Clear Channel: Reach can be be ‘refined’ to target light buyers

Audience reach needs a more “refined” approach to reach so advertisers can use media formats to target light category buyers.

At an upfronts event in London today, Clear Channel executives made the case for out-of-home to be the right and responsible choice, as well as a platform for good.

Lindsay Rapacchi, research & insight director at Clear Channel UK, asked more than 100 different media professionals why they value reach. The top five answers included “prime people”, “increase awareness”, “to drive fame”, “for branding”, “because [ad effectiveness expert] Les Binet said so” and “sell more advertising”.

However, Rapacchi said he was “surprised” that no one mentioned reaching as many light category buyers as possible as that would be “the absolute top answer” for him.

‘Doubling down’ on high-reach media

When looking through hundreds of media plans he found this group are never really referenced and so he urged planners to put plans “through the lens of a light category buyer”. This segment, he said, needed to be “prioritised” by identifying and “doubling down” on media channels that have significant levels of reach in this area to build a bedrock against them, like OOH and TV, which each had 70% total reach using different examples.

He went on to explain, using three fundamental rules of growth from How Brands Grow by Byron Sharp, why and how media plans should aim to drive reach amongst light category buyers as they were an increasingly important and growing segment facing even “fiercer” competition.

This was especially the case as research of 1,000 people across 14 categories showed consumers were purchasing less and were more likely to be making choices between more brands than three years ago.

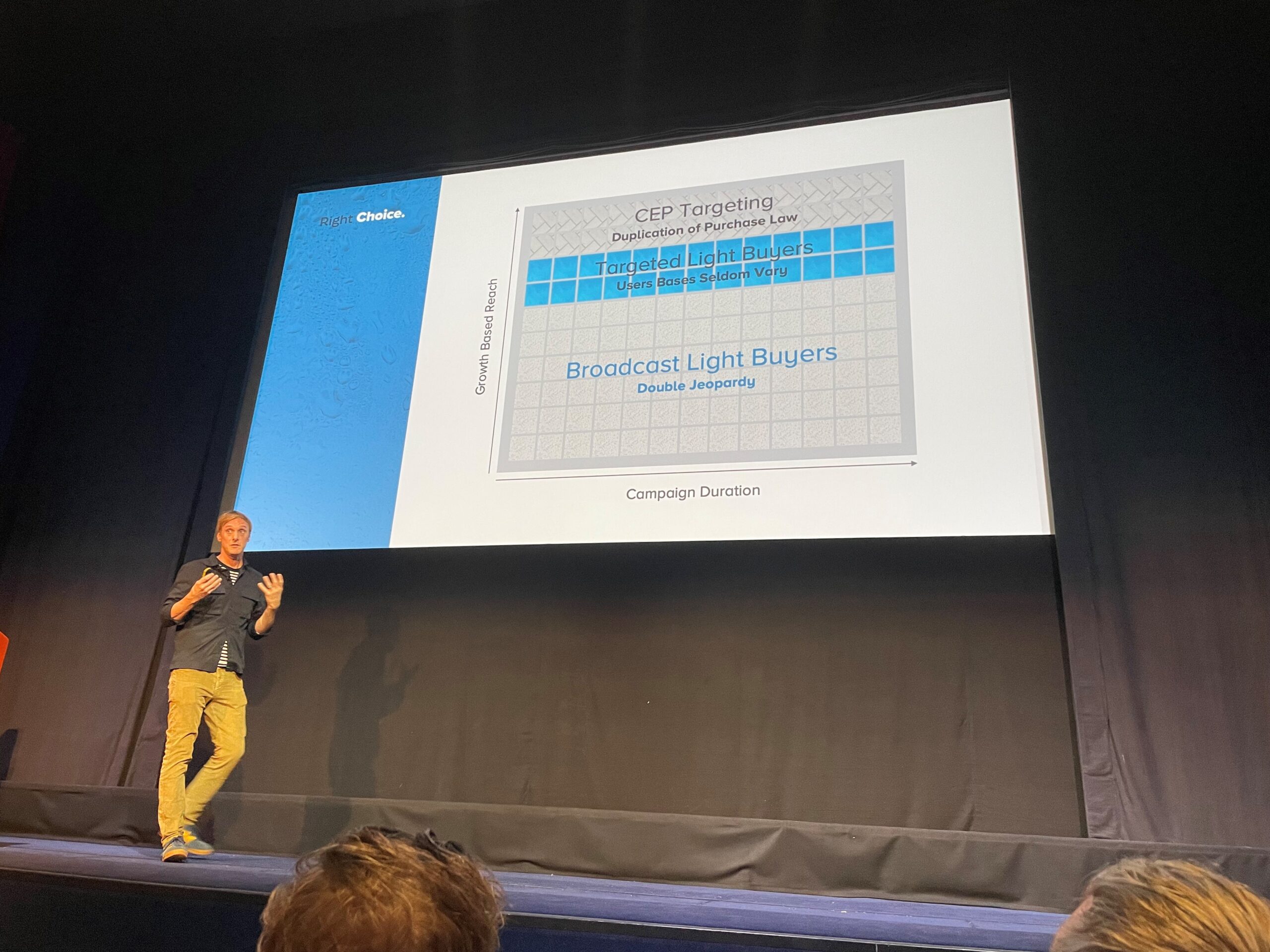

Rapacchi advised building a “tetris” of reach in media plans using these rules to broadcast to light buyers, target light buyers, and target category entry points.

