'Podcasting made us sexy again': 7 key takeaways from The Future of Audio Europe

Opinion: 100% Media 0% Nonsense

Advertisers want long-term partnerships and are concerned about the ‘missing middle’, but are broadcasters strong enough to face down Big Tech?

It’s just over 50 years since the poet, activist, and “godfather of rap” Gil Scott-Heron coined the phrase “the revolution will not be televised”.

This, of course, had little to do with Mediatel’s inaugural The Future of Audio Europe conference, held in London in late June, but the spirit of revolution (in its own corporate way) beamed through much of what was said by the speakers, whether they were brand marketers, media owners, media agency specialists, or analysts.

But, fitting for a conference whose theme was “the audio revolution”, people were generally excited about the prospects for audio but recognised the new digital formats are not yet being used to their full potential.

Meanwhile, this revolution was sort-of televised, after all. All the sessions are available on our YouTube channel.

Here are my key takeaways and observations from the day. Any comments I’ve quoted are included as time-stamped clips, while some sessions have further write-ups here.

Audio ‘needs to reflect the conversation in the market’

“[We] know that big media decisions are also not being made in the UK,” Radiocentre’s client director Lucy Barrett warned. “As the world becomes smaller, radio — actually all audio — could be in danger of being missed off media plans.”

This is because, as she went on to explain, big advertisers “aren’t consistent across Europe” with how they make their media spend decisions. She went on to cite a “top retail brand in the UK” that spends about 10% of its total ad budget on radio, compared to 28% in Ireland.”

I’m not a regular listener of Irish radio (I’m a child of the 90s where you didn’t need to be; half the pop bands on UK radio seemed to be Irish), but there are of course many reasons why a major advertisers could take that decision.

Clearly it’s more difficult to create a global audio ad than it is to create a TV ad or a print ad across different European countries because of the obvious fact of differing languages. Say what you will about car ads where generic European people are driving through generic-looking cities with generic grins… they’re simple and cost-effective to produce.

Nevertheless, Barrett argued: “On a country by country basis, an audio ad needs to reflect the conversation in the market. There are some things that we can take forward like sonic branding, but if the conversation about radio or audio isn’t happening in the head office then even some global sonic brands won’t be created and this wonderful booming audio revolution isn’t going to get the advertising it deserves.”

Podcasting has made radio and audio ‘sexy again’

There was so much discussion throughout the conference about the growth of podcasts as a medium and how much influence the sector has on the audio industry as a whole. But, since so many podcast ads are bought directly within the walled gardens of Spotify, Acast, and co., it’s often difficult to get a market-level view of how significant this spend is.

