UK TV exports reach record £1.85bn

UK TV exports in 2022-2023 have reached their highest level, increasing 22% on the previous year to £1.85bn, new data has found.

This total is the highest since Pact (the Producers Alliance for Cinema and Television) began reporting export revenues in 2017, a marked contrast with decline of 3% during the Covid-19 pandemic in 2020-2021, and up on 7% growth in 2021-2022.

More than half of programmes sold in 2022-2023 were to international streaming and video-on-demand platforms (53%), an increase of 39% on the previous year.

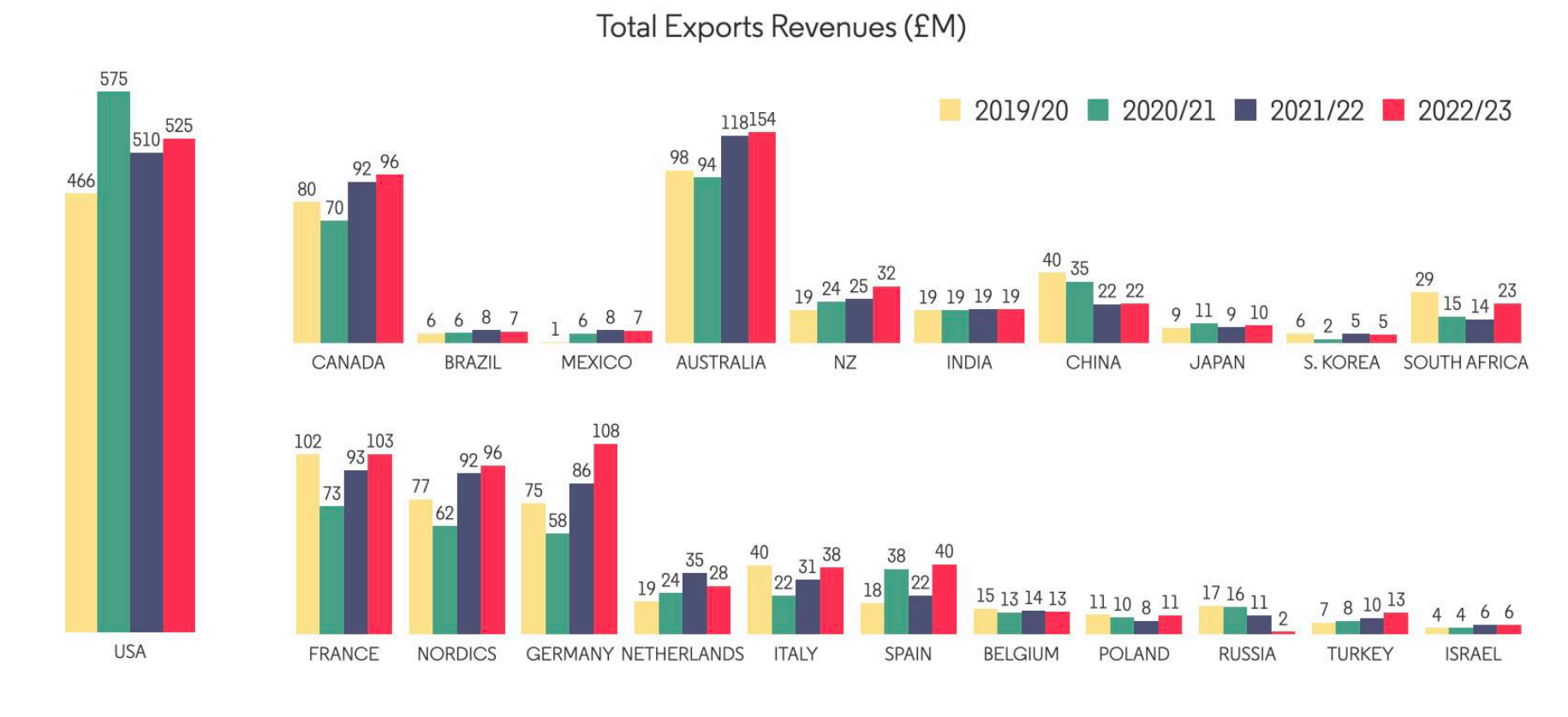

North America was the biggest market for UK TV sales, making up £525m or 38% of total exports. This was mostly flat year-on-year with modest 3% growth.

Meanwhile several European markets experienced double-digit growth including Spain (79%) Poland (39%), Germany (26%) and Italy (21%).

Finished programmes made up the majority of sales (60%); this was up 11% on 2021-2022 and in excess of £1bn for the first time.

Scripted drama were described by the report as “a key revenue driver,” representing 49% of revenue, followed by entertainment (21%), factual (18%), TV comedy and other (5% respectively), and kids (2%).

However, the report tempered these growth headlines with the expectation that this year will be “exceptional” rather than lead to a further double-digit growth trend.

Pact CEO John McVay OBE, said, “These strong sales figures highlight yet again that UK indies continue to produce quality TV programmes that the rest of the world want to watch. However, we anticipate that this is likely to be an exceptional year and that next year’s report will reflect the current global financial uncertainty and rising production costs.”

Half of respondents said their businesses were “impacted by the period of austerity and cost management that major US companies experienced” over the last year, but all of them expected conditions to return as macroeconomic conditions improved.

In its latest earnings, ITV CEO Carolyn McCall highlighted the current “challenging macro environment” which is impacting the TV advertising market and also the demand for content from free-to-air broadcasters in the UK and internationally.

She pointed out ITV Studios’ growth which was “faster than the market, with 9% revenue growth.”

McCall said: “It is evident that our strategy of growing the Studios and M&E digital business is helping ITV to offset the current headwinds and we remain confident in delivering our 2026 targets, when we expect two-thirds of revenue to come from these growth drivers.”

Going forward, a lack of financing support from commissioners was cited by all respondents as a key factor that will impact the distribution of UK content internationally over the next year. Similarly, 91% identified increased costs of productions as a potential drag on the market.

Respondents also predicted that subscription video on-demand (SVOD) contribution to long-term growth is “changing” and advertising funded video-on-demand (AVOD) “will become a more important part of the market”.

Nearly three-quarters of respondents (73%) said the growing market for free ad-supported TV (FAST) would impact the market for UK programming.

Pact’s UK TV Exports Report is sponsored by Fremantle, BBC Studios, ITV Studios, All3Media International. The surveys in the report are carried out by 3Vision of 20 UK distributors.