Global pay-TV penetration to shrink by end of decade

Global pay-TV subscriptions are forecast to fall over the next five years as the US in particular continues to see consumers “cord-cutting” and switching to streaming services.

Global pay-TV penetration is expected to reach 56% of TV households by the end of 2023, and this will fall slightly to 54% by the end of 2029, according to Digital TV Research’s Global Pay TV Forecasts report.

Between 2023 and 2029, the report said, 82 countries will add pay TV subscribers and 56 countries will lose subscribers. The US will be the biggest loser — down by 10 million subscribers.

The number of pay-TV subscribers across 138 countries will remain at just under 1 billion. Digital TV Research forecasts a slender decline until 2025, with a small recovery thereafter.

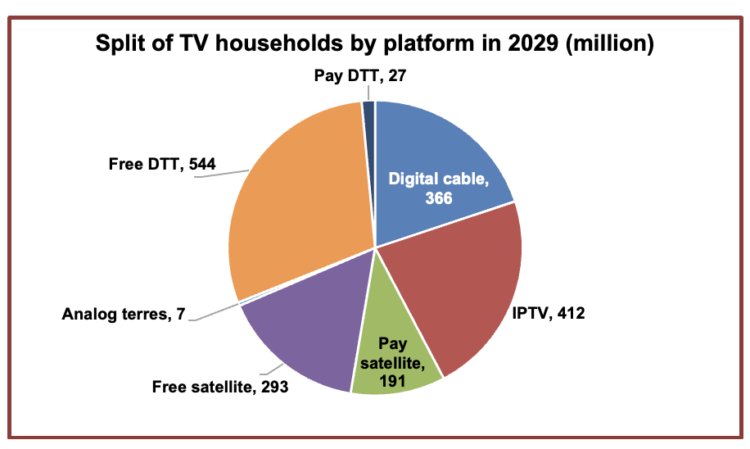

Simon Murray, Principal Analyst at Digital TV Research, said: “IPTV (streaming) is the pay-TV winner. IPTV will add 36 million subscribers between 2023 and 2029 to take its total to 412 million. IPTV overtook pay satellite TV subscribers in 2018 and will overtake digital cable in 2024.”

Internet Protocol Television (IPTV) is television content delivered to the consumer via broadband to a TV, which is linked to a set-top box or “smart TV” operating system.

Analysis: The cord is now being cut at both ends

Sky is currently airing an ad campaign in which it promotes a basic Sky package bundled with Netflix for “less than you think,” i.e. £26 per month.

This is available for people who sign up via Sky Stream, a streaming stick that Sky launched last year and an alternative to Sky Glass, the smart TV it unveiled in 2021, as a way to subscribe without having to bother with a satellite dish.

In other words, it’s not just consumers who are broadly “cutting the cord” all over the world, as today’s research reveals — the pay TV giants are beginning to cut the cord, too.

It’s a short-term tactic to deal with a long-term problem. Last year Sky and Virgin Media, the UK’s Big Two pay-TV providers, were forecast to lose a sixth of their combined subscriber base by 2027. And, earlier this year, figures from Digital TV Research showed that the pay-TV subscriber count in Western Europe will drop by 7%, leading to a faster decline in revenues than previously thought.

It’s doubtful that offering tactical bundles, like Netflix and Sky together on Sky Stream for £26, is a long-term solution. If customers can buy a basic ad-free Netflix subscription for £11 in the UK, that’s only £15 for 250 channels.

Compare that to the £45 average revenue per user that Sky could rely on in the years before it sold to Comcast (because it is no longer a UK listed company, ARPU figures are not freely available). Of course, the 2018 Comcast acquisition also came before the Covid-19 pandemic, which incentivised consumers to upgrade their internet connection and give streaming services a try as they were forced to stay home and watch more TV.

We can expect pay-TV providers to become increasingly creative with providing “over-the-top” or IPTV offerings in the coming years as consumers exercise more choice with streaming options.

At least Sky, unlike Virgin, has an existing streaming service in the form of Now. But the company will be careful to resist the temptation of its sister Comcast business, NBC, which has heavily invested in streaming service Peacock and found limited success.

While NBC has a huge content archive to lure in subscribers, Sky has for years relied on HBO programmes (carried in the UK exclusively through Sky Atlantic) and Premier League Football on Sky Sports. The HBO deal is up for renewal in 2025 and is not a sure thing, as parent Warner Bros Discovery pursues its own streaming venture (Max), while it currently faces a tough Premier League rights negotiation to broadcast the competition again from 2025.