IPA Bellwether: Budgets expand again but main media weakens

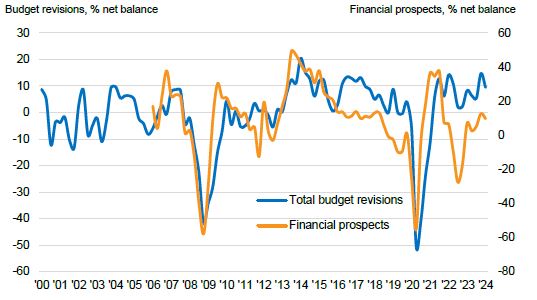

Total marketing budgets saw “solid expansion” in Q1 in a growth streak since Q2 2021, according to the IPA’s latest Bellwether Report.

The quarterly study, which analyses marketers’ confidence and media spend decisions, found that 24.4% of UK marketing professionals surveyed increased their overall marketing budgets in the first quarter of 2024, while 15% decreased them.

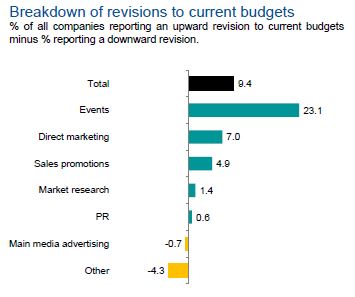

This translated to a net balance of 9.4% upwardly revising budgets — the second-highest figure in almost two years, but down from 14.7% in the previous quarter.

The “sustained upturn in marketing spend” comes as the UK economic backdrop is “improving”, with an “impending emergence from recession and falling inflationary pressures”, according to the report.

Joe Hayes, principal economist at S&P Global Market Intelligence, said: “With business survey data suggesting UK GDP will expand in the first quarter, it’s no surprise to see another strong round of marketing budget growth.

“Cost-of-living pressures and high borrowing costs have led households and businesses to retrench in recent times, making the market more competitive to earn and retain customer business. Throughout this period, we’ve seen marketing perform strongly, so it’s very encouraging to see that firms are staying true to the course that has clearly yielded positive results.”

Richard Temple, JAA’s CEO, called the IPA findings “very intriguing”.

He continued: “It seems that many marketers are pinning their hopes on AI. However, most AI advertising models are predicated on performance marketing principles. Despite the collective knowledge that marketers have on ‘the long and the short of it’, the reality is that most businesses are tied to quarterly performance targets. So, with the magical elixir of AI, it’s not a surprise to see performance channels growing so fast.”

Main media marketing decline

Main media marketing fell from a positive net balance in Q4 2023 of 1.9% to -0.7% in Q1. This was driven declines in OOH (-10.8%), published brands (-5.7%) and audio (-4.5%), which “slightly offset growth” in other online (7.1%) and video (0.8%).

Sam Drake, chief growth officer at Goodstuff Communications, said this was “not a surprise or a concern”.

“In times of economic crisis, budgets fall under heavy scrutiny. With main media taking such a significant percentage of budgets, it makes sense that there is caution to invest. From my conversations with clients, it does not mean they will not.

“Advertisers are increasingly spending time building robust cases for this investment, so businesses have the confidence to invest. We are helping to model returns, with a view that advertisers will invest.”

Five categories saw positive net balances in Q1: events (23.1%), direct marketing (7.0%), sales promotions (4.9%), market research (1.4%) and PR (0.6%).

The biggest increases compared with Q4 2023 were: events, up from a net balance of 15.9%; sales promotions, up from 1.4%; and market research, up from -5.0%. The other categories either had marginal budget expansions or a slight “cooling” from previous highs.

Optimism and caution

David Grainger, senior vice-president and head of planning at EssenceMediacomX, told The Media Leader that the “optimism” in the latest report showed “the resilience of the UK marketing landscape”.

He said: “It also points to how brands are beginning to adapt to the new communications economy. When user-generated content is the most consumed form of content, it’s perhaps no surprise that brands are augmenting ‘main media advertising’ with events and sales promotions.

“The shape of our plans and what’s in them needs to change, and the report is a keen reflection of that agenda.”

Only one other category experienced a decrease: other marketing activity saw a net balance of -4.3%, a slight improvement on the previous quarter’s -6.4%.

Paul Bainsfair, the IPA’s director-general, urged for caution over the tendency to up promotional spend while lowering main media spend — a trend that had not been present over the past couple of quarters.

He explained: “While sales promotions can stimulate short-term sales increases, the evidence also shows that their overuse can undermine a brand’s profit margins and pricing power over time by habituating consumers to buy mainly on price.

“As always, a careful balance needs to be struck to ensure longer-term growth, for which greater investment in brand advertising, particularly in main media, pays dividends.”

Budget plans

Budget-setting plans for the coming financial year were “strongly positive”, with 40.7% of respondents signalling they have lifted the funds available for marketing, compared with 18% reporting a planned cut. This resulted in a net balance of 22.8% reporting “strong budget setting” for 2024/25.

Events is set to be the main area for budget growth, with a net balance of 18.7% anticipating upping spend in this area compared with the previous year. This was followed by direct marketing with a net balance of 11.9%, main media advertising with 10.1%, PR with 6.3% and sales promotions with 6.0%.

Market research and other marketing activity were on course for lower spend with respective net balances of -4.4% and -3.4%.