Advertisers appear to be taking the words of Elon Musk to heart.

Apparently happy to “go fuck [themselves]”, adspend on X has been drying up. At the end of 2023, Fidelity once again marked down its valuation of the Musk-owned social media company and now believes it to be worth 71.5% less than when Musk purchased it in October 2022.

“We do see that marketers are decreasing investment in X/Twitter,” Jane Ostler, Kantar’s executive vice-president for global thought leadership, tells The Media Leader. “We’ve seen this for some time.”

But if advertisers are, at least for the time being, leaving the company formerly known as Twitter, it begs the question: where are they taking their money?

Recent data reported by the Financial Times suggests many advertisers have moved spend to Microsoft-owned LinkedIn, which has raised its ad prices as a result. But, says Ostler, there are likely multiple winners to be had from advertisers’ exodus of X — primarily other digital and social media companies. It may just take time for that investment to be repurposed.

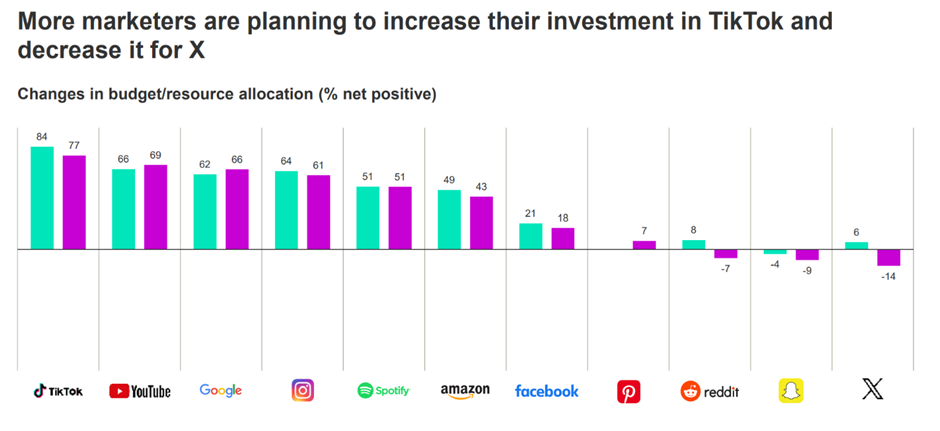

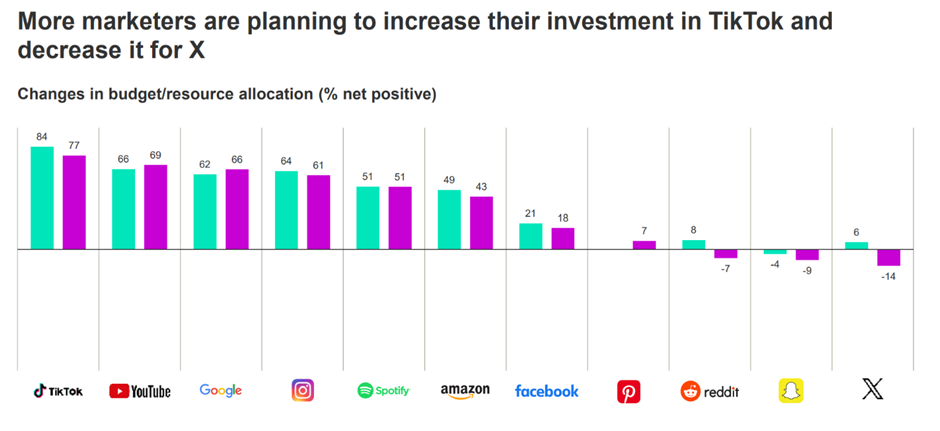

“You can’t immediately substitute one channel for another because advertising on TikTok is not the same as advertising on Twitter,” she explains. “Content is different, the ad environment is different, formats are different. But TikTok and YouTube and Google mostly are the ones certainly slated to grow next year.”

Shamsul Chowdhury, executive vice-president of paid social at The Brandtech Group’s marketing performance company Jellyfish, tells The Media Leader that the biggest beneficiaries the agency has seen from the decline in spend on Twitter are Meta and LinkedIn.

“Meta because of the scale and cost efficiencies and LinkedIn because many of our B2B clients were seeing better leads on LinkedIn than on Twitter, despite the higher CPMs,” he explains.

