Vast majority of linear TV ads only reach ‘half’ of UK households

More than nine in 10 ads shown on traditional broadcast TV are only being seen by half of households in the UK.

That’s according to research from TV tech provider Samba TV, whose latest State of Viewership Report for the UK also found that the half of UK households that do watch linear TV are being bombarded by over 70 TV ads each day.

Whereas the top 50% of linear viewers watch an average of 71 ads per day, the bottom 50% of linear viewers only watch an average of seven.

The total hours of linear watched in the UK has dropped below 9 billion, the report said, the lowest it has been in the last two years. Meanwhile, linear’s average daily reach remained in line with last year, at about half of UK households (14 million).

Broadcaster video-on-demand (BVOD) penetration has increased by 6% year-on-year, the report added, citing figures from Insider Intelligence.

Matt Hill, research and planning director at commercial TV’s UK marketing body Thinkbox, told The Media Leader that the Samba data highlights a real trend where “lighter” TV viewers are getting harder to reach through linear TV. AA/WARC figures estimate that BVOD now accounts for 17% of TV spend and the odds of reaching lighter viewers are much higher on streaming platforms like ITVX, Channel 4, and My5.

He explained: “Samba’s data is a good example of Pareto’s 80/20 principle, where 80% of consequences are generated by 20% of causes. All media channels experience this: for SVODs like Netflix it’s 59/20 (59% of viewing is by 20% of viewers) and for video sharing platforms like YouTube it’s 73/20. Commercial TV is actually one of the better performers, 20% of viewers account for 60% of viewing. Samba’s numbers may sound alarming, but it’s the nature of media consumption in general and the same analysis across any other channel would reveal a similar pattern.”

On the question of viewers being “bombarded” with ads, Hill pointed to past research that TV has one of the “highest value exchanges”.

He added: “Viewers are happy to watch the ads in exchange for the content — it’s one of TV’s superpowers. Whilst there is likely to be excessive frequency for people who watch immense amounts of TV, the relatively high frequency of TV ad delivery in general is a critical factor in driving its efficacy. Data from WPP’s vast econometric databank shows that both linear TV and BVOD are the most effective video channels in terms of short and long-term return on investment.”

