Google touts AI Overview strategy amid mixed financial results

Alphabet CEO Sundar Pichai has stressed the importance of its AI strategy to drive continued business growth, even as the tech giant warned of forthcoming challenging comparables in the latter half of the year.

In its Q2 earnings call, Alphabet reported 14% year-on-year revenue growth to $84.74bn — something that company executives attributed primarily to continued growth in search and cloud revenue.

Total advertising revenue amounted to three-quarters of total revenue ($64.62bn) and increased 11% year on year.

Notably, while YouTube grew revenue by 13% to $8.66bn, it missed estimates from Wall Street analysts, who were expecting stronger growth from the world’s largest video platform. The Q2 figure amounts to a deceleration compared with the tech giant’s Q1 results.

On the earnings call, executives warned that growth in the first half of the year came on the back of relatively low comparables and that next quarter Alphabet will “lap” a return to stronger growth that began occurring in the second half of 2023.

“As we look forward to the third quarter, we will be lapping the increasing strength in advertising revenues in the second half of 2023, in part from APAC-based retailers,” said chief financial officer Ruth Porat.

Shares of Alphabet declined more than 3% in pre-market trading the day after the earnings release.

Analysis: Will Google’s AI push pay off?

Google executives appeared keen to assuage any concerns that its AI strategy was lagging behind competitors, suggesting that its investments in generative AI, primarily through the new AI Overview feature in search, would pay off.

This is despite widespread concerns around the accuracy of AI Overview results that led to Google reducing the visibility of AI Overview responses earlier in the summer.

“We are delivering better responses on more types of search queries and introducing new ways to search,” Pichai said, adding that the tech giant has “taken a conservative start, focused on quality” before scaling the feature up and releasing it in more markets.

Chief business officer Philipp Schindler said “people are finding ads, either above or below AI Overviews, helpful” and argued that Google has “a solid baseline here from which we can innovate”.

Schindler added that Google will soon start testing search and shopping ads placed in AI Overview responses. These will be “clearly labelled as sponsored” and delivered to users “when they’re relevant to both the query and the information in the AI Overview”.

Pichai emphasised that Google is “continuing to prioritise approaches that send traffic to sites across the web”.

Publishers have previously warned Google’s AI Overview feature is likely to further threaten their traffic, given AI-generated responses to queries may disincentivise users from clicking links.

How Google’s AI Overviews could impact publishers’ audience development

YouTube’s market position

Meanwhile, although YouTube’s revenue growth came in below expectations, its market position remains commanding compared with streaming competitors.

Schindler said the company’s “long-term investment in CTV continues to deliver”, with YouTube “continuing to benefit from a combination of strong watch-time growth, viewer and advertiser innovation and a shift in brand advertising budgets from linear TV to YouTube”.

