From good free content to toggle behaviour: Behind the UK’s SVOD decline

Barb’s latest audience data showed a drop in UK households with one or multiple streaming subscriptions.

The measurement body’s Establishment Survey revealed 18.8m UK homes, or 65% of the population, had access to a subscription VOD (SVOD) service in Q4 2023, compared with 19.3m, or 67%, in Q3.

There was a similar trend for those with two or more SVOD services: 12.8m UK homes (or 44.7% of the population) had multiple services in Q4, down from 13.3m (46.4%) in the previous quarter.

These declines affected Netflix, Amazon Prime Video, Disney+, Apple TV+ and Sky’s Now, with only Paramount+ registering a small quarter-on-quarter increase.

Meanwhile, Kantar’s Entertainment on Demand study found an average 1.8 percentage point increase in household penetration across all tracked markets in Q4, although it also highlighted planned cancellations increased quarter on quarter across all major SVOD providers.

Analysis: Plateau in UK streaming market?

While data shows high SVOD penetration in the UK, it appears to be on a decline compared with some other markets.

First of all, Doug Whelpdale, head of insight at Barb, said there are “a huge number of things” that play into levels of SVOD penetration in the UK and beyond, and it is “a question of whether there is any more room” for further growth.

“The UK is obviously quite a mature market in terms of these things and I think we’ve been seeing plateauing of the SVOD numbers for quite a while now,” he told The Media Leader. “I can imagine that actually what we’ll see is we’ll bump along with some quarter-on-quarter drops and some quarters picking up for quite a while to come, partly because there isn’t that much headroom for new homes to take on the services.”

Whelpdale predicted that other markets showing subscriber growth are “probably at a lower penetration” than in the UK.

Free content available

Meanwhile, Sam Olive, head of video at Wavemaker UK, highlighted two keys reasons why there “have always been significant differences” in the way the UK consumes TV content compared with other markets.

“Ofcom exists,” he said. “They set the rules and monitor the amount of advertising that plays out on TV. This is a significant measure in protecting the long-standing value exchange that exists between brands, broadcasters and viewers.

“The second and probably most important reason is the quality of the content provided by our free-to-air channels. Driven by the BBC, universally regarded as one of the best content producers on the planet, any player that has entered the UK TV market in the subsequent near 90 years has had this to contend with and aspire to.”

Whelpdale echoed this suggestion, citing the free-to-air seasonal offering as a factor in Q4’s SVOD drop. Broadcasts during this period included the Rugby World Cup, Strictly Come Dancing, I’m a Celebrity… Get Me out of Here!, The Great British Bake Off and Doctor Who, as well as staples such as Coronation Street and Gogglebox, while 51 films shown in December reached an audience of more than a million.

Olive added that the regulation and the content combined meant that the average UK TV viewer “has got it pretty bloody good” and any additional content would “largely be a luxury and not a necessity”.

That said, Olive believes consumers “tend to re-evaluate how important luxuries of all kinds are” when heading into uncertain times.

