YouTube ad revenue surpasses $8bn even when ‘discounted’ on media plan

YouTube’s ad revenue increased 21% year on year to $8.09bn, parent company Alphabet reported in its Q1 financial results.

That is apart from subscription revenue generated by YouTube Premium and YouTube TV, which earned $15bn in full year 2023.

More broadly, Alphabet saw 15.4% revenue growth, including $46.1bn from search and $61.7bn from advertising.

In signs of maturity, the tech company also announced its first-ever dividend ($0.20 per share) and a $70bn share buyback scheme to return value to investors.

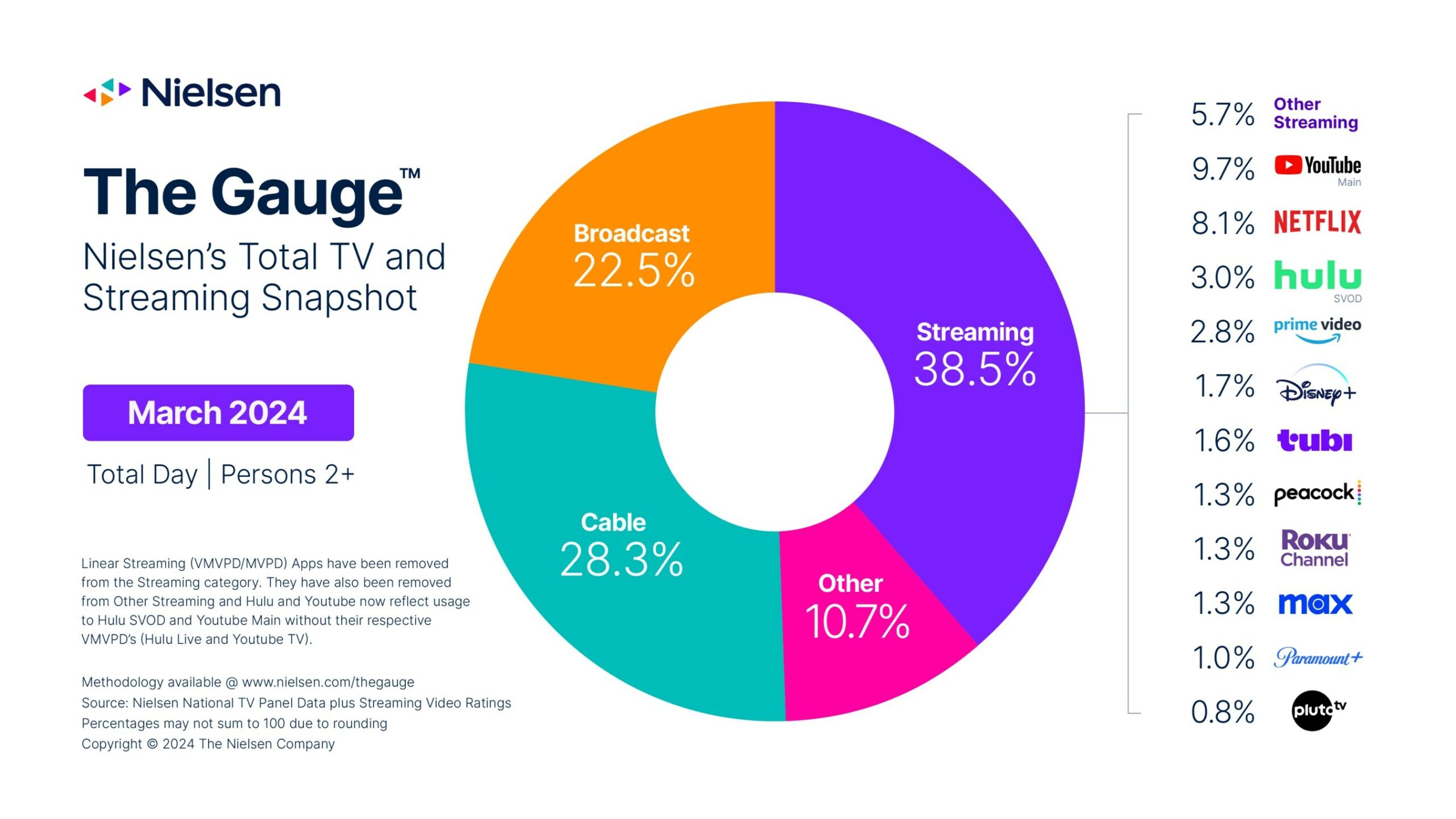

According to Nielsen’s The Gauge report in March, YouTube accounted for 9.7% of total TV usage in the US market — the largest share of any streamer, followed by Netflix (8.1% share).

Alphabet senior vice-president and chief business officer Philipp Schindler also noted in the company’s earnings call that YouTube has been the leader in US streaming watch time “for the last 12-plus months”.

“Viewers are watching YouTube because they expect to access everything in one place across screens and formats: their favourite creators, live sports, breaking news, educational content, movies, music and more,” Schindler said. “And advertisers continue to lean in to find audiences they can’t find elsewhere.”

In a panel at The Future of Audio and Entertainment in London, Ampere Analysis editorial director Nick Thomas called YouTube the “default” and “predominant” media platform for Gen Z. He noted that 59% of Gen Z watches influencers on the platform daily.

Jamie Lyons, global head of gaming and virtual experience at Omnicom media agency PHD, suggested that despite YouTube’s continued ad revenue growth, the video-sharing platform is still being discounted on media plans because of its ubiquity with younger audiences.

“We do often discount it,” he said. “If you think about innovation, you don’t immediately jump to YouTube. If you think about Gen Z, you don’t immediately jump to YouTube.”

That should be music to the ears of Alphabet CEO Sundar Pichai, as it suggests YouTube’s ad revenue may have yet to peak even as the service continues to garner subscribers.

On Alphabet’s earnings call last week, Pichai added: “On average, viewers are watching over 1bn hours of YouTube content on TVs daily. And on subscriptions, which are increasingly important for YouTube, we announced that, in Q1, YouTube surpassed 100m Music and Premium subscribers globally, including triallers.”

The 100m total subscriber milestone is noteworthy as YouTube continues to diversify its business model away from reliance on advertising. It is the opposite strategy taken by other TV streaming companies, such as Netflix and Disney, which began with streaming models but are now diversifying into advertising as subscription growth plateaus in core markets.

YouTube, influencers and gaming: Bridging the Gen Z generation gap