GroupM’s global advertising growth estimate for 2023 remains unchanged from its December 2022 forecast at 5.9% growth.

The WPP investment arm’s mid-year forecast, titled ‘This Year Next Year’, found that, excluding US political advertising, global advertising in 2023 will total $874.5bn. GroupM further predicts 6.0% growth in 2024.

The 5.9% expected growth in 2023 is in nominal terms; such an increase will be a decline in real terms, given the International Monetary Fund (IMF) expects global inflation to hit 7% this year.

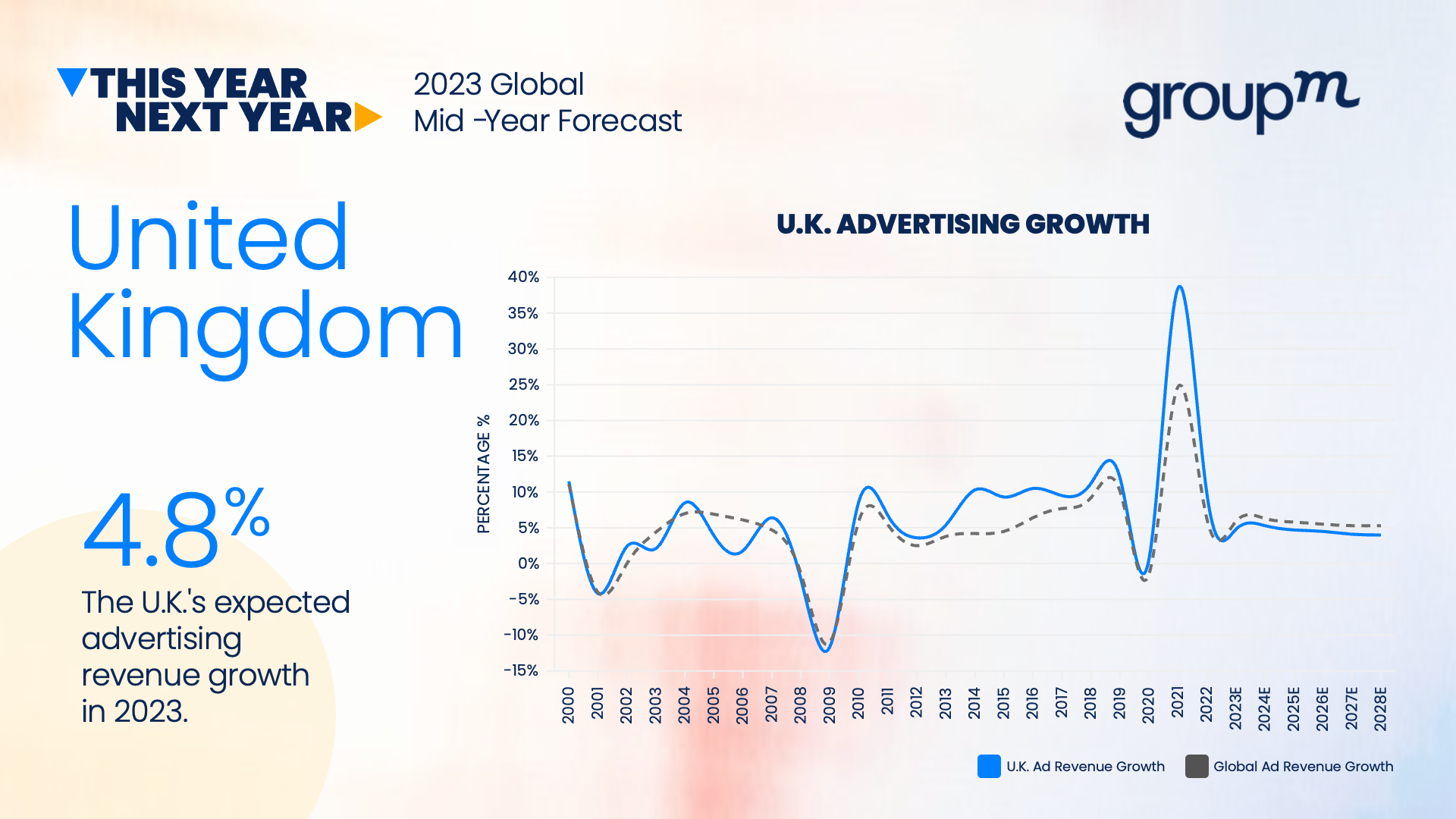

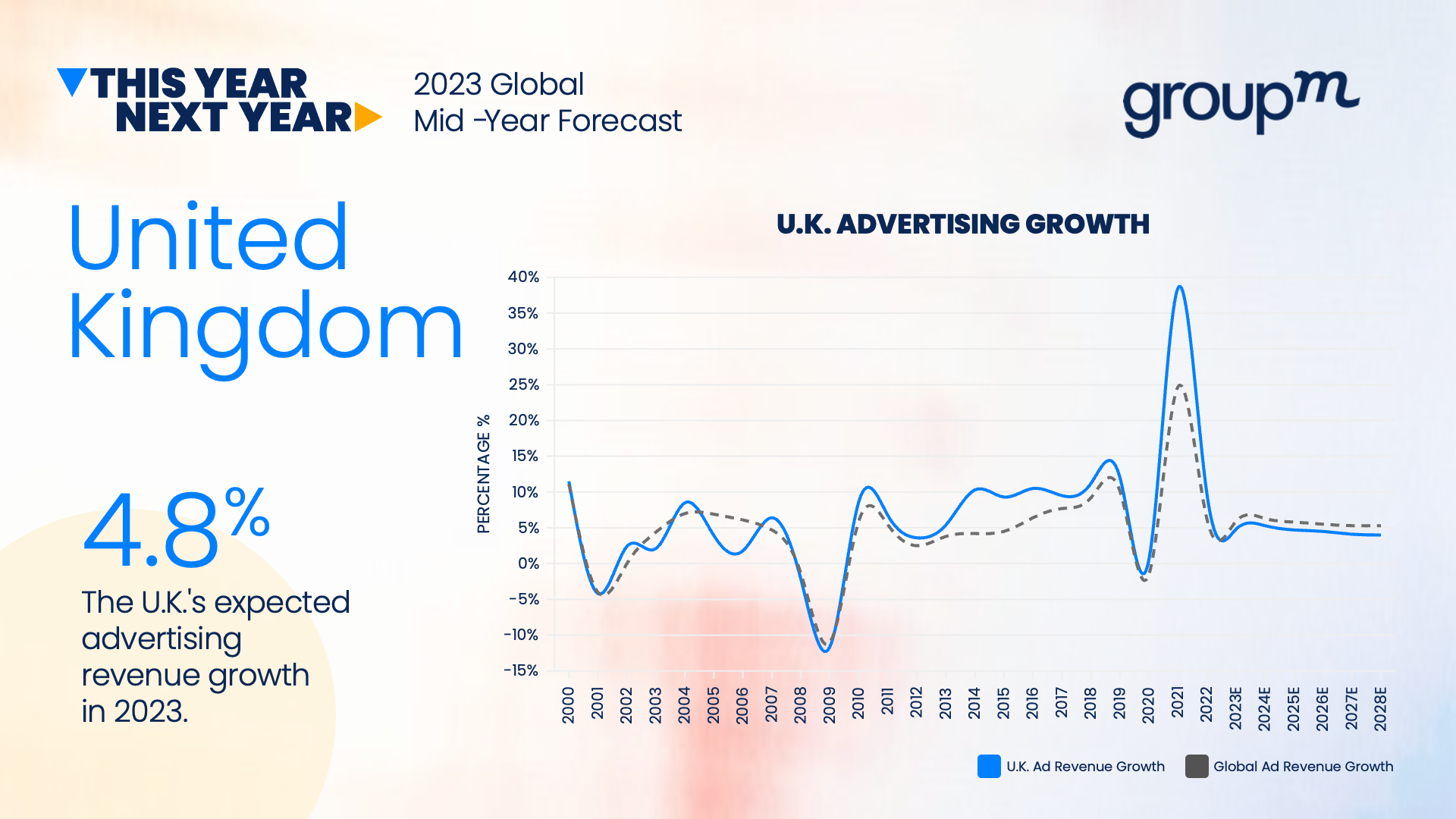

In the UK, nominal ad growth of 4.8% is anticipated. “The UK remains a little more challenged,” said GroupM’s global president of business intelligence Kate Scott-Dawkins. “In addition to coming out of the pandemic, we’re still seeing the effects of Brexit on the economy.”

