Clear Channel Outdoor’s latest earnings called out a decline in quarterly revenue in the US market “driven by weaknesses in Media/Entertainment vertical and San Francisco/Bay Area market”.

While this may seem like a small decline, 1.9% or $5m, its CEO Scott Wells said the writers and actors’ strike impacted its largest market (LA) not just through media and entertainment spend declines, but also just general activity in LA.

He explained: “With all of the folks impacted by those strikes, local as well as national advertisers have potentially been a little less inclined to be launching campaigns into that environment. We are seeing that abate in in Q4, but I think about LA in the context of California which is very complicated.”

Wells said the factors affecting LA; including technology being “a down category” for much of this year, alongside the media & entertainment impact, and the fact California holds two of its largest markets, were “explanatory of the vast majority of our challenges this year”.

“We are seeing signs that those things will we’ll be moving in a better direction going forward,” he added. “I think getting the writers back to work will really be helpful. Hopefully the actors will get through and we’ll be able to pick that up. But I feel like it’s always hard to call a trough moment, but I think Q3 has indicators that it could be a trough moment for our challenges in California and LA.”

How will these changes affect the UK out-of-home (OOH) market?

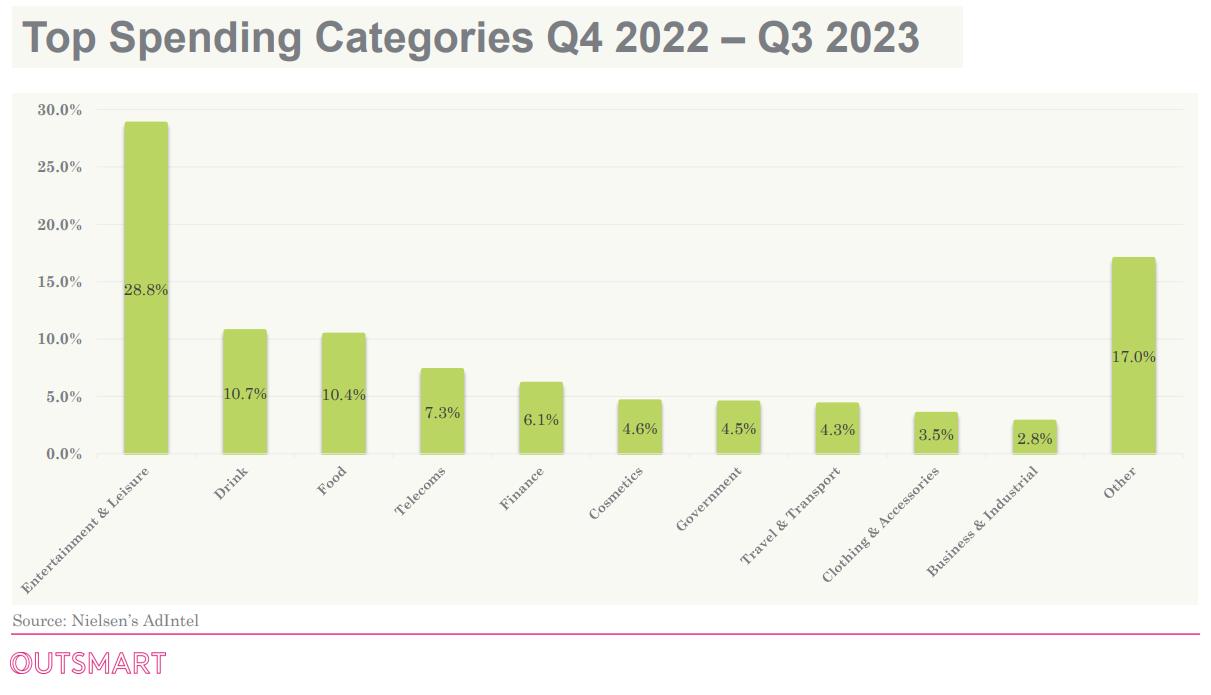

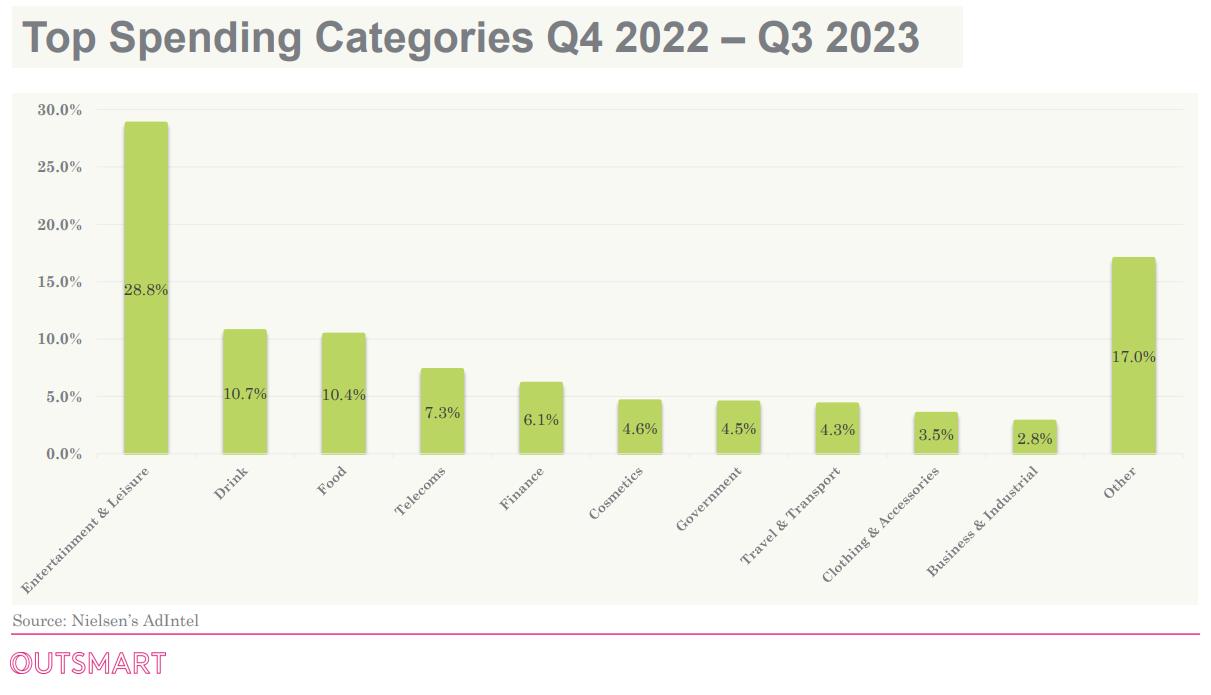

The latest Outsmart figures for Q4 2022 to Q3 2023 showed entertainment & leisure was the top-spending category overall for out-of-home OOH in the UK taking a 28.8% share of spend for the period.

By environment, entertainment & leisure still came out on top for spend in roadside (28.1%), transport (34.9%), and retail & leisure (22.8%).

The Media Leader understands Clear Channel UK has seen “some minor revenue impact” in the media & entertainment vertical linked to a small number of film releases moving from 2023 to 2024, but this has been offset by “considerable growth across the FMCG vertical”. Media & entertainment’s revenue share currently hovers between 15% and 20%.

