouTube 15.5%, but Google’s advertising network was slightly down (-2.1%). YouTube’s Music and Premium subscription services also surpassed a combined 100m global users, up from 80m reported in November 2022.

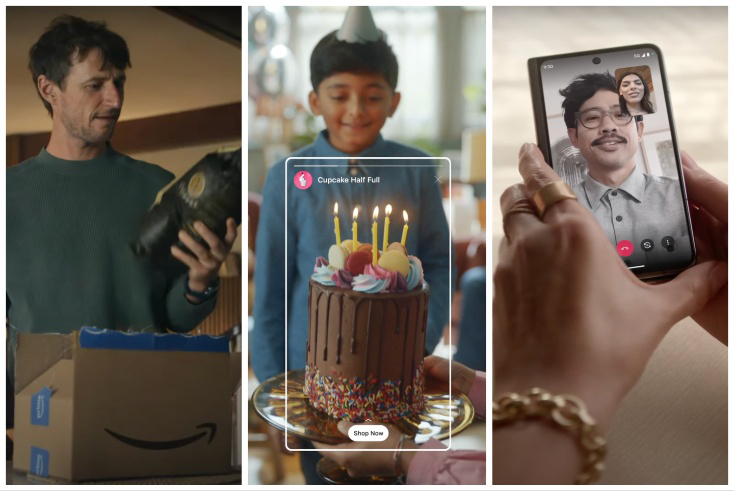

Amazon’s ad services, meanwhile, grew 26.8% year on year to $14.65bn, with the company saying growth was “primarily driven by sponsored ads” as opposed to display and video units.

It is increasingly leaning in to advertising as a high-margin revenue driver and is launching a default advertising tier on Prime Video in a number of countries including the UK this month.

Analysis: ‘Concentration in online advertising’

In his Madison and Wall newsletter, financial analyst Brian Wieser called Meta’s $7bn incremental Q4 ad revenue “massive in absolute terms”, noting the company now comprises around 17% of the world’s total ad market outside China.

“If that incremental revenue were any other company’s full-year revenue, by itself it would be among the top 10 sellers of advertising globally,” he wrote.

Indeed, Alice Enders, head of research at Enders Analysis, believed there are “substantial indicators of concentration in online advertising” that she ascribed to first-mover advantages in two-sided marketplaces for ads.

“Google dominates search, Meta is a scale player in display (with some competition from YouTube and TikTok) and Amazon is the only player in its walled garden,” she told The Media Leader.

Enders noted that publishers have been increasingly crowded out of the digital market, with many retreating behind their own walled gardens via paywalls. “Algorithm changes by platforms are of course not helpful to traffic to publisher sites,” she said.

Meanwhile, Enders senior media analyst Jamie MacEwan added that the macroeconomic downturn has biased buyers towards advertising channels that can prove a return on spend.

This is where big platforms have an advantage by capturing large shares of user activity, especially close to the point of purchase. “If you’re not core, you’re looking over your shoulder,” he said.

TMT analyst Alex DeGroote agreed, telling The Media Leader that there is a reasonable “oligopoly thesis” to be considered that applies to most media sectors in Western markets currently, as walled gardens squeeze out smaller players.

According to GroupM’s December This Year Next Year report, the top five global ad sellers — Google, Meta, ByteDance, Amazon and Alibaba — have become responsible for the vast majority of revenue growth over the past seven years.

On The Media Leader Podcast, GroupM head of business intelligence Kate Scott-Dawkins, who wrote the report, pointed out that much of the growth is being led by small and medium-sized businesses, as well as innovations in AI to benefit all advertisers.

“Direct buyers rather than agencies and large advertisers are a majority of revenue for companies like Meta, Google and Amazon, and the self-service mechanisms they have put in place to make it easier for small businesses […] has really helped them gain ground and pick up that long tail of advertisers,” she said.

The UK Competition & Markets Authority has previously warned that declining competition in the online ad market is likely to negatively impact consumers, who would otherwise see “substantial financial gain” from a more competitive market.

Podcast: GroupM’s global research chief on the state of the ad market