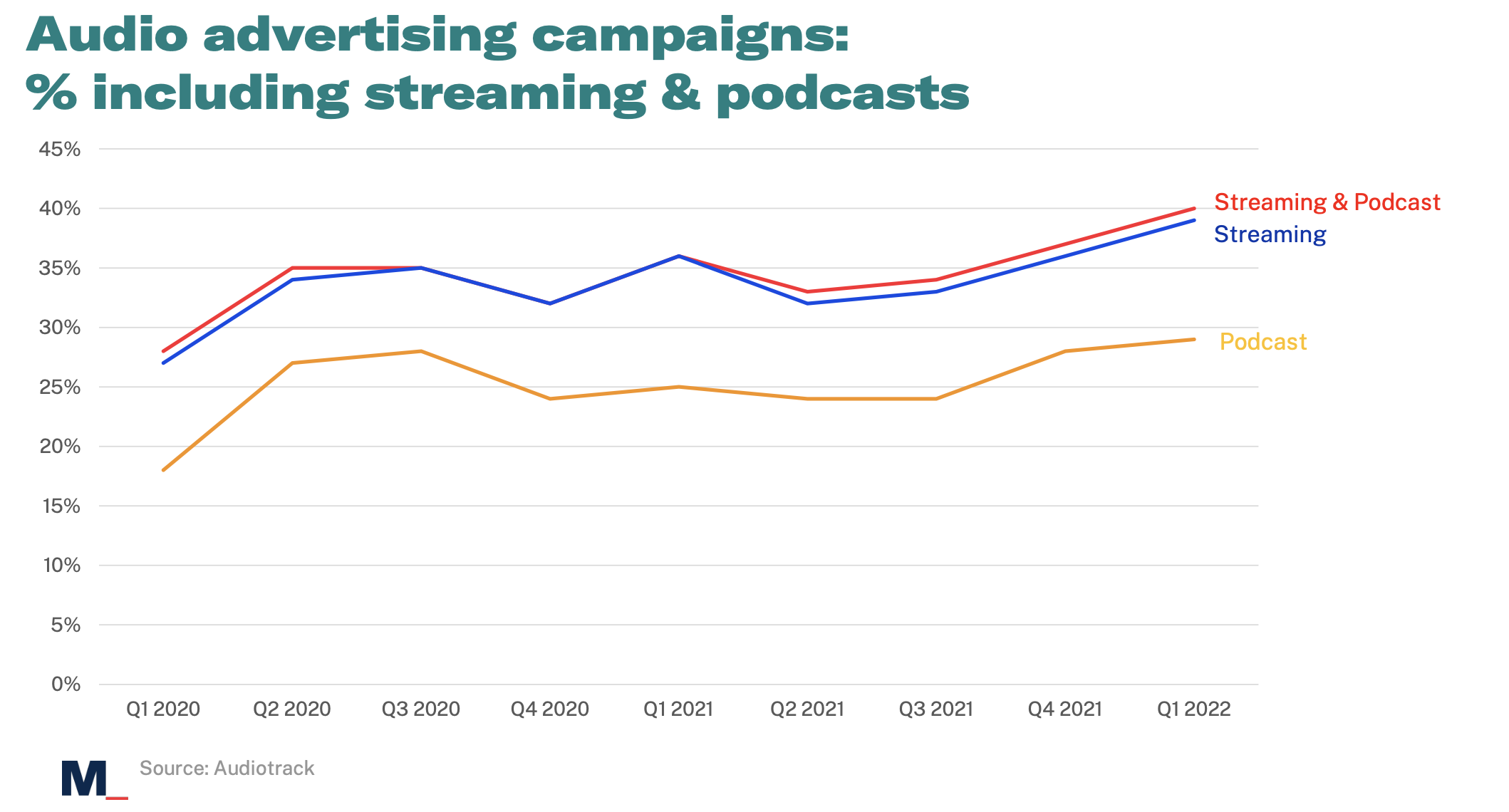

Step forward our very own Anne Tucker, Mediatel Connected’s head of research and AV, who presented exclusive Audiotrack data that reveals 29% of all linear ad campaigns in the UK now include campaigns on podcast, which is up from 18% in two years ago.

Meanwhile, 39% of linear ad campaigns include campaign activity on streaming devices, and 40% of linear campaigns now include an element of digital audio, up from 18% in 2020.

Tucker explained: “These numbers [are] on the ascendancy as tech infrastructure improves, helping clients become increasingly confident with investing in these digital audio channels alongside their traditional linear campaigns and the positive impact that the complementary audio options have on clients’ ROI.”

According to Kenneth Andresen, VP head of radio, Norway, at Viaplay Group, podcasts have been the key factor in making radio and audio “sexy again”.

“I don’t think radio has changed overnight; we have been tinkering with technology and delivery but at its core it’s the same thing that we have been doing all the time… [Podcasts] have made the awareness much higher, especially on the buyer’s side. I also think [the] viewership on television is just declining really strongly […] across the world and makes television a lot less efficient and more expensive.”

Advertisers want ‘long-term’ partnerships and are concerned about ‘the missing middle’

The conference heard a lot about the so-called “missing middle” which refers to a blind spot in the marketing funnel as brands have increasingly become preoccupied with splitting ‘top of funnel’ brand-building and ‘bottom of funnel’ activation or ‘performance’ marketing.

Alex Baker, head of creative strategy at Bauer Media Group, described “middle funnel” as: “you turn that brand awareness into brand salience; you take brand awareness from being ‘I’ve heard of that brand to it being this is a brand that I care about… this is a brand that shares my values.”

This sentiment was shared by Laura Leaper, thought leadership and content lead at NatWest, who revealed that this “missing middle” was where the bank brand’s audio marketing was trying to sit against.

“It is around strengthening consideration and intent around us as a brand. It can be harder to link the actual metrics that we track with brand sentiment tracking, so we work to agile marketing principles where we’re trying to set very measurable goals and and forecast target results in terms of downloads, engagement rates, and subscriptions.”

The problem is, it’s harder to link those metrics to actual shifts in brand sentiment and consideration. Leaper described this as “definitely a work in progress”.

Perhaps this is why Sky’s media strategy lead Julia Belyaeva, revealed that the UK’s biggest pay-TV operator is most excited about developing long-term relationships with radio channels when it comes to its audio advertising.

Belyaeva described how Sky has seen “an incredible return” on marketing investment and “amazing CPA numbers” for podcasts and digital audio. There is of course a suspicion of UK bias in this analysis, given that it is Sky’s home and its most important market, but nevertheless the company has upped its spend across the board in digital audio, podcasts, and spot radio.

She described partnerships as being “absolutely critical” to the recent campaign around launching the Sky Glass TV set, given the need to drive advocacy for the brand as well as comprehension and understanding of the product. The campaign is set to launch in Sky’s other key European markets, Italy and Germany, later this year, so we shall see how big a part audio continues to play in those markets, too.

Audio can take advantage of TV’s decline by ‘focusing on content’

The decline of TV audiences this year was cited several times as an opportunity for audio. Television, of course, was always going to struggle this year to match a bumper two years during Covid-19 when “nobody had anything else to do,” according to Dentsu’s partner, AV delivery, Gemma Lee.

“Because of the lack of being able to get decent programming produced, now we’re seeing a massive decline [in TV] because the content’s not there… Saturday-night viewing on ITV has massively declined. The issue is, if people aren’t watching Saturday night TV anymore, how do you get them back to doing that? Because once you step out of it and then try to go back to it, it almost becomes depressing.”

