Why BARB has not yet given Project Origin a tick

Media Leaders

BARB and Origin have each been making progress towards the delivery of cross-platform measurement this year. BARB’s CEO reflects on the progress it has made without the participation of the online platforms.

A year ago, I wrote about how BARB has long been aligned with the principles that underpin ISBA’s delivery of Project Origin. The WFA’s principles seem to have been inspired by the decades-long philosophy behind joint-industry currencies and could have been written with BARB in mind.

We’re independently run — by the industry and for the industry — with funding and governance that includes buy-side and sell-side partners.

We put in place consistent audience building blocks that allow comparable evaluation of media, and our industry-agreed methodology doesn’t prejudice or discriminate for or against any media service.

Importantly, our data have always supported the measurement of brand and sales outcomes.

The objective of Project Origin is also close to our heart. BARB has been delivering deduplicated cross-platform reporting since audiences started to fragment across distribution platforms in the late 80s and early 90s.

And audience fragmentation continues with the rise of streaming services. Offering a wide range of content from high-quality premium movies and programmes through to user-generated videos, streaming services have attracted the attention of viewers who traditionally relied almost entirely on linear channels for their viewing entertainment.

With the cooperation of the broadcasters, we started reporting audiences to their streaming services in 2015. We recognise this wasn’t delivered as quickly as the industry would have liked, yet BARB isn’t the only business to have confronted the technicalities of integrating device-based data with people-based data. It’s very challenging to get this right and to do it to the standards expected of BARB.

What’s happened in the last 12 months and what comes next?

Bigger reporting samples

2021 promised to be a transformative year for BARB for two reasons.

We took a big step forward in June when we announced the award of research contracts that confirm the commitment of the UK advertising and television industry to BARB until the end of 2029.

Understanding people — not just devices and distribution — has always been a fundamental part of BARB’s remit. This is why it is critical we have a high-quality panel of homes at the core of our service. The great news is we are committed to the largest-ever increase in our reporting sample — up to 7,000 homes, which is close to 16,000 people.

But our service is not just about having a panel. Our audience ratings will continue to be underpinned by the integration of big data.

Since 2015, BARB has independently collected and audited a census count of viewing to Broadcaster video-on-demand (BVOD) services. We harness these device-based data with people-based data sourced from a panel that represents the breadth of UK society.

SVOD measurement

Our second big step forward is a once-in-a-generation upgrade in our audience reporting.

Later this month we will extend our services to cover subscription video-on-demand (SVOD) and video-sharing platforms such as YouTube.

This means the television and advertising industry will have access to independent, objective and transparent measurement of audiences to streaming services, even without their active participation in BARB.

This development reflects a long-standing ambition to deliver comprehensive insight into what people watch, and our determination to extend our reporting to embrace streaming services such as Amazon Prime Video, Disney+, Netflix, TikTok and YouTube.