2023 in green; 2024 forecast in purple. Source: Kantar

Musk has drawn ire from advertisers for allowing hate speech to run rampant on X, including by reinstating formerly banned accounts of far-right conspiracist Alex Jones and alleged rapist Andrew Tate.

According to Ostler, this has led to “uneven” concerns over brand safety at X compared with other social media platforms, despite the likes of TikTok and Instagram also being accused of spreading misinformation and disinformation about hot-button issues, such as the Israel-Hamas war.

She draws a distinction between a platform being deserving of trust as opposed to simply being perceived as trustworthy regarding brand safety.

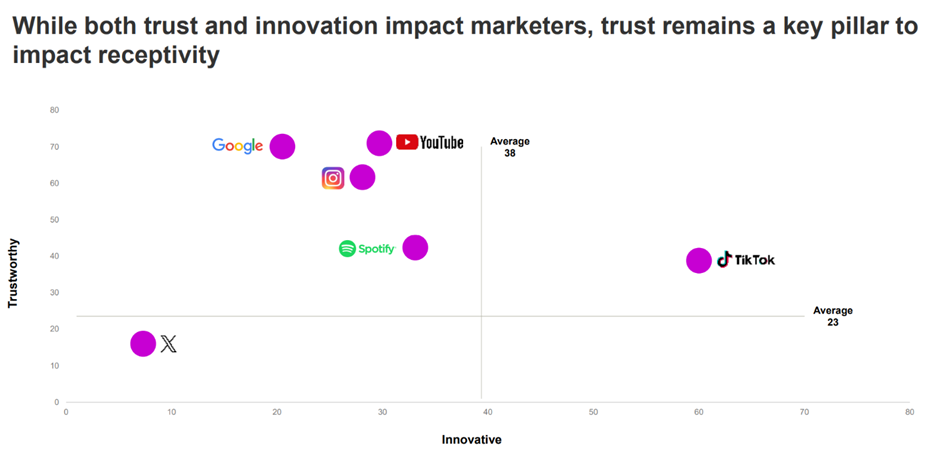

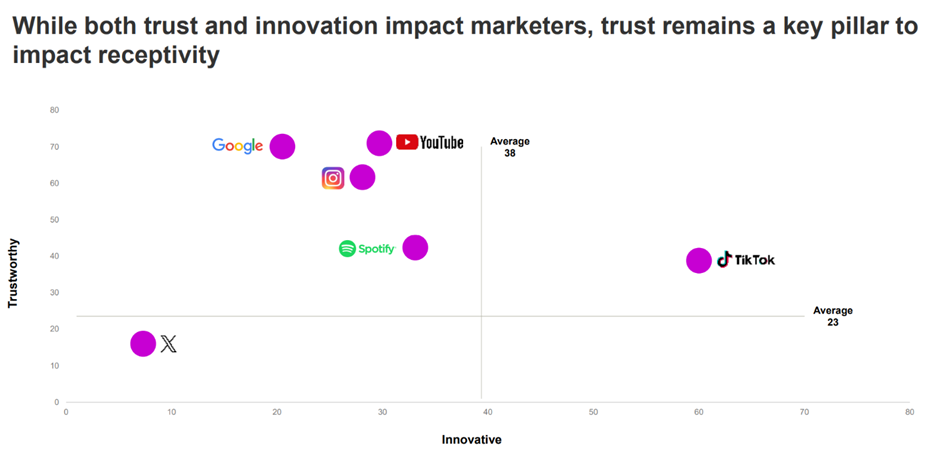

For instance, Google, YouTube, Instagram, Spotify and TikTok are all viewed by marketers as above-average in terms of trustworthiness, according to Kantar’s latest survey, whereas X is viewed as untrustworthy.

Source: Kantar

Even though other social media platforms could also be unsafe for brands if ads are algorithmically served alongside controversial user-generated content, it’s clear that Musk’s antagonism of the ad industry has led to a negative perception of X. As Ostler adds: “Elon Musk being inextricably associated with Twitter and his disdain for advertisers doesn’t bode well.”

“I think most responsible publishers and media owners realise that trust is a key part of encouraging investment in a property or platform, whether it’s online or offline,” she continues. “If you’re running a brand, you have a responsibility for that brand to avoid risks and not court controversy and to maintain or improve the financial position; you’re not there to just try something out and see if it causes harm.

“If there are media channels that intentionally create these risks, it’s easier as a brand to pull out and avoid them.”