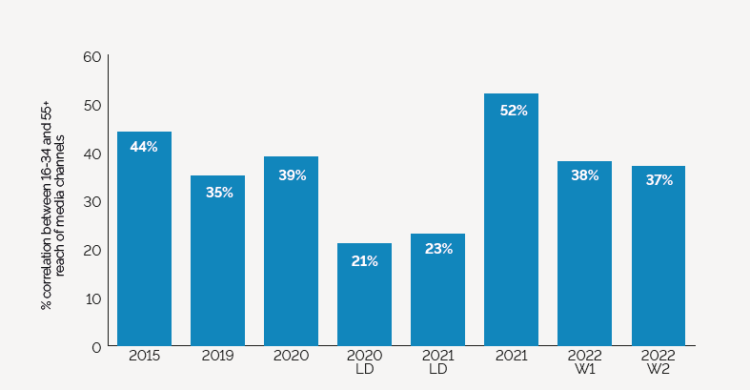

Similarity in media habits between generations fell 29% year-on-year as consumers reverted to pre-pandemic behaviours, the IPA trade body has revealed in its latest TouchPoints report.

The latest data stands in stark contrast to last year’s TouchPoints report, which found that the media habits of the old and young had begun to narrow, thanks in part to pandemic-era media digital media consumption growth.

Whereas last year there was a 52% correlation in commercial media usage behaviours of 16-34s and over-55s in terms of reach, the number has now dropped to 37% — lower than pre-pandemic figures (39%), reports the fifth edition of Making Sense: The Commercial Media Landscape.

“I believe a lot of the drastic shifts we have witnessed may prove to be short-lived as we settle into post-pandemic 2023,” said author of the report and head of IPA TouchPoints marketing and data innovation Simon Frazier.

“The new tech-driven consumption behaviours by the 55+ market that drove the similarities have waned and evidence of increasing divergence has returned,” he added.

In part thanks to the changing habits between generations, the IPA concludes that, for the fifth year in a row, only out-of-home (OOH) consistently delivers over 90% weekly reach across all age groups. Commercial live or recorded TV manages similar reach, but only among over-55s—the only other media and age bracket combination to reach that mark.

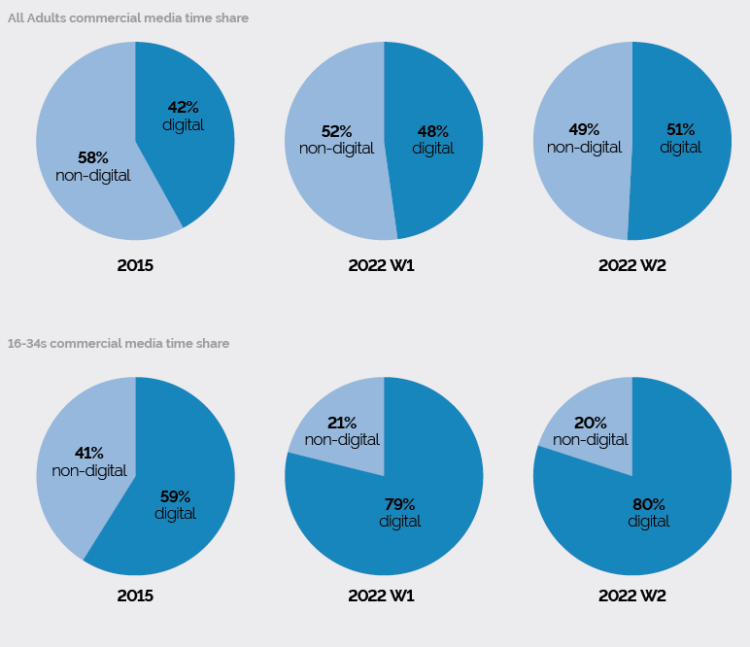

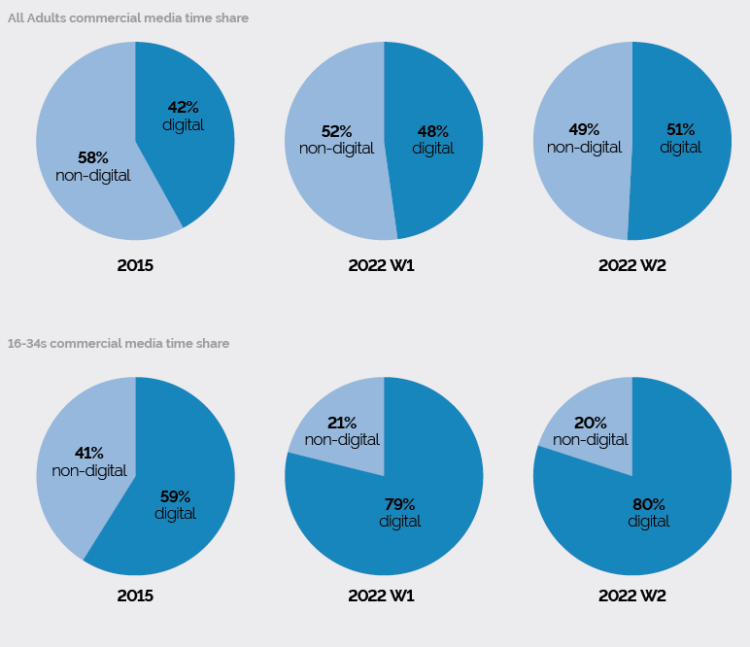

Younger audiences are predictably spending much more time with digital media than older generations. While overall share of all adults’ media consumption is 51% digital, that number rises to 80% for 16-34s compared to just 28% for over-55s.

