Why digital news subscription price hikes don’t tell the full story

2023 was a year of price inflation across many sectors of the economy, including media.

Digital news subscription prices increased by 19% in 2023, according to a recent analysis of paywalled UK publishers by Press Gazette.

Such price inflation was considerably higher than overall UK inflation (5%), but closely aligned with other price hikes seen by entertainment streaming services such as Netflix, Disney+, Hulu, Spotify and Max.

Analysis by the Financial Times in August found a “basket of the top US streaming services” also cost 19% more in autumn 2023 than it did the year before.

Analysis: ‘Commoditised’ news vs exclusive entertainment

Ben Walmsley, managing director of The Sun, told The Media Leader: “For the mass market, there is a scenario where some readers would pay — a hypothesis being tested with the Mail‘s limited paywall and Daily Record offering a paid premium bundle.

“The cost-of-living crisis shows that consumers are willing to pay for things they deem to be good value — but consumers have a breaking point that these increases will test.”

At the same time, Axate founder and former News International strategy director Dominic Young believes the sharp uptick in news subscription prices only tells part of the story.

One-fifth of publishers consider cost cuts as social traffic drops

“As we can all see when we visit news sites, there are almost always huge discounts on offer for customers signing up,” he said.

“The higher the headline price, the more valuable the discount appears to be, and many publishers include an automatic step-up to the headline price as part of their trial small print. Some customers might keep paying at that higher price long term, but even if they don’t, there is the opportunity to retain them with a smaller discount when they call to cancel. So, from some perspectives, a higher headline price makes sense, even if nobody actually pays it.”

Brand loyalty?

Of course, any time a subscription service raises prices, it risks reducing its total number of subscribers. According to Kantar data seen by The Media Leader, among VOD consumers, price-related issues are a core concern for those choosing to unsubscribe. Common cancellation reasons include wanting to save money (28%), the end of a free trial (10%) and price increases (7%).

It is unclear whether consumers, when faced with the need to cut back on unaffordable subscriptions, necessarily prioritise entertainment services such as Netflix or Spotify over news outlets.

Alice Enders, head of research at Enders Analysis, explained: “Not every subscriber has the same attachment to any service and those that are highly engaged (superfans) will bear the price increases without a thought.”

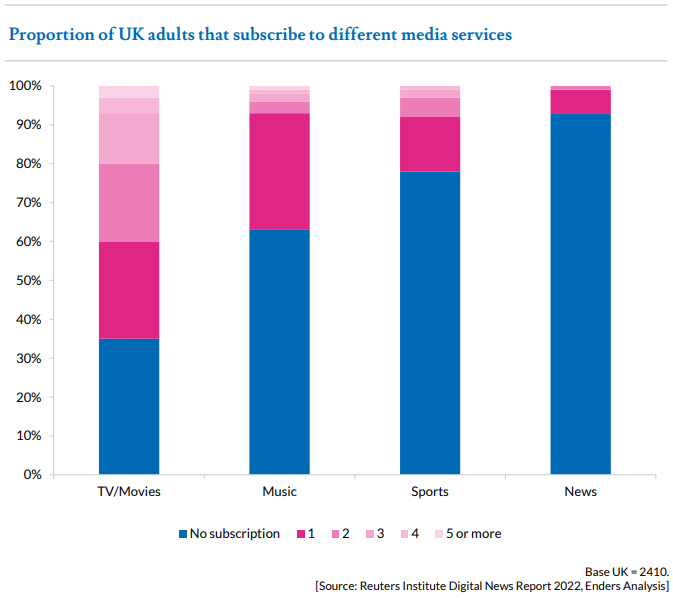

A September 2022 report from Enders Analysis highlighted that, in general, consumers more commonly choose to subscribe to TV and film, music or sports media services than news. Just 9% of UK consumers reported paying for online news at all, be it through subscription, membership, donation or any one-off payment.

In 2022, subscription management company Rocket Money (formerly Truebill) found that the subscription services with the lowest cancellation rates were most likely to be productivity services (such as Wix, Squarespace, Dropbox and Zoom), gaming/entertainment services (for example, Xbox Game Pass) and financial services. Netflix’s supposed cancellation rate was also considered low at 4%. On the other hand, according to Rocket Money, The New York Times had a cancellation rate above 15%.

News outlets that lock their content behind a paywall do so knowing they will need to compete with an increasingly commoditised product that is widely available through free sources, be they competitor ad-supported publishers, broadcasters (and their websites), social media or blogs. It is plausible that a consumer would prefer to unsubscribe from a news outlet rather than a streaming service that offers exclusive entertainment.

In other words, if you want to watch Stranger Things, you need a Netflix subscription; if you want to know the latest update on the Russia-Ukraine war, you can check the BBC or reporters’ social media accounts, rather than a paywalled article on The Times.

Reluctance to commit

A potential loss of subscribers sensitive to price hikes is anathema to many publishers’ stated goals. The Telegraph, for example, set a goal in 2018 to reach 1m subscribers by 2023 — something that it accomplished in August on the back of 700,000 digital subscribers. But, in order to do so, it made considerable use of discounted price offers, as Young noted.

“We saw from numbers released by The Telegraph last year that their average revenues per subscriber fell quite dramatically as total subscriber numbers were increasing,” he said. “Most publishers do not share similar data about the real-life amounts of money that subscribers are paying. If any of them have increased in line with the headline price, ie increased average revenue per subscriber by 19% or more, then it’s a truly impressive achievement.

“However, it would go against the trend of the last few years, which has seen discounting as low as below zero in some cases as publishers confront the reality that most of the would-be readers who might be willing to pay are very reluctant to commit to a subscription.”

Walmsley believes the future for news publishers will be “a hybrid model of paid and ad-funded”.

He continued: “It’s important that we maintain an ad-funded internet. We don’t want a two-tier internet where only the wealthy have access to reliable news, especially as AI threatens to unleash a torrent of unverified content into the open web. A healthy democracy requires open access to verified and regulated news media.”