SVOD platforms pin hopes on economic recovery and ad tiers amid UK plateau

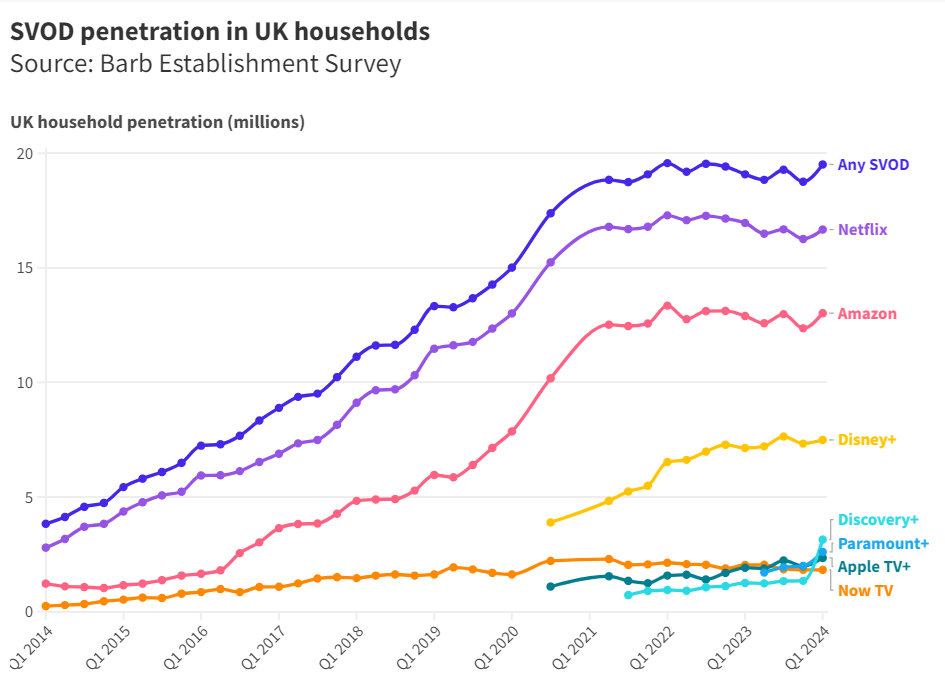

The number of UK households with one or multiple streaming subscriptions is showing a plateau, according to Barb’s latest Establishment Survey.

The TV audience measurement body found that 19.5m UK homes, or 67.9% of the population, had access to a subscription VOD (SVOD) platform in Q1.

While this is up from 18.8m households (or 65.4%) in Q4 2023, this is almost flat compared with Q1 2023, when SVOD penetration was at 19.08m (or 68.4%).

The proportion of homes with two or more services hit 13.6m (47.3%). Again, while this marked growth on the previous quarter, this was flat year on year.

Netflix remained the most popular service, present in 16.7m (or 58%) of UK homes, up on the previous quarter but slightly down on the same period a year earlier.

Analysis: Post-pandemic stabilisation

Doug Whelpdale, head of insight at Barb, said it was “fair to say SVOD penetration has plateaued post-pandemic”.

While the Covid-19 pandemic resulted in several missing quarters of data, from Q2 2021 there were 12 quarters in which penetration was “up and down”, he explained, hovering between 18.7m and 19.5m, or 65-68%.

Similar to the outlook on the streaming market in Q4 2023, Whelpdale said the picture remained “broadly stable”.

Bundling effect

James Weinberg, executive director, media and product at T&Pm, pointed to bundling’s effect on the overall figures.

First, a change in Barb’s survey methodology has “potentially inflated figures” for Paramount+ and Discovery+, meaning year-on-year comparisons should be avoided.

New wording was introduced to survey questions in Q1 to capture “passive subscriptions” included in packages like Sky that were previously not fully accounted for.

This was “especially relevant” for Paramount+, which saw a 31% quarter-on-quarter increase in penetration in Q1, Weinberg highlighted. Similarly, Discovery+ reached 10.9% penetration, crossing the 5% threshold to be included in Barb’s tracker, but these figures “should be interpreted with caution”.

He explained: “Anecdotally, we know that these packaged subscriptions are often offered for free, such as Discovery+ being free for all Sky customers and Paramount+ being included for Sky Cinema customers. Paramount+ is also regularly gifted to Sky customers via the VIP programme. So, in a sense, these slightly inflate the overall ‘interest’ from Sky households for these services.”

More widely, Weinberg added, there is a trend of bundling of SVOD services such as Disney+ with some Lloyds bank accounts and EE monthly contracts — something that “also drives the same impact”.

Growth still expected

Regardless of methodology changes and the effect of bundling on the data, Weinberg was seeing “overall viewing flatten out” and slightly down from the 68.4% peak in Q1 2023, attributing the “clear albeit negligible dip” in Q4 2023 to households cutting back.

For Weinberg, it’s “no surprise” that, having built from a low mass to critical mass, there is “a significant slowdown in subscription growth”.

Both Ampere Analysis director Richard Broughton and independent analyst Ben Keen agreed that there has been a slowdown in the streaming market over the last year or so — a trend influenced by market saturation and cost-of-living concerns.

However, Weinberg is expecting “small but sustained growth” going forward, as SVOD platforms invest considerably in content to hold on to viewers and look to release more shows in blocks.

Broughton is also optimistic: “As the economy recovers, this lessens affordability concerns for some households, which will revitalise a little spending activity. The roll-out of ad tiers simultaneously supports the ability to monetise lower-spend consumer groups.”

In fact, bundling and distribution deals will likely become more common in an “ad-supported world”, as service providers become “more focused” on overall subscription monetisation rather than number of subscribers alone.

This means SVOD services “may be willing to take a slight hit on net pricing” if it means they’re boosting reach and driving ad revenue as a result, Broughton explained.

The shift in focus to subscription monetisation is also reflected in Netflix’s decision to stop reporting subscriber numbers. He continued: “This is a tacit recognition that future sub growth will be more challenging and a signalling to the market that it should be focused on top-line and bottom-line financial growth rather than primarily on customer numbers.”

Sophia Vahdati saw growth coming from the advertising-supported offerings. She said: “To combat the plateauing and the effect this could have on monetisation, streamers like Netflix, Disney+ and Prime Video are developing their ad tier offerings. It is too soon to evaluate the effectiveness of this strategy, but we know that a significant proportion of new Netflix subscribers each month are joining the ad-supported plan.”