‘Maturity’ of digital and ascendency of retail media

Pureplay digital ad revenue in 2023 is expected to account for 69% of total global revenues. GroupM notes a “marked deceleration” in digital adspend growth, as it expects 8.4% growth in 2023 compared to 32% growth in 2021.

The high single-digit growth figures are the slowest digital has seen since 2009 during the great financial crisis. However, the report argues that the deceleration “should be thought of more as a function of the size and maturity of ‘digital’ rather than a recessionary environment” (the IMF forecast from April 2023 expects global GDP growth at 2.8% in 2023).

“With digital now more than two-thirds of total advertising, digital growth at historic double-digit rates has become difficult to achieve, and we expect digital to decelerate further over the next five years,” the report said.

Retail media proves the exception this year, with growth forecast at 9.9% for 2023 to total $125.7bn and represent 14.4% of all advertising. Notably, of the top 25 media owners by ad sales globally, 5 are in retail media (including Amazon and Alibaba) and 17 are in digital. However, Scott-Dawkins did note that she is “noticing share shifts” in retail media, with smaller players like Walmart, Tesco and Sainsburys increasingly taking market share from Amazon as the overall retail media market grows.

Linear audiences continue to decline on TV, with viewership quickly shifting towards connected TV. In 2023, global traditional TV revenue is forecast to be $133.6bn (excluding US political advertising), a decline of 1.2% from 2022. By comparison, CTV revenue in 2023 is estimated at $25.9bn, an increase of 13.2% compared to 2022. Linear is increasingly being supported by live sports, which represented 21% of the time people spent watching national linear TV (up from 15% four years ago). Scott-Dawkins added that there is “ample headroom” for total subscription video-on-demand (SVOD) spending to continue increasing, especially in markets where pay-TV penetration has been historically high.

Global audio is forecast to decline in 2023 (-0.3%) and remain “roughly flat” over the next five years. GroupM writes it “does not expect audio to regain pre-pandemic revenue despite the continued growth of digital audio, which is estimated to increase revenue 10.9% in 2023, reaching $9.9 billion in 2028.”

Despite growth in its digital extensions, print media is also expected to continue its decline this year by -4.8%. By 2028, GroupM now expects print’s share of total advertising revenue to drop from 5.7% this year to just 3.7%.

On the other hand, out-of-home is now forecast to grow 12.7% in 2023, thanks in part to a strong rebound in China, which is expected to grow 40% after declining by the same rate in 2022 due to pandemic lockdowns. OOH is now expected to surpass 2019 revenue levels a year earlier than GroupM had predicted in its December 2022 forecast. The sector is primarily being led by strong growth in digital (up 26.1% in 2023 to $13.3bn), which now represents 37% of total OOH revenue and is expected to represent 43% in 2028.

How OOH can overcome its ‘5% syndrome’

Pulling off a ‘soft landing’?

Macroeconomic stability is still a major concern for the health of the advertising industry. Scott-Dawkins said that we have now reached a point where, globally, continued price increases have created added “friction” in consumer spending. GroupM has been working under the assumption that the economy would be able to manage a “soft landing”, which at present appears to be a distinct possibility.

Part of why GroupM appears optimistic about the broader health of the economy is that business applications (individuals applying to start new businesses) have been up this year in a number of major economies. EU business applications were up 8.2% year-on-year, with Germany up 38%; US applications, meanwhile, remain well above pre-pandemic levels. Scott-Dawkins said she believes businesses could be boosted by using AI for improved productivity and efficiency among start-ups and small- and medium-sized businesses.

According to GroupM, the industry is already using artificial intelligence to inform half of all ad revenue, and the agency expects this will surpass two-thirds of ad revenue by 2028. This has occurred despite a lack of discussion, standardisation and controls or regulations instituted on the use of AI for work. Lawmakers around the world and especially in the EU have signalled their interest in promptly regulating the use of AI, a development that has been welcomed by AI companies themselves.

Broadly, however, Scott-Dawkins portrayed GroupM’s retention of its December forecast as an optimistic sign that the industry will start to improve performance. She added: “We expect, in the second half of the year, more of a recovery story.”

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.