Clearly Lee has a more active social life than I do. I have nothing going on on Saturday nights and ITV, if you’re reading this, I’m more than willing to spend lots of time with you in future. My only request is that you get rid of Ant & Dec (or at least compel them to revive Byker Grove — which remains their best work). Oh, and ITV must promise to axe all talent competitions and game shows from the lineup. Kevin Lygo, I await your call.

Compare this decline, Lee argued, with how radio not only held up during the pandemic, but saw the rise of a mid-morning audience growth due to people working from home more frequently.

“The shape of [radio’s audience] changed slightly, but it’s still been the same as it always has. It’s really important for radio media owners and audio to really focus on the content and the talent to give that listener the best experience possible.”

Not too late to ‘tackle TuneIn’

The key problem that I see for audio industry right now is ensuring that the tech giants, whose smart speakers are becoming increasingly popular as radio players, ensure radio remains freely available online. Of all her many, many failings, Culture Secretary Nadine Dorries ducked this vital issue when publishing a Broadcasting White Paper earlier this year.

A cross-party group of MPs, which form the All-Party Parliamentary Group on Commercial Radio, are backing new laws to guarantee access to UK radio stations on digital platforms like smart speakers in future.

Several panellists on a particular panel, chaired by MG OMD’s head of implementation planning at Omnigov, Flora Williams, advocated their support for Radioplayer, the tech platform jointly-owned by the BBC, Bauer, Global, and Radiocentre, which enables radio broadcasts on the internet.

But hasn’t the horse already bolted, I asked this panel from the audience. Aren’t the tech companies already acting as gatekeepers between audio broadcasters, such as featuring them (and listener data) via radio aggregation services like TuneIn?

Andresen replied: “We can tackle TuneIn, but the only way that we will be able to do that as broadcasters is standing together. My biggest thing is distribution control, that will be key going forward. We need to protect the bond between the broadcaster and the audience.

“You have come really far in the UK, actually, with with the [Future of Radio report, published last October] and we are lobbying for the same in other European countries. We are really pushing for some legislation that will encompass ‘must carry’ and due prominence.

Andresen then asked rhetorically: “Do you [broadcasters] want to be on TuneIn, even though it might cost you some listening in the short run? I would say that broadcasters in Europe should really take a hard look in that, consider withdrawing from TuneIn and other platforms and come together on one platform that we control ourselves. And that is RadioPlayer.”

How audio ads should adapt for digital age

Shazia Ginai, CEO of brain analytics company Neuro-Insight, had a lot of compelling arguments as to how audio content impacts us in ways that normies like me don’t understand very well.

Consider this, for example: “Advertising plays a role in influencing human decision making behaviour and how we walk around and work in the world; particularly on the subconscious side… we’ve all probably sat in research where our consumers said ‘I’m not affected by advertising”, but they don’t really realise just how much of an impact it has at an emotional level and also in terms of capturing attention.”

Ginai went to explain that human brains will essentially do anything to avoid ‘doing work’, due to an evolution-driven need to conserve energy and take short cuts wherever possible. A study conducted with Octave Audio, Say it Now, and Xaxis revealed that a 10% uplift in brain response when audio ads are actionable as opposed to a conventional spot.

What’s more, if Amazon’s Alexa says a brand’s name, there is an 18% uplift. If the listener says the brand name themselves, the response shoots up to 30%.

Matt Hopper, co-founder and creative director of digital audio ad specialists Trisonic, presented a range of ways for how advertisers should adapt their audio ads to better suit the newer forms of the medium and how they are consumed.

For example, 85% of podcast listening is done through earphones, so it’s essential for host-reads ads or spots on podcasts to be recorded at a lower volume than they would for a radio spot. Newer headphones and devices also offer “3D audio” which offer a more engaging listening experience.

So why aren’t more ads being adapted?

Hopper speculated: “Probably lack of knowledge, certainly low priority. Radio or audio is often the last thing to be thought of in a big campaign that involves TV and digital.”

Cost is also cited as a reason, but Hopper warned this is a “fallacy” because it’s hardly any extra burden to ask a voiceover artist to record two different versions of an ad’s script.

And finally… if radio didn’t exist, would we invent it?

Baker, in conversation with Magic Radio’s Emma B, wondered if radio would even be allowed to exist if someone had invented it today instead of in the late 19th Century.

The pitch, according to Baker, would go like this: “‘You can sit in a studio and beam your voice and your personality and connect with people into their heads through a variety of different devices’, be that smart speakers, apps, whatever, it might be in their car, in their home, wherever… people would think ‘that’s the coolest thing ever’. There’d be conversations about whether or not it should even be legal — the conspiracy theorists would go mad!”

Maybe. But it does make you realise how integral the birth of radio has been to media generally, whether it was transmitting content through airwaves, or creating audio brands according to their ‘channel’ on a spectrum of wave frequencies. It might be a digital world now, but the same attachment to audio brands remains strong.