GroupM downgrades growth forecast but expects ‘deceleration, not decline’

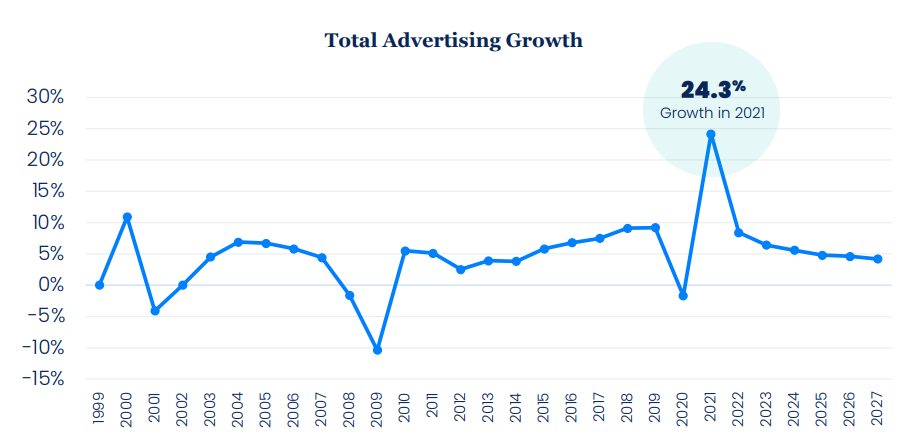

GroupM downgraded its 2022 ad business growth forecast from 9.7% to 8.4% but struck an overall optimistic tone about the state of the economy and ad business in its latest report.

The WPP media investment company noted that most marketers are still adding to their media budgets in 2022 – it is just occurring at a slightly slower rate than last year.

The forecast downgrade was described as caused primarily by slower growth from China, due in part to ongoing pandemic lockdowns and other policies, such as the Data Security Law and Personal Information Protection Law, as well as time limits on minors playing video games, that impact the ability of some marketers to engage with consumers.

China’s growth forecast was cut significantly, from 10.2% expected growth in December to 3.3% now.

The war in Ukraine was not considered as having a “global impact in a meaningful way” on the advertising industry by Brian Wieser, global president for business intelligence at GroupM, though its effects will be felt locally in Eastern Europe.

GroupM also now anticipates for the US to grow 10% in 2022.

The US estimate excludes political advertising, which GroupM expects to account for $13bn this year as the midterm election season heats up.

Such growth will mean the US will comprise a projected 39% of global adspend – nearly double the next-largest country, China (20%).

In the UK, GroupM notably upgraded their estimate from 7.3% growth in December to 9.3% due to “incremental increases in digital advertising growth expectations, primarily following on the remarkable 39% growth rate observed during 2021.”

‘Deceleration, not decline’

GroupM expressed optimism in the face of economic challenges – namely the rising cost of living – in 2022.

Wieser noted that inflation-adjusted expectations are not dissimilar to 2019, which he described as a good year for the business.

“Recession should not be the base case scenario,” said Wieser, adding that we should expect a “deceleration, not decline” in economic growth.

The forecast notes: “It should be unsurprising after the extraordinary growth of 2021 that we would see a deceleration in 2022, especially among the largest digital players, and there are still meaningful sources of growth fueling the global advertising industry.”

Wieser supported the more-positive economic outlook by pointing out continued low unemployment rates, stable household savings, robust total consumer spending, and still-low interest rates (even as hikes have been announced).

The GroupM report added: “Generally, we hold the view that so long as real (inflation-adjusted) economic growth is positive, inflation should be a positive contributor to advertising growth.”

“If economy-wide inflation runs hotter than we expect this year, so too should our forecasts for advertising because of the general impact inflation has on advertiser budgets. This should be true so long as any central bank interest rate increases do not cause reductions in investment or other sources of company expansion.”

Continued strong growth in digital

Meanwhile, digital adspend continues to grow and is now forecast to contribute two-thirds (67%) of all spend in 2022, up from 64.4% predicted in December.

Pure-play digital platform growth is expected to have a 12% increase, compared to a 32% pace in 2021 led by high-flying ecommerce growth during the pandemic, but GroupM believes ecommerce will continue leading digital growth in the future.

“We think that retail or ecommerce-based media growth should outpace all other major forms of digital media in years ahead,” the report reads.

While TV is projected more modest 4.3% growth, CTV, however, is growing at a projected clip of 24%.

Regarding out-of-home, GroupM’s forecast included a slight global decline in outdoor advertising led entirely by “current weakness” in China; excluding China, growth in out-of-home would amount to 14.3% this year, and is expected to eclipse 2019 volumes by 2024.

In the UK, out-of-home advertising is expected by GroupM to continue its rebound with 26% growth, slightly lower than 2021’s 29% growth rate.

The various sector growth is occurring in a media landscape that is becoming increasingly concentrated – GroupM currently estimates that the top 25 media owners represent 74% of global advertising, and not including China, the top 17 companies represent 70% of global advertising in 2021, a 26 percentage point increase from 2016.

GroupM noted that its categorized projections have become more difficult to conduct over time as the “blurriness of media”, as Wieser described it, has created ambiguity for how to categorize different media outlets and productions. Overall projections will continue to remain robust, however.

When asked to describe the differences between GroupM’s forecast methodology and other forecasts, such as Zenith’s released last week, Wieser noted that “there will be many, many differences.”

“To properly assess that, you need to do it data point by data point. In general, we are trying to estimate media owner ad revenues. Focusing on historical data points, we frequently disregard commonly relied upon local market estimates because we can see at a global level that collectively they are wrong, and so are fairly involved in helping create new historical estimates.”