The online advertising bubble has burst: a roadmap for the way ahead

Opinion

At this crossroads in online advertising and media, Nick Manning examines what went wrong, where we are now and where advertisers should turn to reprioritise quality messaging, effectiveness and creativity.

The impending bankruptcy of Vice and the closure of BuzzFeed News are sure signs that the seemingly unstoppable internet juggernaut has reached a critical crossroads. BuzzFeed itself has lost 94% of its value since it floated in December 2021. Vice was once valued at $6bn.

The recent Vanity Fair article on the demise of the two new-age news operations graphically describes how and why they declined: “It turned out that advertising was a bad bet”, thanks to their reliance on Facebook and Google. But now advertising as a basis for the funding of many internet-led businesses, including ad tech, may also prove unsustainable.

We are reaching the end of a long period of meteoric but unrealistic growth for some online media properties as a combination of higher costs and lower revenues brings hard reality to a sector that has been overblown for several years, buoyed up by insane levels of adspend not justified by effectiveness nor efficiency.

Towards the end of 2022, the independent analysts Arete Research predicted that digital ad spending would decline by 5% year-on-year in 2023 as economic conditions deteriorate and ‘bubble’ sectors such as home-delivery grocery players reduce ad investment.

Arete also predicted that Connected TV and Retail Media would buck the trend and show true growth.

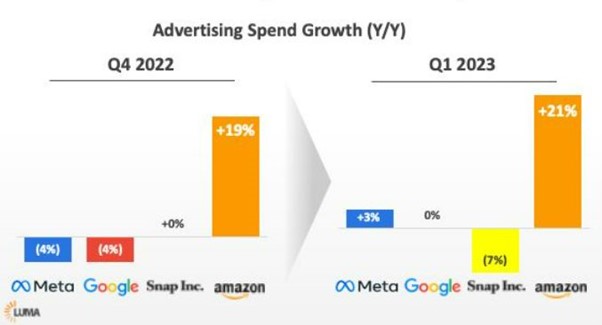

In May 2023, I think we can see that their predictions were broadly correct and we are in post-bubble territory, as highlighted by this graphic issued by Luma Partners.

Amazon’s exploding advertising revenue is partial evidence of how Retail Media Networks have mushroomed as advertisers seek more accountable environments where first-party data makes targeting better and which smooth the path between advertising and sales.

With general tightening of spend, Arete also predicted that intermediary fees (the adtech ‘take’) would get compressed as the supply-chain players find the going tough, especially if chasing unrealistic targets (ie most of them).

We are witnessing the compression of the adtech “daisy chain” as the intermediaries aim to take a bigger share of the meaty transaction charges that still often make online display advertising a hugely wasteful exercise.

The supply-side tech companies are trying to eat each others’ lunch as money dries up and adtech valuations plummet. After the Klondyke-era set of IPOs, most adtech companies are trading at a massive discount, and desperately seeking new revenue streams to stave off further erosion.

The essential online site Quo Vadis tracks adtech stocks since IPO and their latest figures show that 15 out of 18 online companies are now trading well below their float price. Purveyors of the worst kind of online advertising (Taboola and Outbrain) are over 80% down, wiping out millions of dollars of investors’ cash.

An era of inefficiency in online advertising

In short, we are at the end of a two-decades long era when online advertising exploded, driven by mass consumer adoption and the apparent (but mostly mythical) attractions of cookie-based advertising.

Online display advertising gave the artificial appearance of being both efficient and effective by offering low ad unit prices with better targeting.

Now cookies are going (maybe) and privacy is being improved through internal factors (Apple’s ATT moves) and overdue external regulation. As Bob Hoffman has been saying for years, tracking people is wrong but the industry has run with it even though it was contrary to advertisers’ corporate values.

The world has also, finally, realised that personalisation at any level was hugely erratic and personalisation at scale a myth that only made sense on conference platforms.