For the first time, each of the top five media properties among 16-34s are video sharing and social media platforms — led by Facebook (71% reach) and followed by YouTube (70%), Instagram (68%), Snapchat (44%) and TikTok (43%). Previously, ITV/STV was in the top five, before the broadcasters were unseated this year by TikTok.

In comparison, over-55s’ top properties included four commercial TV channels: ITV/STV, Channel 4, Channel 5, Sky Entertainment, as well as Facebook.

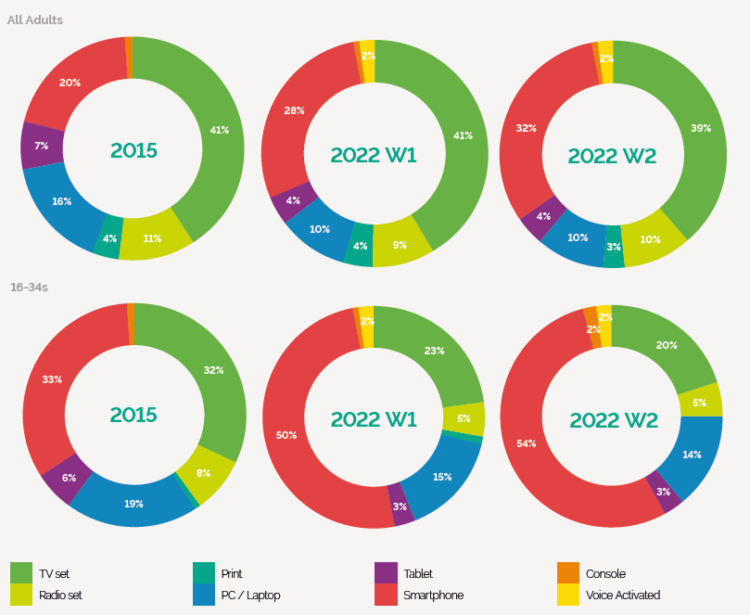

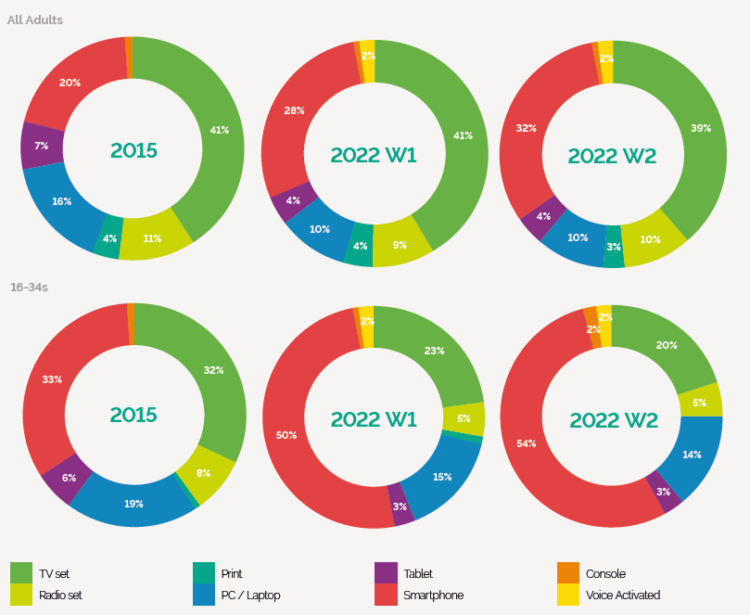

The dominance of the smartphone, particularly among young people, is named as a contributing factor for the change. Overall, UK adults now spend nearly as much time on a smartphone (32%) as they do watching a TV set (39%), with no other device taking a higher share than 10%.

Young people, in particular, now spend 54% of their curated commercial media time on their phones, up from 47% pre-pandemic. Share of time spent on a TV set fell to an all-time low of 20% among the youngest demographic.

Commercial media usage among Britons in general continued to decline, with consumers now spending 51 minutes less consuming curated commercial media as compared to 2015, and 15 minutes less time than pre-lockdown 2020.

The fall in time spent with curated commercial media is led primarily by those in the 16-34 age group, who now spend an hour and 22 minutes less with curated commercial media, a 22% decrease from 2015. 34-55s and over 55s have respectively seen just a 3% decrease in time spent with curated commercial media over the same timeframe.

“The disruption of the past few years has seen further fragmentation of the media landscape alongside an overall decline in curated commercial media opportunities which makes it increasingly complex to effectively engage with consumers and optimise media spend accordingly,” reflected Frazier. “Accurate, detailed data and diverse media plans are therefore crucial.”

Frazier, however, is optimistic that consumers’ time with curated commercial media will increase in the near future as ad-funded models become popularised, particularly among major streaming-video-on-demand (SVOD) players like Netflix and Disney+.

He adds: “Despite a lukewarm initial reception in the industry regarding audience scale and CPMs, I believe this will represent not only a substantial revenue generation stream for the likes of Netflix, but also a potential new opportunity to reach previously walled-off audiences on a scale that only the BBC could rival if it were to pivot the same way.”

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.