The first law is the “Double Jeopardy Law” which states brands with less market share have fewer buyers, and these buyers are slightly less loyal.

Using washing powder brands as an example, he said: “The frequency of purchases between these brands does not differ that much. It is penetration loyalty that is driving that. Here are two jeopardies: the first jeopardy is that small brands tend to have smaller market penetration, and the second jeopardy is that they suffer a second time because those smaller brands tend to have slightly less high purchase frequency. The key thing I want to take away from that is that penetration is driving growth.”

Rapacchi (pictured, below) said that if the brand profile differed from the category, it usually was an impediment to growth. Using an example with lager brands, he said that one was “missing the big picture” as it was “absent” for 18- 34 year olds in its marketing which is where this law of growth would tell us to focus.

He insisted he was “not advocating a hugely targeted approach” but by adjusting this skew and using programmatic digital out-of-home, radio and Sky AdSmart to speak more to light lager users and align with the wider market, a beer brand could reach 1.6 million people.

The third layer of the “tetris” Rapacchi mentioned was “Duplication of Purchase Law” related to the fact brands typically compete with other brands in line with competitor brand popularity.

Using beer brands, there is more potential for growth by targeting more popular brands. Rapacchi advised “clever” targeting of category entry points, or cues that buyers use when faced with a buying situation, like “relax after work” or “cool down on a hot day”.

Ultimately, targeting these category entry points where brands that have a higher market share will lead to growth.

OOH on ‘right path’ to reach net-zero goals

Speaking about the sustainability of OOH, Louise Stubbings, partnerships and creative director at Clear Channel UK, revealed in her presentation that only OOH and press were “taking the steps needed” to hit net zero targets.

She referenced an Outsmart report which found OOH was six times more energy efficient than online advertising, and 17 more times than TV advertising. Meanwhile, all TVs, laptops and household appliances left on standby use 50 times the energy of the entire OOH industry.

“It is important that we look to reduce that where we can, but it is important to put it into context. The small amount that we use here as an industry is coupled with the fact that we deliver huge reach being a one to many medium,” she said. “When you marry that up with the fact that almost all the energy that the whole industry buys now is renewable thanks to this huge step change that we’ve had in the last few years, you can really see just the argument for why we’re the most responsible choice.”

Stubbings (pictured, above) said Clear Channel had reduced its emissions by 83% since 2008, 10% of its inventory across the country contains some recycled elements and that its focus this year will be on installing energy efficient screens soby the end of next year 30% of AdShel Live will be using 50% less energy.

She also spoke about something the industry “do not shout about enough” in terms of how much OOH is “the only medium” to give back nearly half of its revenues to the public purse, charities and communities. This included £189m to the public purse annual in rents and rates paid, and £1.1bn between 2008 and 2021 invested into public infrastructure like the installation, maintenance and cleaning of the nation’s bus shelters, and ad space donations of £28m to charities.

‘You can’t do national reach without Clear Channel’

In the final presentation of the morning, Richard Bon, managing director and Europe commercial lead for Clear Channel UK, said Clear Channel delivers 91% reach every two weeks or 49 million adults, which equates to more than all linear TV put together.

“What might come as a little bit more of a surprise is that no other media channel can do the same and no other media owner can do the same. More importantly, our reach is going to keep on growing as we progress forward,” he stated.

Bon (pictured, below) added that another “surprise” might be that Clear Channel has got London “covered”, given JCDecaux and Global have got the bus shelter and tube contracts.

He revealed Clear Channel reaches 85% of all Londoners or 6.6 million adults every two weeks with 1,500 sites across every London borough.

Bon also said Clear Channel UK’s growing digital reach was “one of the biggest changes” of the last few years, with Route showing its digital footprint now delivers 80% reach every two weeks, or 43 million more panels than any other outdoor media owner.

Looking to 2024, Clear Channel plans to build 750 new screens, half of which will be AdShel Live, and will expand its long-standing partnership with Sainsbury’s with new screens in new stores, and upgrades of sites.

Strategy Leaders: The Media Leader‘s weekly bulletin with thought leadership, news and analysis dedicated to excellence in commercial media strategy.

Sign up for free to ensure you stay up to date every Thursday.