Online advertising has worked at a level for many businesses (and especially small to medium ones built around performance) but vast sums have been wasted by advertisers on artificially pumping up platform and adtech revenues for relatively little return in a channel plagued by issues of exposure, attention, fraud and a lack of reliable metrics. “Walled Gardens” remain a mystery for a reason.

What’s next?

So, to the future. We are at a crossroads and advertisers need to decide which way to turn and who will help them reinvent online advertising as the old order fades and new solutions emerge.

The first stage is perhaps obvious. Online advertising is only one part of the consumer repertoire; behaviour is shaped by many experiences in the real and virtual world.

For example, we are seeing a move towards omnichannel Retail Media solutions that include digital media such as Digital Out-of-Home and physical in-store presence, a hybrid of brand communications, trade marketing and Shopper marketing that draws budget from all three sources, thus bringing new money into the advertising market.

Advertisers are spreading their bets on digital and physical assets, and choosing more carefully off the full menu.

With so many channels both available and used, there is no reason not to put together the most effective combinations, despite the lack of joined-up technology and measurement and the sheer difficulty of juggling several balls at once.

Great media planning has never been more important or difficult and media buying should now be relegated to its rightful position as a support to planning, especially in a biddable world.

What should advertisers look for?

To achieve all of this, advertisers should look internally for the way ahead and rely less on their external partners.

As Travis Lusk of Ebiquity states in his Substack blog, the advertisers who win will be the ones who take the most control, especially as the market churns and newer channels predominate.

Increasingly knowledgeable clients will then demand more from their external partners, some of whom have benefitted from a vanilla service where fees were easy to get in an eco-system riddled with dark holes and with clients ill-equipped to ask the right questions.

Travis provides a great check-list of actions that advertisers should take to make their online advertising work harder and better. Why anyone wouldn’t follow this advice is hard to understand.

For an even more extensive guide to how to fix a broken system, advertisers should look no further than a new playbook for online advertising from Method Media Intelligence (MMI), entitled ‘A Marketer’s Guide to Digital Advertising’, a veritable how-to publication that looks at the ‘transparency, metrics and money’ that are the three base requirements for today’s advertisers.

MMI is a content verification business but the authors of the book are experts in all aspects of online advertising, and it shows. The book covers every conceivable aspect of the online ad business, including technology, measurement, supply-chains and the essential tools and skills.

They look forensically at the many problems plaguing online advertising, including ad fraud, poor viewability and the black holes where data and money disappear. They also do this across the widest range of online channels.

More importantly, they offer solutions to the many shortcomings that have led to gargantuan revenues for the supply-side but scant reward for advertisers.

Attention, creativity, and effectiveness

However, perhaps the biggest need of all is the most obvious and basic. Advertising works best when it breaks through the attention barrier and makes a strong impression on its audience, and the messaging, format and design of ads make an essential contribution.

We have spent the last twenty years trying to make the channels work harder, without an equal emphasis on ‘the work’.

The success of new video formats on TikTok and Instagram reminds us that creativity sells and media works harder when creativity is prioritised. It is the job of the media folk, as ever, to help make this happen.

It is hard to explain why advertisers have allowed the historic relative ineffectiveness and inefficiency in online display advertising to last this long, but we are hopefully now entering a new era where better-equipped advertisers, especially with in-house expertise, are voting with their ad dollars and investing in better properties.

More powerful messaging in the right channels is crucial, with exposure and attention as essential helpmates.

Sometimes it takes a crisis to drive change. We can be confident that today’s difficult market conditions lead to an improved emphasis on creativity and effectiveness as long as advertisers take the advice of people who can guide them through the labyrinth and out the other side.

Nick Manning is the co-founder of Manning Gottlieb OMD and was CSO at Ebiquity for over a decade. He now owns a mentoring business, Encyclomedia, offering strategic advice to companies in the media and advertising industry. He writes for The Media Leader each month — read his column here.

Nick Manning is the co-founder of Manning Gottlieb OMD and was CSO at Ebiquity for over a decade. He now owns a mentoring business, Encyclomedia, offering strategic advice to companies in the media and advertising industry. He writes for The Media Leader each month — read his column here.