Ofcom scraps plan to relax PSB ad restrictions

Ofcom has decided to not remove stricter TV advertising rules that apply to commercially-funded public service broadcasters (PSBs) following a consultation.

The potential benefits to audiences, PSBs and the wider market are “uncertain”, the UK’s broadcast regulator announced this morning, but stressed that it has only decided to retain the status quo “for the time being”.

Ofcom said it remains convinced that there is merit in harmonising TV advertising rules by relaxing added restrictions on PSBs. ITV, STV, Channel 4, S4C and Channel 5 are subject to tighter advertising restrictions than non-PSB commercial channels, such as ITV2, 5USA and Pick.

“Instead we consider it appropriate to consider the impact of changes to TV advertising rules on viewers in the broader context of other changes to the PSB system in the coming years – including the implementation of the Media Bill,” Ofcom said.

Why did Ofcom want to relax ad restrictions for PSBs?

Ofcom reiterated today that there is a positive case for relaxing 30-year-old stricter advertising rules that form its Code on the Scheduling of Television Advertising (Costa).

The regulator’s rationale is that the availability of additional advertising on PSB channels may result in a deflationary effect across all linear television advertising which might help slow its decreasing competitiveness compared to other types of advertising.

Meanwhile, relaxing the rules could benefit audiences if PSB channels gain additional revenues from selling more advertising minutage, Ofcom said.

When it launched a consultation in April, Ofcom argued that the audiences migrating to streaming platforms from linear TV means that consumers enjoy a much wider range of ad-supported and subscription services over broadcast and online.

“Allowing the PSB channels slightly greater flexibility in the scheduling of advertising may strengthen their commercial position as they continue to manage their transition to digital-led organisations, and would afford them greater opportunity to monetise their content,” Ofcom said at the time.

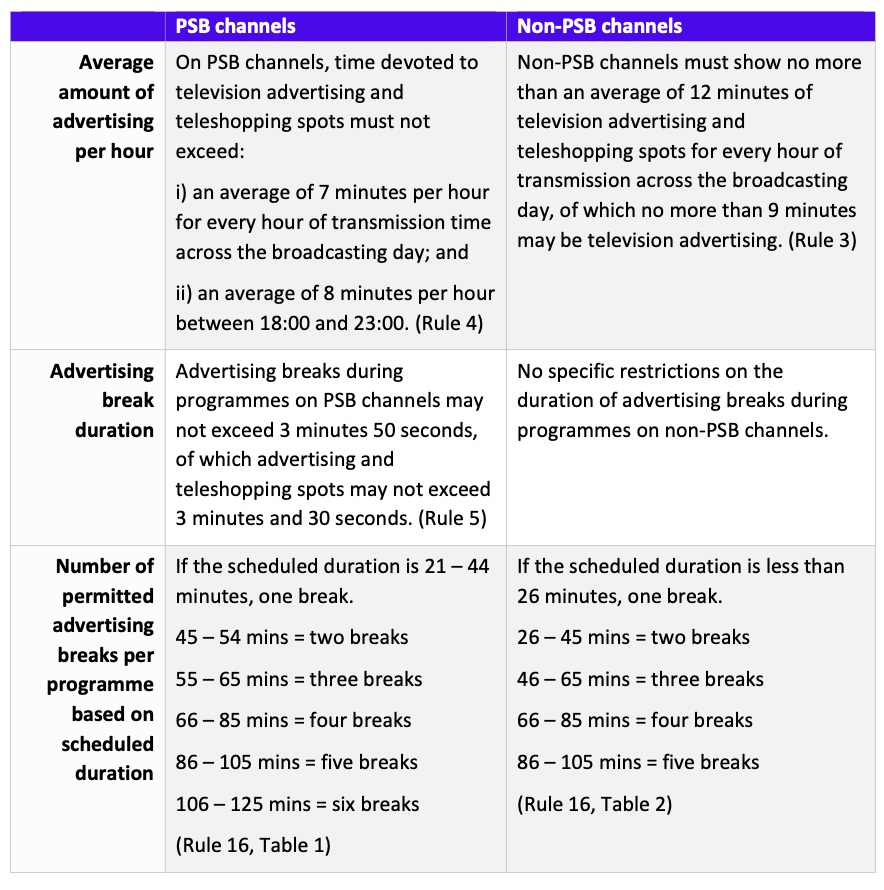

What are the current rules?

(Click image, above, to enlarge)

However, Ofcom noted that the current rules have “clearly influenced scheduling decisions by the PSBs”, even if this was not the original intention of the rules.

PSB channels currently tend to broadcast the maximum 12 minutes of advertising in and around mass appeal programmes in the 8pm-9pm slot during peak, Ofcom said, and these broadcasters usually balance this with fewer or no advertisements in the 6pm, 7pm, 9pm and 10pm slots, which typically contain news programmes.

Who’s in favour and who’s against changing the rules?

Ofcom’s consultation asked the UK media industry to feed back on two options for changing the Costa rules:

Option 1: full harmonisation of the rules between PSB and non-PSB channels.

Option 2: partial harmonisation while retaining the limit on the number of internal breaks permitted in programmes on PSB channels.

Option 2 was Ofcom’s preferred option. The regulator cited “audience research” which highlighted viewer concerns about an increased frequency of ad breaks.

ITV, STV, Channel 4, and ad industry trade body the IPA are broadly in favour of Ofcom’s proposals, but wanted to go further i.e. they favoured Option 1 (full harmonisation). They agreed, Ofcom said, that the stricter Costa rules for PSB channels are “no longer needed to ensure quality of the viewing environment”.

However, Sky, Channel 5 owner Paramount UK, and advertisers’ trade body Isba said they were against full harmonisation and favoured Option 2 instead, as did the Commercial Broadcasters and On-Demand Services (Coba) which represents niche broadcast channels. Coba argued that a relaxing of restrictions should only apply on weekends only to minimise the impact on the revenues of smaller and niche channels and on the number of minutes of news on PSB channels in “peak” (6pm-11pm).

When Ofcom’s proposals were unveiled earlier this year, Coba warned that the changes would cost £180m a year in ad revenue for non-public service broadcasters and hit niche channels hardest.