Kantar: expect increased TV streaming media spend in 2023

The introduction of ad-supported video on demand (AVOD) to major streaming platforms like Netflix and Disney will drive an increase in TV streaming adspend at a time when consumers are more likely than before to be receptive to it.

That is according to Kantar’s latest Media Trends and Predictions 2023 report.

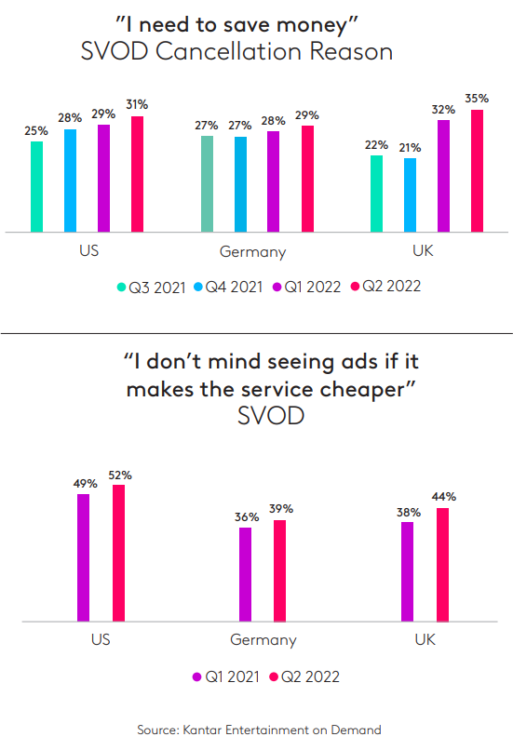

As more consumers around the globe struggle with inflation and the cost-of-living crisis, subscription cancelations to cut costs have increased.

In the US in Q2 2022, 31% said they canceled an SVOD subscription because they need to save money, up 6% from Q3 2021. The change since Q3 2021 was doubly pronounced in the UK, where inflation has remained higher.

At the same time as consumers are churning or altogether leaving SVOD subscriptions, they have become increasingly open to receiving advertisements on the platform.

As such, Kantar predicts that the timing is just right to introduce ad-funded tiers to limit price-sensitive churn, and marketers are likely to respond to new inventory in kind by increasing budgets.

“As 2022 draws to an end, our industry finds itself on the cusp of an inflection point, as the VOD businesses that disrupted the linear TV model diversify their operations,” said Antonio Wanderley, Kantar media division CEO, Latin America, Spain, Asia Pacific & Africa.

Wanderley added that established VOD platforms dipping their toes into AVOD, such as Netflix and Disney+ will “soon find it a business imperative” to become especially involved in audience measurement, and that the future will see audience measurement increasingly move towards a more holistic model in line with a fragmented and growing AV ecosystem.

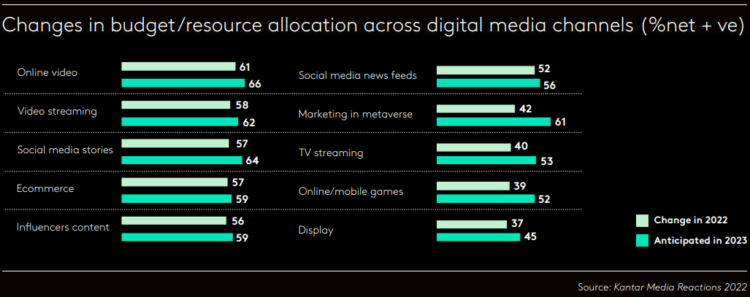

Despite rising inflation, Kantar expects overall digital marketing budgets to increase across the board next year. Particular areas of growth are anticipated in TV streaming, gaming and the metaverse. The latter two are seen by Kantar as addressing audiences that “are largely untapped optimal advertising targets for many marketers”.

Kantar notes, however, that barriers to entry for the metaverse (namely hardware requirements) still remain high for many consumers, especially as they seek to cut discretionary spending from personal budgets.

Though Google once again delayed the move away from cookies this year, the report maintains that marketers should continue preparing in 2023 for the unviability of the hyper-targeted online ecosystem that advertisers have been used to. The report predicts that “procrastinators will fail”, and warns that “Google may have given more time to prepare, but it’s time that mustn’t be squandered”.

Commenting on the predictions, John McCarthy, strategic content director, media division, at Kantar, said: “We foresee a year full of challenge and opportunity for the media industry. As global price rises impact consumer spend and advertising, campaign planning could be optimised through improved data application, making budgets go further.

“From post-cookie solutions to better campaign planning, data is our fuel — but its usage is changing. The future will continue to deliver a host of new technologies, each brimming with potential, and it’s important not to get lost in the hype”.

Kantar also notes that media companies will need to increasingly respond to consumers’ and advertisers’ sustainability expectations. The report found that 34% of survey respondents say it is the media’s responsibility to solve climate issues. That is more than those who say the media is responsible for solving issues such as Covid-19 (23%) and inflation (6%).

While there has been progress on sustainability in the media, there is much room for growth in platforming the issue. According to Kantar’s Link ad-testing database of more than 230,000 ads, the number of campaigns that address social and environmental issues has tripled since 2016, but still only now stands at 6%.