Four-fold surge in Booking.com TV ad impressions

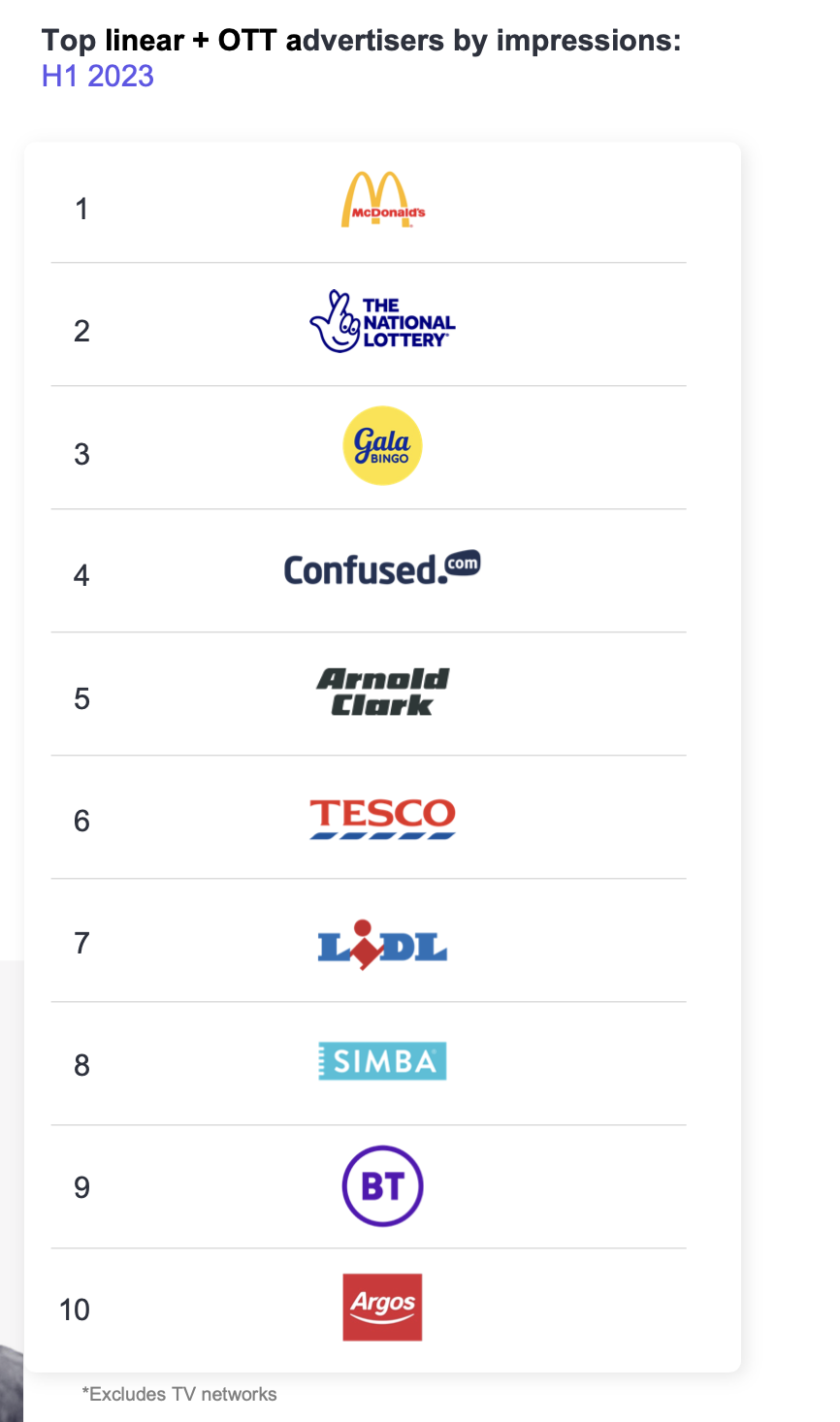

McDonald’s remained the top advertiser based on linear impressions served, closely followed by the National Lottery. The report noted how brands that celebrated anniversaries this year contributed to “big ad impressions”, including retailer Argos (number 10), which celebrated 50 years in business.

McDonald’s remained the top advertiser based on linear impressions served, closely followed by the National Lottery. The report noted how brands that celebrated anniversaries this year contributed to “big ad impressions”, including retailer Argos (number 10), which celebrated 50 years in business.