JCDecaux, which is the only outdoor media owner to split out revenues in its public financial releases by client categories, reported revenue for entertainment/leisure/film was flat globally year-on-year for the period H1 2023, making up 13% of revenues.

For the full-year 2022, media & entertainment was up 31% compared to the previous year, and in H1 2022, it had increased 78.9% compared to H1 2021, which was impacted by pandemic lockdowns.

Global and Ocean Outdoor did not offer comment for this story.

What’s coming next year?

A Kinetic spokesperson told The Media Leader when asked about the impact of the actor and writers’ strike: “We haven’t seen spend in this sector reduce this year. The strike will have more of an impact next year as there will be delays to film and TV releases. And this will impact all media.”

Meanwhile, Neil Tookey, VP head of commercial trading at EssenceMediacomX, said he had not seen a slowdown in spend from media & entertainment category over the last quarter or six months, but he has seen more competition with new entertainment channels in the market.

“A a couple of years ago, Disney and Paramount weren’t even real spenders in this space, so more competition has increased the pressure to capture eye balls, and OOH is a perfect environment for that — reaching broadcast audiences on the go,” he explained.

Tookey said agency insights showed beauty and FMCG were growth categories for the channel, and emphasised OOH is still used to “spearhead the focus of mass awareness”, particularly when it comes to media & entertainment brands in the UK.

Dan Dawson, chief creative officer at Grand Visual, part of OOH specialist agency Talon, said that this year had seen two major production releases shift launch dates to next year which impacted revenue.

However, he stressed this had meant more time on creative development and concepts which enabled Grand Visual to create “even more showstopping campaigns for our film and entertainment clients in 2024.”

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.