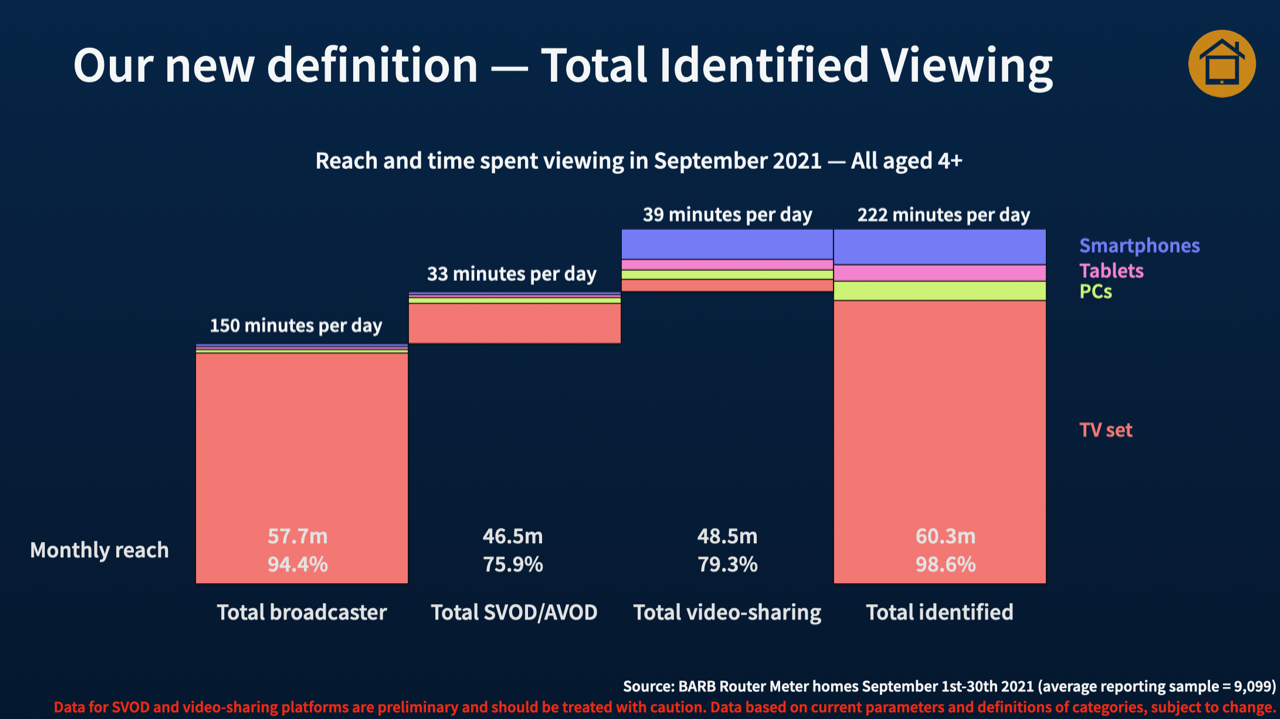

The chart (above) shows how this expands the total amount of viewing we will report. Our new definition of Total Identified Viewing is made up of three parts; total broadcaster viewing, total SVOD/Advertiser-funded video-on-demand (AVOD) viewing and total video-sharing viewing.

Broadcasters clearly account for the majority of viewing through their linear channels and BVOD services, while the TV set is dominant for both broadcasters and SVOD/AVOD services. This reflects people’s continued desire to use the biggest screen available to watch professionally-produced, long-form content.

The same isn’t true for video-sharing services, which are mostly watched on smartphones. This isn’t surprising given how easy it is for people to watch short-form content on smaller devices.

So BARB’s position is that we deliver service-level viewing, programme ratings and post-campaign reporting for linear broadcast channels across all devices. Service-level viewing and programme ratings for BVOD services — again on all devices — are also part of our daily reporting.

Many buyers and sellers of advertising are using our Advanced Campaign Hub which offers a pre-campaign planning service across linear and BVOD services. And our involvement with CFlight — to provide assurance on the integrity of its post-campaign validation reporting — is taking shape.

The extent of our reporting for SVOD includes service-level reach and viewing time across all devices, while we will also publish programme ratings for viewing on the TV set. Our viewing figures for video-sharing services are restricted to service-level viewing that takes place through the home WiFi network; again this is across all devices.

Turning on the supply of new data is made possible by BARB’s established processes which reflect our constant determination to do things properly. Due diligence on methodologies and rigour in evaluating the outputs are part of the fabric of BARB. We need to ensure we are introducing developments that adhere to our principles which — to my earlier point — we share with the WFA.

So where does this place BARB in relation to Project Origin?

We recognise Origin seeks the involvement of multiple data partners and welcome its stated intent to respect the integrity and value that joint-industry currencies like BARB can provide.

Equally, it’s important to clarify how and where Origin aligns with deeply-held and long-established industry standards, and where it doesn’t.

Contrary to what you might have heard, BARB has not given Origin a tick. We aren’t involved in the assessment of the methodology, although we will take a view on whether our data can be integrated into the system.

A failure to insist on consistent inputs in cross-media planning systems undermines a principle that’s important to both the WFA and BARB — namely the need for consistent audience building blocks that allow comparable evaluation of media.

This is why we will only make our data available to solutions that harness BARB with data sources that are objectively equivalent. To this end, we have had conversations with ISBA about how we audit its proposed use of BARB data. But it’s too early in the development of Origin for us to have reached any conclusions.

BARB is starting to deliver cross-platform measurement of audiences to online video-streaming services. This might not meet the breadth of Origin’s ambition to capture all online activity, yet this month’s data launch means our service goes further towards meeting an industry need.

We have delivered many of these enhancements without the active involvement of the online streamers. And we could go further with their participation, although this would need their acceptance of industry standards that underpin everything BARB does.

And, I have to ask, why shouldn’t they agree to that?

Justin Sampson is CEO of BARB