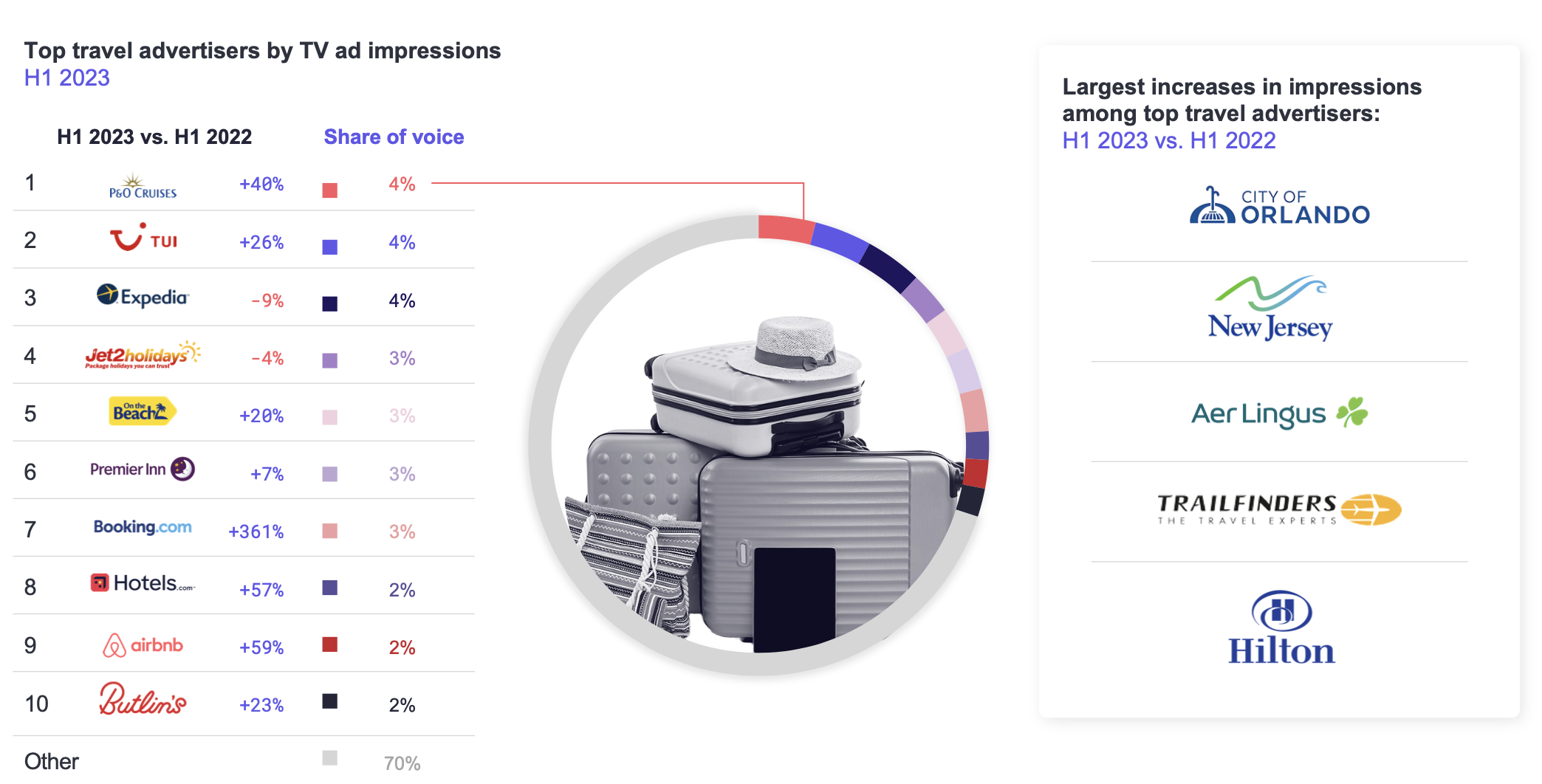

Eight of the top 10 travel advertisers increased TV ad impressions compared to last year as worldwide Covid-19 restrictions eased compared to the beginning of 2022. Booking.com, the UK’s seventh biggest travel advertisers on TV by ad impressions, has increased activity by more than four times (361%) year-on-year, while there have been double-digit increases for most of the top 10, led by P&O Cruises.

