How metrics become currencies: the arbitrage cycle

Opinion

Evidence indicates that there’s plenty of opportunities for arbitrage remaining when using attention metrics.

When new metrics are introduced into a market, it typically happens slowly with a handful of intrepid buyers or sellers (usually buyers) looking to experiment with new approaches. As these new metrics are validated, they gain traction and broader adoption. However, this results in information asymmetry – buyers know something about the market that other parties, notably sellers, do not.

In this first stage of the cycle, buyers use asymmetrical information to cherry-pick the best supply. Because this information is not widely shared, cherry-picking the best inventory doesn’t necessarily come with a price premium, enabling arbitrage. As this data infuses a marketplace, however, the opportunity for arbitrage diminishes.

Gradually, quality inventory will become more scarce and rather than risking availability in the spot market, some buyers will ask sellers for guarantees using the new metric. This marks the turning point at which a metric becomes a currency, and pricing benefits begin to accrue for high-quality sellers.

This is the cycle we’re seeing play out today with viewability and video completion rate (VCR): two metrics widely used by advertisers that have been thoroughly gamed.

With a rather low hurdle of 50% on screen for one or two seconds, viewability offers very little assurance of quality and incentivizes publishers to pack as many ads on a page as possible. VCR is even worse, as video players shrink and attach themselves to the side of the page, muted, for as long as needed to achieve completion. These days, buying high-viewability, high-VCR placements results in fairly low-quality media.

To address this, some advertisers are shifting resources towards new ways of measuring media quality. Attention metrics have emerged as the leader in this space.

Adelaide has proven that our attention-based media quality metric, AU, predicts marketing outcomes throughout the funnel. In 2022, we released a compilation of 25 case studies demonstrating how advertisers are driving 20-60% gains in efficiency by leveraging AU measurement and replacing viewability with AU.

Having proven the utility of AU for measurement and optimization, we wanted to understand the relationship, if any, between prices and AU quality across current advertising markets. Our findings demonstrate that attention-based metrics are currently in the arbitrage phase of the currency cycle where significant value accrues to buyers at little to no marginal cost.

The relationship between the cost and quality of media across channels

Starting at the broadest level, we find little to no correlation between CPM price and media quality, as measured by AU, across channels and platforms.

There are some general trends we observe: for instance, channels with a higher likelihood of attention, such as CTV and YouTube, tend to demand higher CPMs compared to lower-AU platforms, such as programmatic Display or Social. However, the scale of variance in CPM price does not appear to be aligned with the variance in AU scores by channel. Additionally, CPMs across Display, Social, and OLV bear no relationship at all to the respective AU scores for these vehicles.

The relationship between partner and channel cost vs. AU assessment

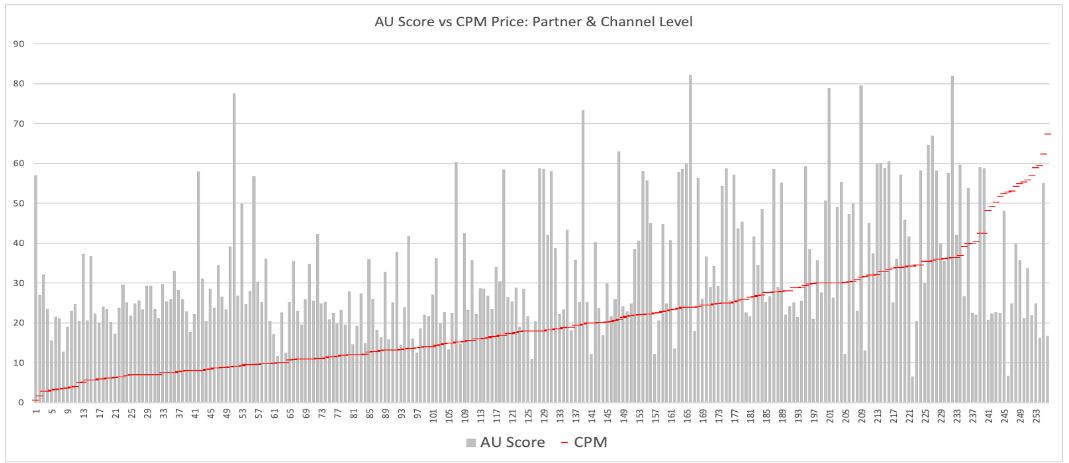

Digging a bit deeper, we assessed AU quality across both partners and formats. Using data from 256 unique combinations of Partner and Format, representing over 14 billion impressions, CPMs range from under $0.50 on the low end to nearly $70 on the high end without much relation to underlying AU scores.

