US ad market growth stronger than expected in Q1

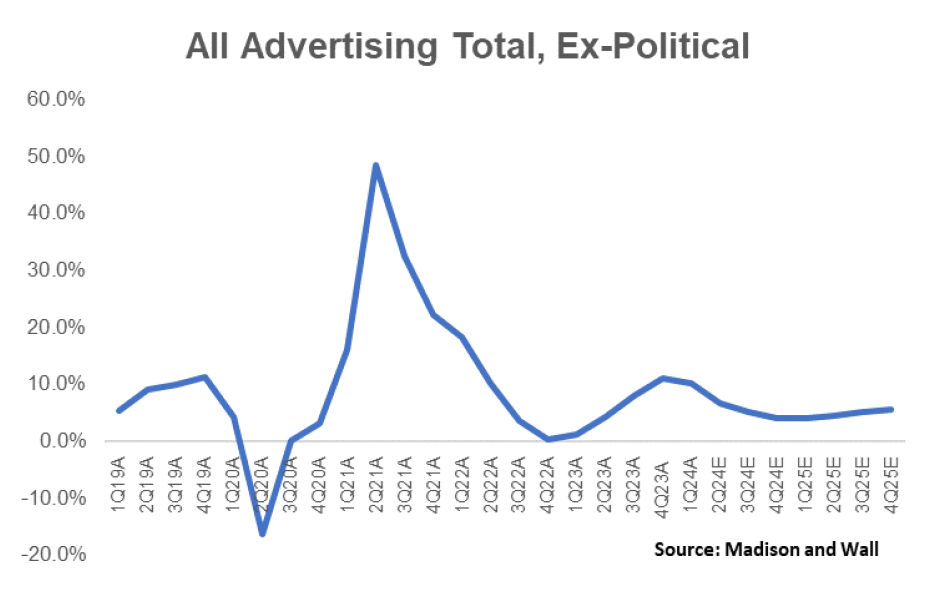

The US ad market grew by 10.1% in the first quarter, excluding political advertising, according to the latest forecast from consultancy Madison and Wall.

Madison and Wall was founded by veteran industry analyst Brian Wieser, who had previously predicted the US market to grow 8% in Q1.

“The stronger market suggests that Q2 will be at least slightly stronger than expected as well,” Wieser noted.

The latest estimates put growth at 6.7% in Q2, with an upgrade for the full year from 5.6% to 6.3%.

Over the past two years, Wieser said, the US ad market has seen 5% annualised growth, suggesting that “many marketers who cut their spending in late 2022 and early 2023 only did so on a temporary basis”.

However, Wieser added the caveat that the strong growth in Q1 was helped by last year’s relatively slow rate of growth (1.2% in Q1 2023). The US ad market picked up more substantially towards the tail end of last year, driven in part by heightened spending from Chinese companies including Temu and Shein that continued into 2024.

He thus predicted Q3 and Q4 2024 to grow “at a slightly slower pace on the back of relatively difficult comparables”.

That is despite the presence of the Olympic Games, which Wieser did not believe will provide a substantial boost to spending in the US market.

“Over the past 10-15 years, I have observed that the Olympics don’t represent a meaningful amount of incremental spending for the advertising industry overall,” he said. “Instead, they drive a shift of spending from existing budgets.”

Going forward, Weiser expected trends to continue in how media budgets are spread across channels.

“Those shifts should include ongoing share gains for digital advertising, modest share losses for outdoor advertising and bigger share losses for audio, television-based media companies and publishers of content with roots in print,” he explained.

Examining US political advertising, Wieser predicted a relative slowdown in growth compared with the last presidential election cycle due to reduced competition during the primary process and a slowdown in fundraising. Still, he forecast “massive” political adspend to the tune of $15.1bn for the year, up from $14.1bn in 2020.