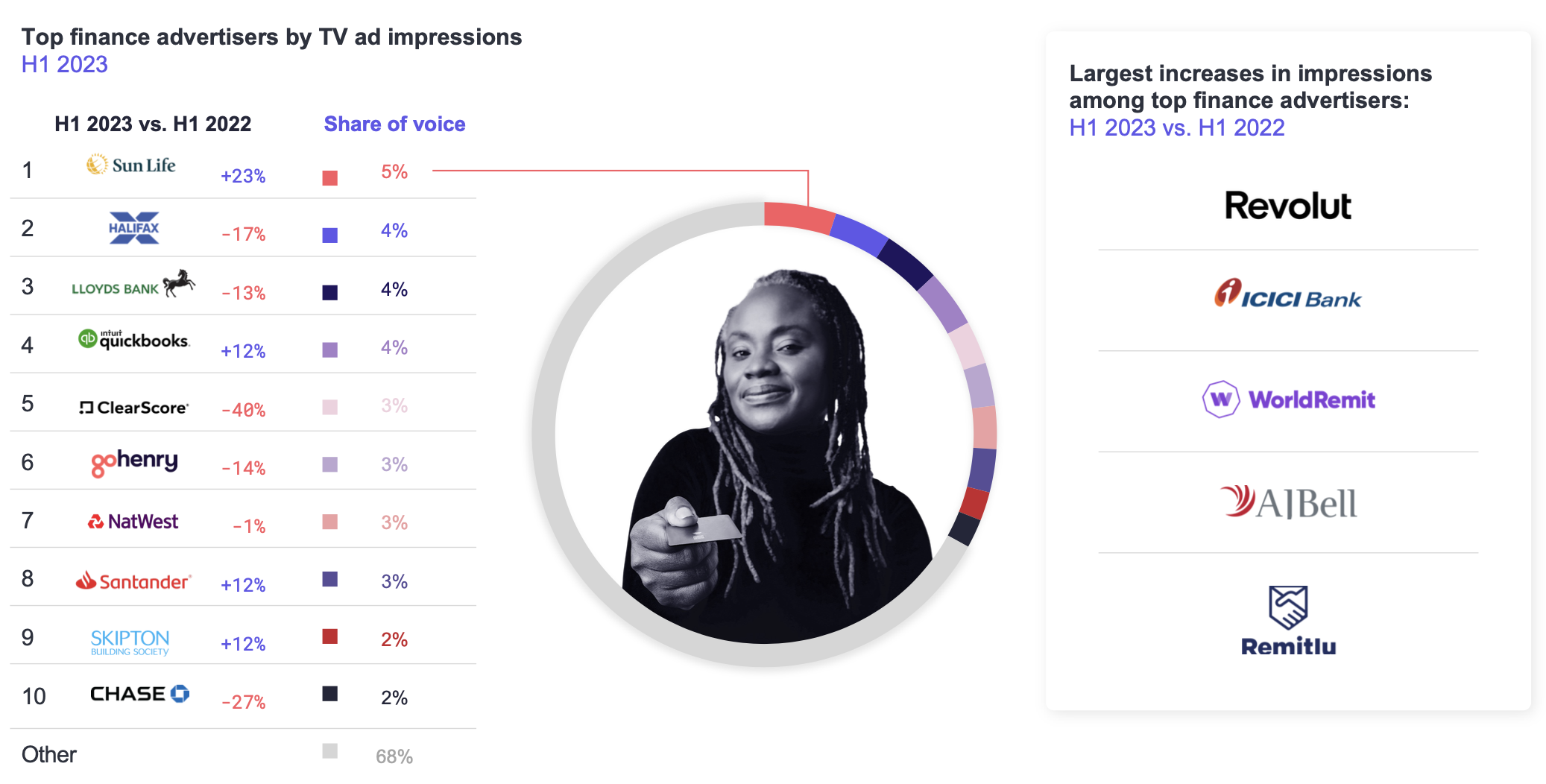

Meanwhile, over half of the top 10 finance advertisers tracked declines based on year-over-year ad impressions amid ongoing economic uncertainty in the UK. Top share-of-voice brands like Halifax and Lloyds Bank have pulled back adspend, while the number one finance brand, SunLife, opted for a different strategy and marketed into the downturn with a 23% increase in ad impressions year-over-year.

Streaming: Strong link between binge-watching and customer retention

While the majority (60%) of UK households are watching “three or less [sic]” streaming services, the report claims that newer ad-supported offerings from Netflix and Disney+ are having a marginal impact.

“[A]n increase in advertising-based video-on-demand (AVOD) offerings by the likes of Netflix and soon Disney+ are contributing to more consumers opting to watch three or four services as opposed to one or two,” the report said.

The report also shows a strong correlation between binge-watching and customer retention. As consumers switch between different streaming services, the competition for attention has shifted toward retaining viewers.

Netflix and Amazon Prime Video generally release whole TV seasons in bulk or with multi-part episode drops, while Disney+ and AppleTV+, and others favour weekly episode releases.

Over half of UK viewers watched many of the top bulk-release shows of H1 2023 in the first five days after premiere. A majority of the most binged shows were miniseries with three or four episodes, led by Disney+’s Ed Sheeran: The Sum of It All and Netflix’s Waco: American Apocalypse. Longer shows with previous seasons, such as Vikings: Valhalla, had a high share of bingers tuning in as well.

Big shows ‘soak up viewership’ in first two weeks

When audiences can binge their shows as quickly as they want, they’re more likely to finish the whole season. The average retention between season premiere and finale across bulk releases was 46% of households, compared with 40% of households across shows that released episodes weekly.

With its bulk-release model, Netflix dominated from a retention standpoint, with Bridgerton spin-off Queen Charlotte retaining almost two-thirds (63%) of its viewers between the first episode and the finale. Meanwhile, weekly episode releases like Citadel (Amazon Prime Video) retained less than one-third of households between premiere and finale. The weekly episode releases with the highest retention each had previous versions or seasons with established and committed fanbases.

The report added: “For advertisers, the takeaway is clear: bingeable shows with high audience retention is a captive way to reach consumers who will be home, heavily focused on TV for a few hours, and available to order delivery, shop online, and browse websites.”

Across the UK, the US, and Australia, the most popular TV premieres soaked up the majority of viewership within their first two weeks. All of the top 50 streaming shows released in the first six months of 2023 saw over half of their audience tune in during the first 15 days, and all but two shows saw more than two-thirds of audiences do so. The exceptions were Physical: 100, a South Korean reality show, and The Night Agent, the number-two show of 2023 so far.

For original streaming series, The Last Of Us (Sky Atlantic) was the number-one performer for viewership of its premiere and the only series to surpass 1 million views within the first 15 days.

