Netflix seeks ‘crawl-walk-run’ approach as it looks to introduce ads

In just six months, Netflix has gone from announcing an ad tier to, by November 3, making it a reality.

In the streaming company’s earnings call on Tuesday, chief operating and chief product officer Greg Peters described their approach as “a crawl-walk-run kind of model” focused on launching the product even if it lacks full-fledged features that will come in later iterations.

Some marketers and agencies have criticized the ad tier’s offering as limited, particularly given high reported costs for CPMs in excess of $65 (£50).

Simon Davis, founder and CEO of London-based media agency Walk-In Media told The Media Leader the launch offering was “rudimentary” relative to what he’s used to buying for video-on-demand (VOD).

When prompted in the earnings call about such feedback, Peters stated: “Part of what we want to do is actually get this out to market quickly […] But we do have relatively basic targeting capabilities in terms of contextual targeting, genre, etc.

“But that’s sort of consistent with what we see with television as well, right? And obviously now our job is to move from that into more of what we expect from a digital world where we have 100% signed-in audience, fully addressable, fully targetable, and so we can start to layer in additional targeting measures over time.”

Peters added that, from a business perspective, Netflix is expecting the launch to be “roughly revenue positive-to-neutral” in the short term and will lead to significant incremental revenue and profit in the longer term. CFO Spence Neumann added that “it’s going to be pretty small out of the gates” from a revenue perspective, in part because it is an intra-quarter launch.

The company anticipates the new tier will bring in “a lot more members”, that it will help to decrease churn rates, and that users will pick and choose what plan is best for them and, it is hoped, stick to it.

However, given the inflationary environment and the potential for recession, Alice Enders, head of research at media research service Enders Analysis, predicted to The Media Leader the potential for increased “spin-down” from the more expensive ad-free option to the cheaper ad-included alternative, especially in countries with particularly exacerbated cost of living crises, such as the UK.

A report from Enders Analysis further added that the research service believes it is unlikely the new ad tier would sufficiently alleviate churn, as it anticipates the “Basic with Ads” tier will comprise only roughly 10% of Netflix’s total subscriber base given that, in their view, “the product offering is arguably worse value” than the other subscription tiers on offer.

‘Thank God we’re done with shrinking quarters’

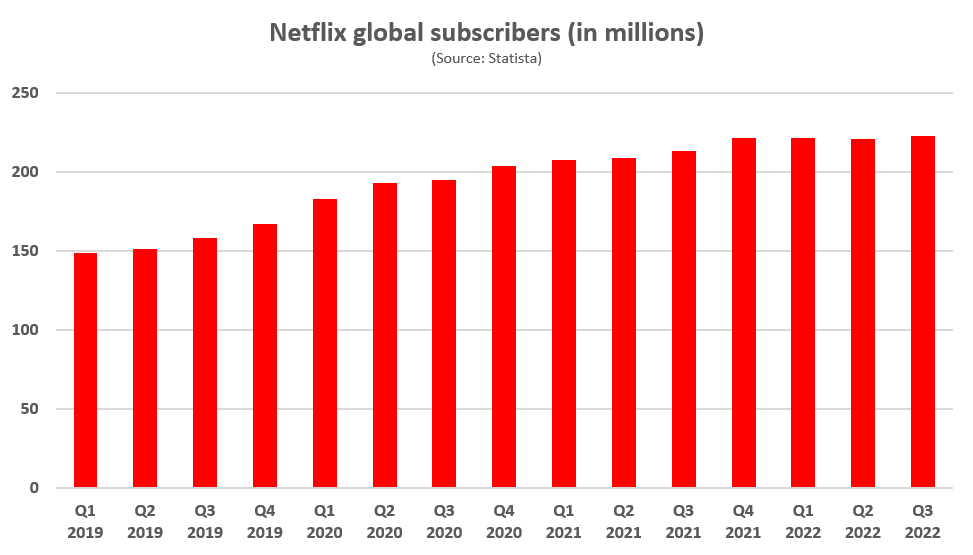

In its Q3 earnings, Netflix added 2.41 million net global subscribers—a needed boost for a company that had seen subscribers slip for the first time in Q1 and Q2 of this year—and anticipates adding an additional 4.5 million net subscribers in Q4, though the company will stop reporting subscriber estimates beginning in Q1 2023 as it shifts its focus to other metrics.