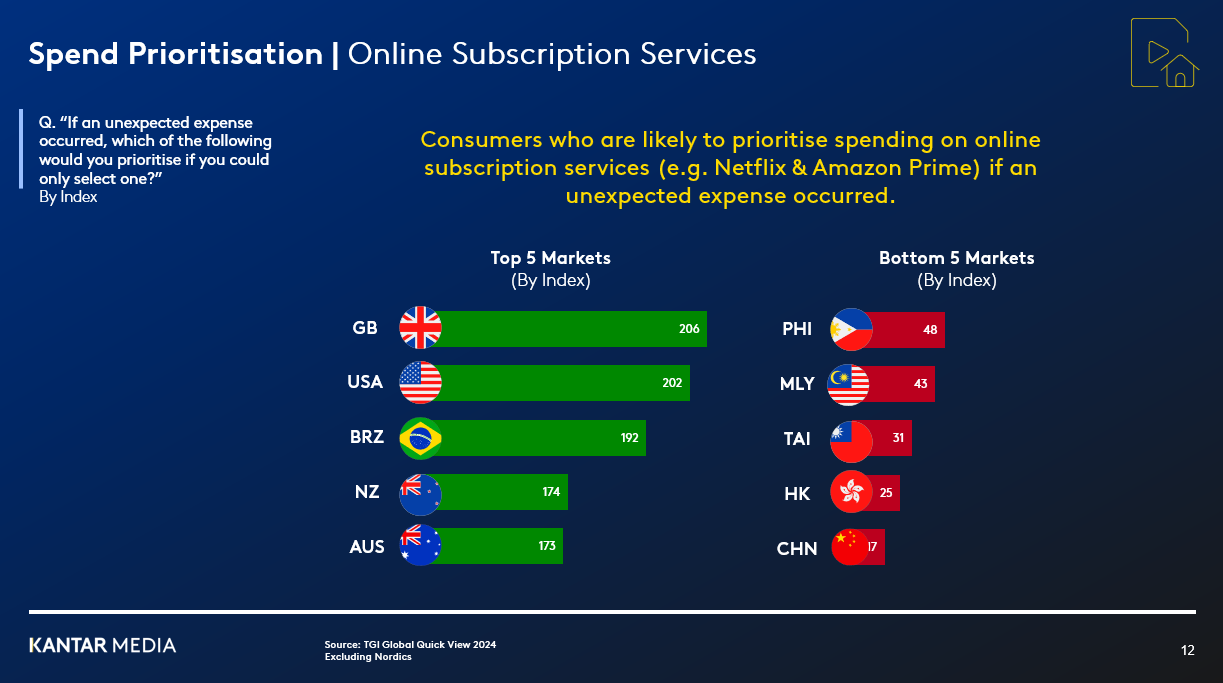

In fact, the most recent Kantar Media TGI Global Quick View survey found that British subscribers were more than twice as likely to prioritise spending on online subscription services if an unexpected expense occurred, in contrast to Asian markets.

Matt Ross, managing director at TV and SVOD analytics company Digital i, highlighted that it was “not surprising” to see the number of households using Netflix reduce as global numbers go up, as this will be “driven by Netflix’s crackdown on account sharing”. This has “ultimately been a win” for the platform in driving subscriber numbers, but will “undoubtedly have caused a reduction” to the total number of households who access the service.

He added: “We know that across all regions reported in their quarterly statement, Netflix increased subscribers in Q4, so while it could be surprising to see it reduce in the UK, I think the difference may be in the purpose of the Establishment Survey, which is to survey homes rather than subscription numbers.”

Digital i’s own research, which estimates how many accounts are shared across households, has found “a significant decrease across all the major European markets and beyond”, alongside a reduction in average daily viewing per account — again, primarily driven by how difficult it is now to watch from the same account across multiple households. In its surveys, Digital i has observed “a marginal decrease” for Amazon and Disney+ subscribers from Q3 to Q4.

Toggle behaviour

Whelpdale pointed to the wider economic outlook as “a big factor”, with more homes coming off low mortgage interest rates as an example.

He remarked: “That’s making a material difference to people’s monthly outgoings and they start to cast around for things that they can cut. Because of the way their subscriptions to the SVOD services work, people can dip in and out — and I think they do.”

Whelpdale said UK subscribers were “getting more used to” this “toggle on, toggle off” behaviour, since streamers do not typically lock people into long-term contracts. This ties in with “general subscription fatigue”.

Furthermore, Whelpdale noted a difference by age demographic: “It seems possible they’re seeing a bit more churn in the younger audiences. Certainly, penetration in the younger audiences is higher — if you’re looking at any service and at, say, 16-24 year-olds, penetration is around 85%. When you’re looking at 65-plus, penetration is about 45%.”

He hypothesised that older audiences could be unwilling to leave a service as they worked through all the content and were potentially not as tech-savvy when it came to “toggling off” temporarily, while younger people were perhaps happier to pause a subscription once they have watched a particular show.

Stability to continue

Moving forward, Whelpdale said “stability is probably what we’re looking at”, unless one of the streaming services took on major sports rights such as the Premier League in the UK. While Amazon had some Premier League matches in recent years, this was “not really enough to move the needle”.

Amazon has not secured any further Premier League coverage thus far. Sky Sports, TNT Sports and the BBC split the live and highlights rights in the latest agreement to 2029.

Whelpdale concluded: “I struggle to see anything that is going to make a really big change. Hopefully, we’re not heading for any major economic shocks — or any more so than what’s already going on. So unless something drastic occurs that means loads of people lose their jobs or the economy massively tanks or we go to war with Russia, I can’t immediately see anything that is going to cause a really significant shift.”

At The Year Ahead 2024, analyst Ian Whittaker similarly did not predict SVOD growth in any major market in 2024.

He explained: “I’ve been negative for several years now on SVOD. I just don’t think the market penetration is there for them and I think what you will see in 2024 is this flatlining coming through and it will be hard to see further penetration.

“The focus very much will be on ARPU [average revenue per user] growth going forward, simply because if you are going to grow your revenues, subscribers times your ARPU. And if subscriber growth is limited, your focus very much has to be on the ARPU.”

There is a difference in the methodology and focus of the Barb and Kantar quarterly reports. The Barb Establishment Survey is based on 13,000 one-off interviews each quarter from a high-quality sample. Barb is used as the trading currency. Kantar’s Entertainment on Demand data comes from the Kantar Worldpanel, which is designed to primarily capture packaged goods from 30,000 households surveyed quarterly, showing longitudinal trends on a single-source basis.

Barb’s Establishment Survey includes SVOD services with a reported household penetration of more than 5%. It warned that “caution should be applied when comparing Barb’s sample-based numbers to audited numbers published by the SVOD services”.

The TV measurement company added that “respondent recall of access to these services is subject to some uncertainty — this could occur where the respondent is not the subscriber in the household or the service is provided in a package with other services”.