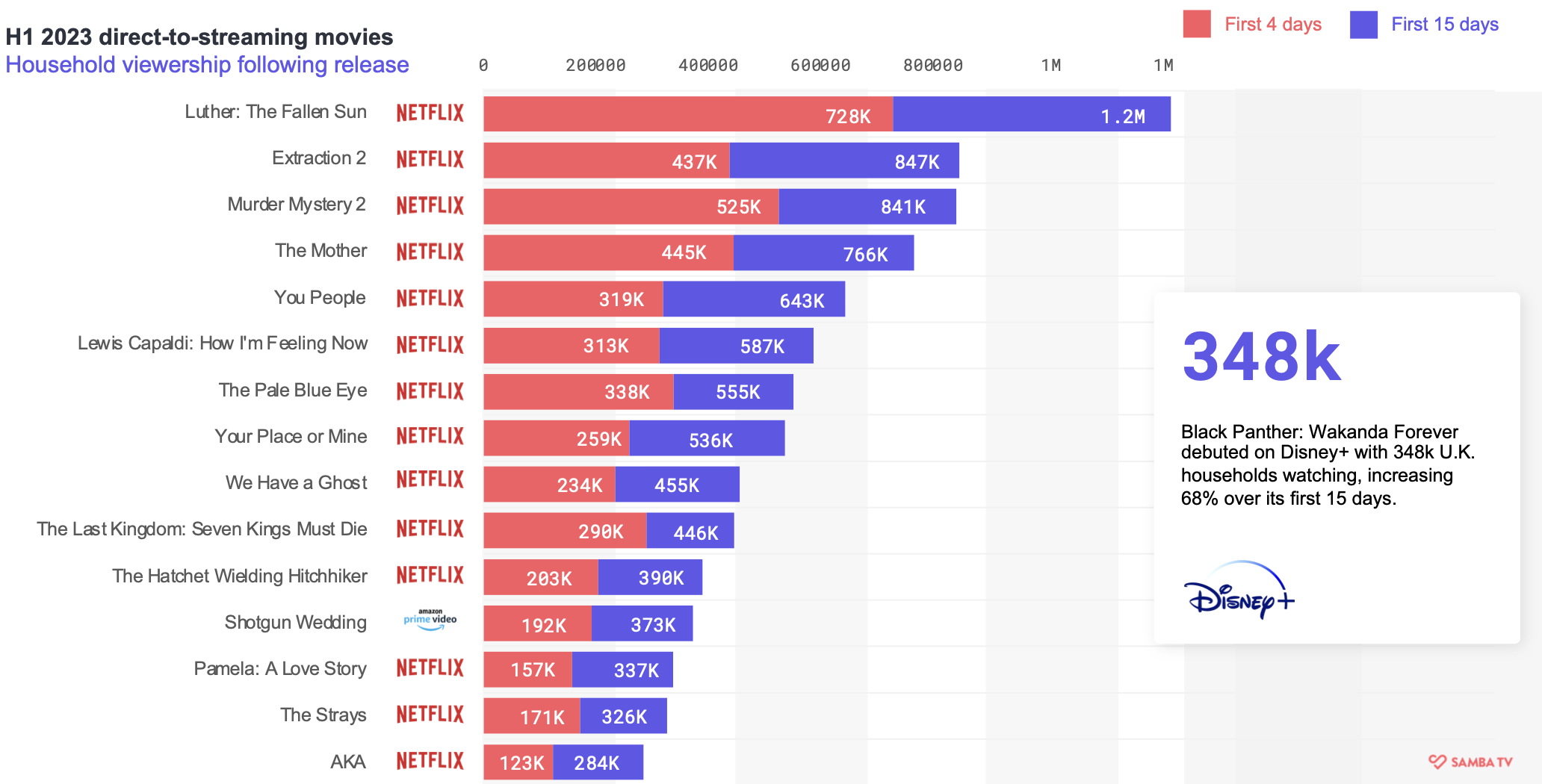

Fourteen of the top 15 streaming movies of the first half were Netflix originals, including several sequels. Luther: The Fallen Sun, starring Idris Elba, was the top direct-to-streaming movie in H1 of 2023, and the only one to surpass 1 million household views within the first 15 days. Disney+ also saw “strong” UK numbers for the debut of Black Panther: Wakanda Forever (348,000 U.K. households watching, increasing 68% over its first 15 days) even after months in theatres.

On linear, the coverage of the Coronation of King Charles III and Queen Camilla was the only linear TV event to surpass 5 million household tune-ins throughout the first half of 2023, with the concert broadcast coming close to 6 million. The FA Cup final match between Manchester City and Manchester United drove the most viewership of any event unrelated to the Coronation (4.9 million).

Editor’s note: In response to reader queries, the headline has been changed to include ‘Vast majority’, given that Samba’s report says 94% of linear TV ads reach half of households. While 94% is a big proportion, it is clearly not ‘all’, and we’re happy to make our reporting clearer.