Streaming and Studios growth stems losses at ITV amid 15% decline in linear ad revenue

ITV’s linear ad revenue plummeted by 15% last year, the company reported, with losses stemmed by a surge in digital revenue.

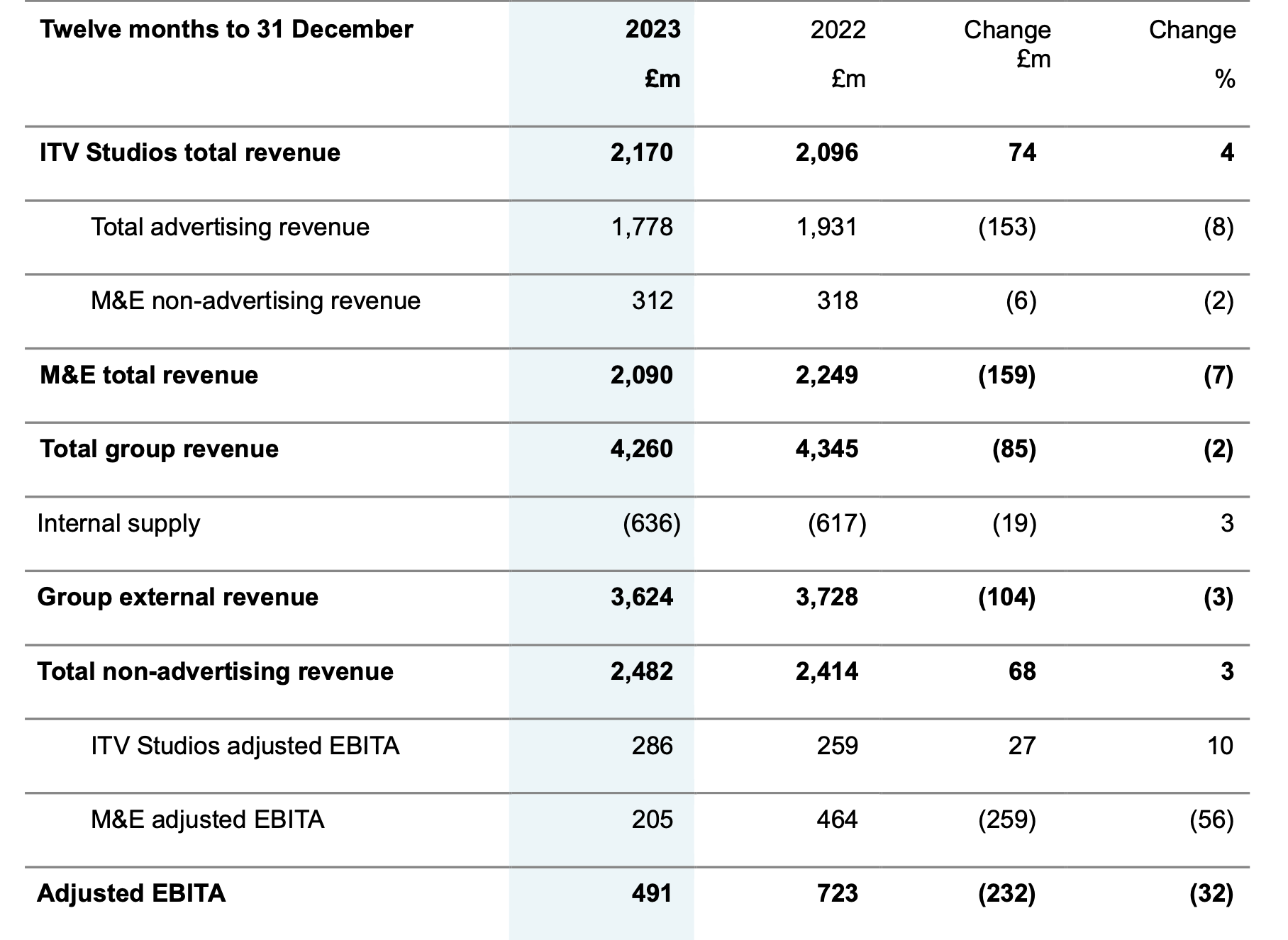

Revenue dipped 2% in 2023 to £4.26bn, as the UK’s biggest commercial broadcaster also reported record revenue (£2.17bn) for ITV Studios, its content arm that continues to outgrow its now £1.78bn advertising business.

Studios’ growth was driven by an uptick in revenue from streaming services, as nearly a third (32%) came from streaming platforms, up 10 percentage points from last year. However, ITV has stated its 2024 Studios income is likely to be impacted by delays in production as a result of the writers’ and actors’ strikes in the US, as well as continued weaker demand from free-to-air broadcasters in Europe.

Adjusted Ebita — ITV’s measure of profit — fell 32% to £489m. ITV CEO Dame Carolyn McCall attributed the drop to the decline in linear advertising revenue and the broadcaster’s investment in its streaming service, ITVX. However, she noted the company has “reached a peak level of net investment in our streaming business” and expects to grows streaming profits from here.

Indeed, McCall said the company saw the benefits last year of “reposition[ing] ITV towards higher sustainable growth”.

“ITV has a leading, scaled, global Studios business, a high-growth streaming service and a cash-generative linear advertising business,” she added. “This ensures that we are well-placed to grow profits from here, as we continue to drive material efficiencies, invest behind our strategic priorities and deliver returns to shareholders.”

Shares of ITV were up over 8% following the release of the financial report in morning trading.

Key to ITV’s future success, according to McCall, is its ability to execute on its “More Than TV” strategy.

The ongoing strategy contains three pillars: expanding Studios, “supercharging” streaming and optimising broadcast.

For Studios, ITV has made progress against its listed priorities. Studios produced 316 hours of scripted content last year, up from 276 hours in 2022 and on track to its 400-hour target by 2026. It has also already surpassed its 2026 goal of garnering 30% of Studios revenue from streaming services (32% in 2023).

On streaming, ITVX grew its monthly active users by 19% to 12.5m and increased total streaming hours by 26% to over 1.5bn. The company aims to improve those figures to 20m monthly active users and 2bn total streaming hours by 2026.

On the other hand, paid UK subscribers dropped 7% in 2023 from 1.4m to 1.3m.

“The progress we have made in streaming and against our KPIs means that we are confident of delivering at least £750m of digital revenues by 2026, with the focus continuing to be ad-funded,” McCall added.

Broadcast performance dipped slightly in 2023 against its strategic priorities. ITV’s commercial share of viewing rested at 32.6%, a decline of 1.2 percentage points and below its 2026 target of 33%. ITV’s share of the top 1,000 UK programmes also fell slightly, from 93% in 2022 to 91% in 2023, although this figure is above ITV’s 2026 target of 80%.

On the whole, McCall stated that ITV has “made great progress towards our 2026 KPIs”.

The broadcaster is in the “early stages” of a “new strategic restructuring and efficiency programme”, according to McCall, who said ITV will look to make savings from improving “technology and operational efficiencies”, including an “organisational redesign” across the group, the Media & Entertainment segment as well as Studios, alongside permanent reductions in discretionary spending.

ITV expects the cost-cutting programme to have delivered incremental annualised savings of at least £50m gross per year by the end of 2024.

In 2023, ITV exceeded its £15m cost-savings target, delivering £24m in permanent cost savings across the business, thanks in part to headcount savings, property savings from its US Studios business and “permanent operational efficiencies” across Studios and Media & Entertainment segments.

In 2019, ITV set an initial cost-saving target of £150m by 2026 and the company has already delivered £130m in annualised savings to date. ITV now said it is on track to reach its £150m target a year early.