Why media analysts are split on ARPU

Average revenue per user (ARPU) has increasingly been used as a “go-to metric” for investors and chief financial officers to evaluate the performance of media platforms.

But, with the rise of “hybrid” VOD platforms as Netflix, Disney+ and Amazon Prime Video launching cheaper, advertising-funded tiers, it is getting harder to compare.

The Media Leader‘s analysis of ARPU, based on selected companies’ earnings statements and investor reports, shows that bigger does not always mean better.

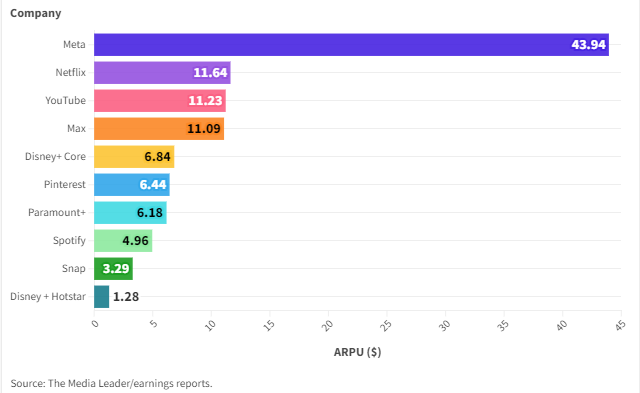

The below chart shows the most recent ARPU figures for different social media and streaming companies, either isolated in their last quarterly report or calculated from their latest earnings by dividing revenue by number of users or subscribers.

However, there are distinctions in calculations and terminology by company. Some calculate this using daily active users rather than monthly, while others provide quarterly over annual figures.

Snap calculates its ARPU by dividing its total quarterly revenue by average daily active users, while for Pinterest this is calculated with monthly active users.

Meanwhile, Snap also reports ARPU by region, split out into North America, Europe and rest of world, while Pinterest segmented this by global, US and Canada, Europe and rest of world. Snap’s ARPU for Q4 2023 sat at $3.29, a decline of 5% on the previous year. However, in North America, this was up 2% to $8.96 and for Europe this was up 5% to $2.49. Rest of world ARPU declined 7% to $1.03.

Pinterest reported growth across the board in its ARPU, with the global figure hitting $6.44 for 2023, $25.52 for the US and Canada, $3.73 for Europe and $0.50 for rest of world. This was up 1%, 5%, 15% and 17% respectively.

Netflix calls it “average revenue per membership” (ARM), which is calculated by dividing streaming revenue by the average number of paid memberships, divided by the number of months in the period.

The streaming giant reported ARM at $7.64 for the year ended 31 December 2023, down from $8.50 in 2022 and $9.56 in 2021.

Disney+ reports its “average monthly revenue per paid subscriber” and splits this into its core and Hotstar services. For Q4, it reported this figure at $6.84 and $1.28 respectively.

In its latest earnings call, Hugh Johnson, Disney’s CFO, highlighted its Disney+ core ARPU increased sequentially by $0.14 compared with the previous quarter, and $1.07 on the previous year, which was “driven primarily by price increases”. He added that this was expected to increase further in the next quarter “due to the continued benefit of price increases”.

Paramount+ reported in its latest earnings that its global ARPU had expanded by 16%.

Spotify reported its ARPU was up 1% year on year to €4.60 in Q4, which would be an increase of 5% with constant currency.

While Meta does not appear to directly split this out in its quarterly financial reporting, by dividing total revenue by number of daily active users, The Media Leader calculated Meta’s ARPU for 2023 as $63.90 for daily active users and $43.94 for monthly active users.

Amazon separated its net sales from its advertising and subscription services in its financial reports, but it did not report average revenue per customer or Prime member.

Analysis: ‘Loose and inaccurate’

Analysts acknowledge ARPU as an important metric to examine overall company performance, both internally and externally. However, it is problematic.

Alex DeGroote, for example, stressed ARPU should be used as “a starting point”, even though it is widely acknowledged as “one of the key metrics” used by media, telecoms and tech analysts to gauge the potential revenue and profitability of a company’s customer base.

He suggested that the measure worked best with companies that have subscription revenue but not so well with advertising-type companies.

“ARPU is pretty useful, but I do think that it’s a bit loose and a bit inaccurate to lump in advertising versus subscription,” DeGroote said. “They are two quite different revenue streams.”

He explained ARPU as a metric that came into being about 30 years ago through telecoms companies, particularly mobile telecoms companies. Then companies like Sky, primarily a subscription-TV company, used it as a reference point for how to model its business, with the idea that it could track its ability to sell additional services like mobile to customers on top of its main revenue stream of monthly TV subscriptions. Advertising was “largely excluded” from Sky’s definition of ARPU as it was not as sizeable a revenue stream compared with TV subscriptions.

DeGroote added that the “game-changer” to ARPU came when social media companies came along 10-15 years ago and began to use it based on advertising rather than subscription, because users did not pay to use Facebook.

This showed the problem with using ARPU with advertising-based businesses, DeGroote continued, as they do not generally have very accurate data on the underlying user base. For example, it is hard to know with social media companies how many bots there are or how many people are on family accounts, so it can be “less accurate” than someone paying for a subscription.

Looking at ARPU from advertiser-funded VOD (AVOD), such as Netflix, Disney+ and other streamers, DeGroote said it would “confuse the underlying SVOD story with advertising” and create “a slightly ‘apples and pears’ type situation because they’re really not the same”.

He also highlighted ARPU has “quite a regional bias” as it tends to be very high in mature Western markets, usually the US and Europe, and then “surprisingly low” in markets such as Asia and Latin America.

High ARPU keeps shareholders happy

General industry sentiment is that ARPU is a better measure of a platform’s success than purely looking at number of subscribers, according to Simon Murray, principal analyst at Digital TV Research.

He gave the example of Disney+ subscriber numbers “rocketing” in its early days, with lots of subscriptions coming from Disney+ Hotstar in India, where they were paying less than $1 per month compared with seven times that in some other countries. As a result, the streaming service had a high number of subscribers, but most of them were not generating much money.

Murray highlighted one reason Disney+ Hotstar gained subscribers “very quickly” was that it held the online rights to Indian Premier League (IPL) cricket until the end of 2022 — something that was “great for boosting subscriber numbers, but not so good for gaining revenues”.

This contributed to Disney deciding not to bid for the IPL rights in 2023 because they “correctly guessed” they would cost a lot more and Disney could not increase subscriber revenue enough to offset the increase, he remarked.

Murray concluded: “Now the platforms look at how much ARPU they can generate — higher in the rich countries. Most of the platforms are making profits, so most have cut content budgets to try and balance the books and keep their shareholders happy.”

At The Year Ahead 2024, analyst Ian Whittaker echoed this as he saw ARPU as the focus for SVOD growth in major markets in 2024.

He explained: “I’ve been negative for several years now on SVOD. I just don’t think the market penetration is there for them and I think what you will see in 2024 is this flatlining coming through and it will be hard to see further penetration.

“The focus very much will be on ARPU growth going forward, simply because if you are going to grow your revenues, subscribers times your ARPU. And if subscriber growth is limited, your focus very much has to be on the ARPU.”