TV market braced for ‘significant real term decline’ in 2023

TV advertising is expected to decline over 10% in Q1 2023 and by approximately 5% overall in 2023, according to a latest forecast by Enders Analysis.

The media research service writes that “although this is a significant real term decline, there are signs that many advertisers will maintain their expected level of spend, realising the value of advertising through a down turn.”

The forecast comes days after Comcast-owned Sky reported its advertising revenue declined 9.6% year-over-year in Q4 2022, and decreased 1.9% for the full fiscal year 2022.

Sky’s performance is comparable to the broader TV ad market; in 2022, Enders estimates total TV ad revenue declined 2% year-over-year compared to 2021. However, such revenues are still up 9% on pre-pandemic figures.

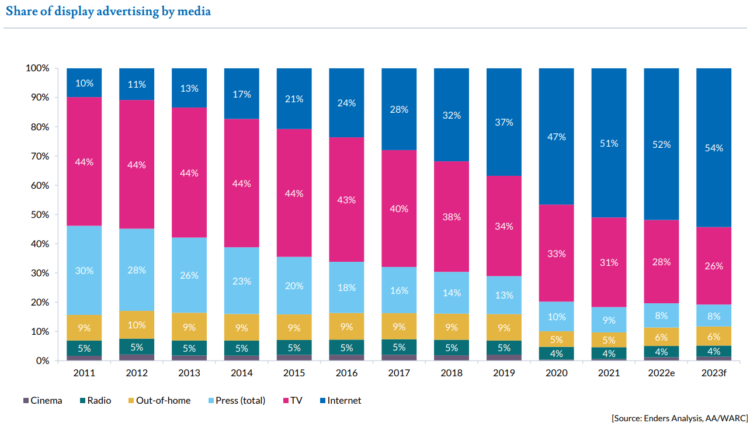

TV’s share of display advertising is expected to continue to erode in 2023 as online adspend expands its majority—TV is expected to make up 26% of display advertising next year, down 2% from 2022. Internet display advertising is meanwhile expected to grow from 52% market share to 54% share.

Much of the explosion in internet display advertising has occurred since the Covid-19 pandemic; in 2019, online display ads account for 37% of market share compared to 34% for TV.

The figures are distinct from last week’s AA/WARC report, which forecasted TV adspend to increase 0.4% in 2023, led by 4.4% growth in video-on-demand advertising.

On the difference, Lindsey Clay, CEO of commercial TV marketing body Thinkbox said: “The variance we’re seeing in forecasts for many media – not just TV – echoes the uncertainty and lack of visibility there currently is.

“The uncertainty also underlines how important it is to make the facts known about TV’s incredible value to advertisers now more than ever. It’s the safest £ an advertiser can invest – they can be confident of that. And they can also be confident that, as Enders say, TV’s effectiveness ensures it’s well placed to benefit when the economy recovers.”

Enders Analysis writes that the recession, which it says began in H2 2022, will be “mild and pervasive”. Regarding other sectors, the company expects online advertising to grow 7% next year, press to decline 7%, radio to increase by 2%, and out-of-home (OOH) and cinema to grow 5% and 15%, respectively, as they continue to recover from pandemic lows.

The AA/WARC report forecasted similar figures for press, online and OOH, but diverged on the extent of cinema’s recovery (expecting 31% growth versus 15% by Enders) and was less optimistic about radio (expecting 0.2% decline versus Enders’ 2% increase).

Elliott Millard, head of planning at Wavemaker UK, told The Media Leader: “it’s clear that for advertisers ‘everything is video’ — if an ad can be video, then it will be. It would be fair to say that this is a direct response to the fact that, broadly speaking, video formats are all up (bar TV) and the more traditional ‘static’ formats are down. Although, OOH bucks this trend — as it digitises — and reaps the benefits from the return of audiences. This aligns with all industry wide research on the power of AV.”

Enders writes that cinema’s more shallow recovery is vulnerable to shocks including a changing film slate, cinema chains shrinking, or inflation weighing on moviegoing demand, especially as some audiences fell out of the cinema habit due to an abundance of releases on SVOD. It also noted that 2022’s box office was more concentrated than ever, with the top ten films of the year generating half of revenue, up from between 30-40% pre-pandemic.

Radio’s growth, meanwhile, is anticipated by Enders due to increased positive sentiment and strong audiences.

The report reads: “Many advertisers recognise the need to continue advertising through a recession, with radio benefiting potentially disproportionately with its short lead times and ability to accommodate additional monies without price inflation.”