The growth in Q3 subscribers was led by the Asia-Pacific region (1.43 million) as opposed to relatively sluggish growth in the US and Canada (100,000).

The company also beat Wall Street expectations on revenue ($7.93bn vs. $7.84bn expected) and earnings per share ($3.10 per share vs. $2.13 expected).

On the numbers, co-CEO Reed Hastings said candidly: “Well, thank God we’re done with shrinking quarters.”

‘A pro-consumer experience’

Peters further elaborated on developing the company’s ad offering, saying that Netflix will be adding “a lot of capabilities over the next couple of quarters that we think are important to advertisers”, pointing to the recent news of adding Integral Ad Science and DoubleVerify as verification partners, as well as joining BARB in the UK, as examples.

When pressed on ad inventory being rumored to cost two-to-three times those of CTV or other AVOD players, Peters refused to comment on pricing, but rather described advertiser demand as “very strong” thanks to its “very attractive offering” of delivering to an audience that is “hard to access in other ways, certainly harder to access in traditional TV in many cases”.

“We wanted to start with an experience that’s very pro-consumer, so that’s definitely informed both our ad load and thinking about the frequency capping,” added Peters. “What I love about those things is the more we talk to brands and advertisers, there’s actually a high degree of alignment between sort of what their desires are and we think is great for consumers.”

Agency buyers like Davis, who described the offering as coming in at “the very very top end of VOD pricing”, are skeptical.

“The question that Netflix will have to prove is that they can pick up live viewers. […] The channels that charge a premium in the UK are able to charge a premium because they can show that they’re picking up live viewers who aren’t watching other channels.

“That argument is yet to be proved in the UK because, generally speaking, the reality is that people who have Netflix are some of the heaviest TV viewers.”

Davis admits the market may be different in the US or other countries, but he nevertheless expects Netflix to be “disappointed in terms of advertising revenue if they think that the numbers they’ve put into the market for people to pay are going to be achievable.”

“Either they’ll have to improve [their offering] very rapidly, or they’ll have to reprice themselves to put themselves at a more realistic level that is comparable to, say, YouTube.”

For its part, Netflix believes in the attractiveness of its offering, especially as it positions itself to compete more directly with linear TV, which has been shedding young viewers for years. Hastings described that advertisers are “just being able to reach fewer people” and that the 18-49 demographic “is even faster than the decline in pay TV” which is “really fueling the cycle that really collapsed linear TV as an advertising vehicle outside of a few properties like sports.”

Meanwhile, Netflix’s pro-consumer approach appeared to be more pragmatic when it comes to account sharing, which the company signaled it will be beginning to crack down on in early 2023. In advance of the earnings call, Netflix announced a new ability to transfer over profiles into new accounts so that personal data and recommendations are not lost when users are forced to pay up with new accounts.

‘Unwinding the logjam’

Co-CEO and chief content officer Ted Sarandos remarked that, from a production standpoint, Netflix was still dealing with fallout from the Covid pandemic that has caused challenges in releasing content.

“It will take several years to completely unwind the Covid logjam […] So we’re trying to be more and more aggressive about smoothing that out to make sure that the content is available when people are ready to watch it.”

Sarandos pointed out that seven of the company’s most popular releases of all time occurred in the last quarter, including the massively successful Stranger Things 4 and Dahmer – Monster: The Jeffrey Dahmer Story.

Looking forward, Hastings sees a continued focus on bringing sports over to on-demand from all the major players, including Apple and Amazon, while Netflix and Disney invest heavily in becoming the two big brands in the premium space, and YouTube continues to grow on CTV.

‘Seriously exploring a cloud gaming offering’

Separately on Tuesday, Netflix VP of Gaming Mike Verdu told a crowd at TechCrunch Disrupt that Netflix was “seriously exploring a cloud gaming offering”.

The announcement comes not long after Google announced it would be shutting down a similar cloud gaming project, Stadia, in January.

Verdu added that Netflix would be opening a new internal gaming studio in Southern California. It will be Netflix’s fifth studio, and follows last month’s establishment of another new studio in Helsinki helmed by former Zynga VP and GM Marko Latiskka.

Netflix currently has 35 games on its service, with 14 games in development at its internal studios, and 41 additional games “in flight”, according to Verdu.

Shares of Netflix jumped over 14% on the earnings report.