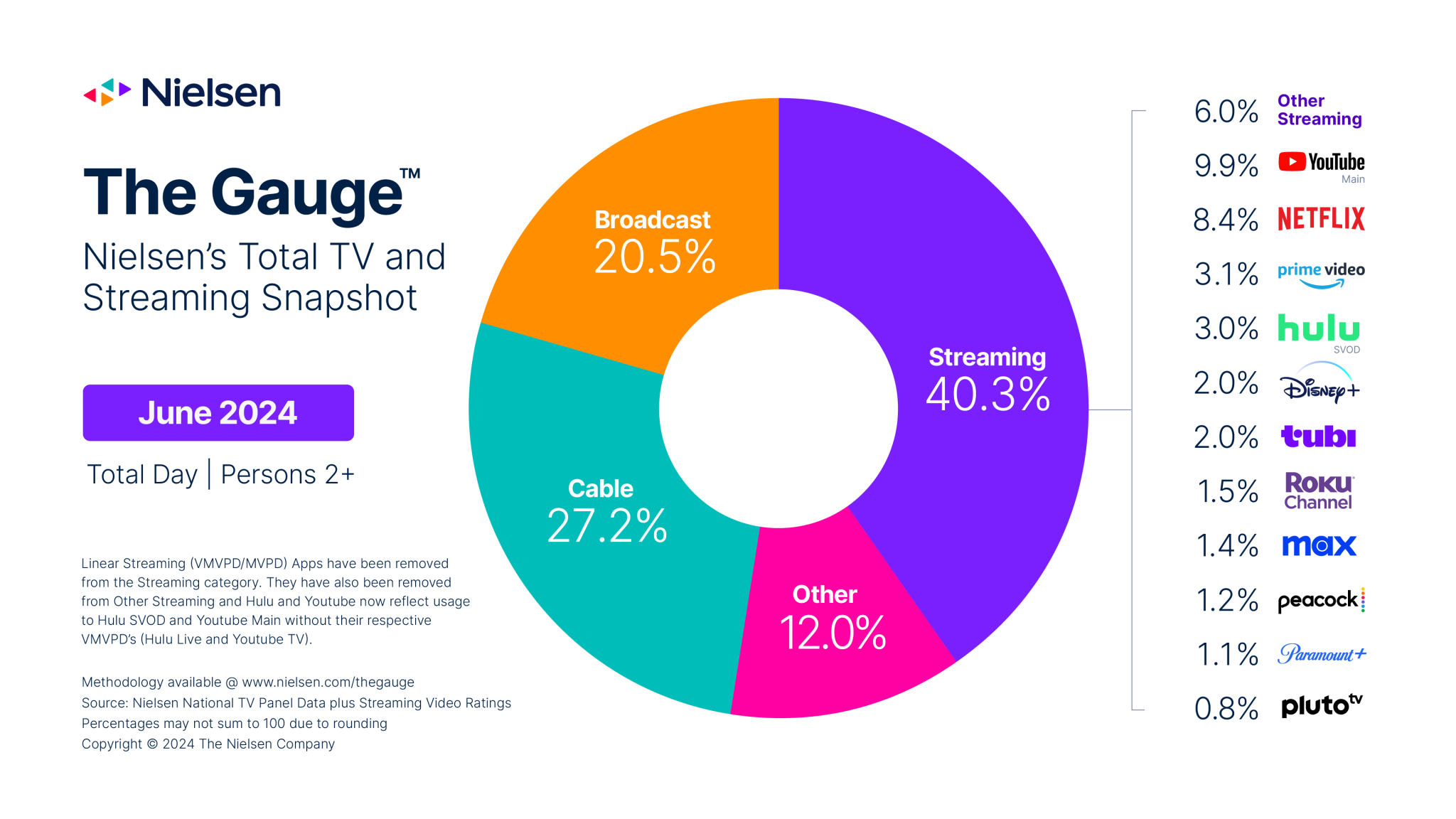

“Views on CTV have increased more than 130% in the last three years,” he announced, citing Nielsen figures that show YouTube is the most-watched streaming platform on TV screens in the US.

Among media companies’ combined TV viewership, YouTube currently ranks second to Disney, according to Schindler.

Porat described YouTube TV and YouTube Music Premium as delivering “healthy growth” in subscriptions. As of last year, YouTube TV counted more than 8m subscribers.

“As we’ve said on many calls here in a row, the subscription revenue growth continued to be quite strong,” she said, explaining that a deceleration in YouTube TV’s revenue growth this quarter can be attributed to “anniversary-ing” its price increase last year.

As discussed by UK editor-in-chief Omar Oakes last week, YouTube benefits from a business model that places financial risk on content creators rather than the platform itself. Although the streamer has struck music and TV licensing deals, it does not front production costs for original content, unlike many of its rivals such as Netflix, Disney and Apple.

Oakes described this as “a video-sharing monopoly” in that “almost no content creator is big enough to negotiate a deal in which YouTube has to take on any risk by paying someone upfront to ensure they don’t go elsewhere”.

You can’t compare YouTube with Netflix: Media’s risk conundrum

A cookie-sized elephant in the room

On the earnings call, Pichai also addressed concerns raised around Google’s volte-face on cookie deprecation. The decision to no longer deprecate third-party cookies on Chrome, announced earlier this week, was met with questions and concerns from advertisers that had been prepping post-cookie strategies in recent years.

“Obviously, we are super committed to improving privacy for users in Chrome,” said Pichai. “And there was the whole focus around Privacy Sandbox — and we remain committed on the journey.

“But on third-party cookies, given the implications across the ecosystem and considerations and feedback across so many stakeholders, we now believe user choice is the best path forward there. And we’ll both improve privacy by giving users choice and we’ll continue our investments in privacy-enhancing technologies.

“But it’s obviously an area we will be taking feedback from the players in the ecosystem and we are committed to being privacy first as well.”

Google cookie U-turn: Industry is ready to move on, leaders say