In fact, the coefficient of correlation for this data is only 0.19, indicating a very weak positive relationship between these two variables. It becomes more clear at this level that current market pricing does not appropriately factor for attentive media quality.

This isn’t surprising, as attention and media quality metrics are relatively novel and this information hasn’t diffused into the market, but it does highlight arbitrage opportunities for buyers who are privy to this knowledge.

Programmatic display & OLV cost vs. AU assessment

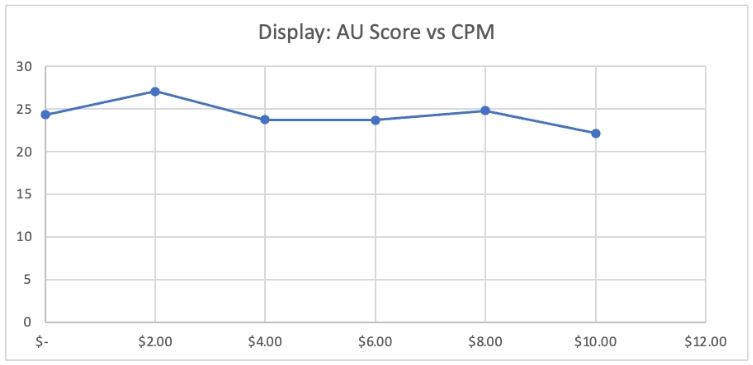

Drilling down to programmatic Display and OLV specifically, the lack of correlation between AU quality and CPMs is even more stark.

We analyzed data across multiple advertisers for a six month period in 2022 at the domain, device type, and ad format level. This data set contains more than 5,000 unique combinations of these variables comprising over 300 million impressions. This data set also spans multiple DSPs and buy types to provide a robust cross-section of programmatic buying trends.

Starting with programmatically traded Display media, we found an average CPM of around $1-$1.50, however, there was a wide spread of data ranging from lower than $0.20 to over $10 per mille. Breaking this data out into $2 CPM bins, we found practically no variation in AU scores across these groups. If anything, we saw a slight decrease in AU-based media quality as CPM prices increased. In the current state of affairs, this means that a buyer could pay sub-$1 CPMs and achieve statistically similar results, in terms of AU value, as they would from buying $8 or $10 supply.

Within Online Video (OLV), we found a similar trend up to a certain price point, after which the data becomes more scattered. For impressions measured in the $0-$20 CPM range, we saw no significant correlations between AU scores and CPM. While the actual values vary between 30-40 AUs, the regression line through this early part of the curve is essentially flat. A vast majority of the impression volume operates in the $0-$20 range here, implying that there is no statistical difference in resulting AU value across this $20 range. The bifurcation in the trend around $20 implies that very expensive media has a higher likelihood of earning higher AU values, but given the irregularities in the curve, there is still risk and uncertainty at these price points.

This analysis proves our hypothesis – the industry is currently in the arbitrage phase of the metrics-to-currency cycle with attention metrics, and the largest opportunities appear to be within programmatic buying specifically. That said, we may be approaching an inflection point.

Attention arbitrage in action

In addition to the more passive analysis above, we also wanted to understand how pricing mechanics react to active campaign optimizations. At Adelaide, we’ve helped numerous brands optimize their media spend towards AU providing a rich set of examples to draw from for this analysis.

Focusing on a subset of recent programmatic campaigns that leveraged AU data for optimization across Display and OLV formats, we can see the effects quite clearly. Across these campaigns, brands were able to increase their average AU Scores anywhere from +3% to +21%, while driving down overall average CPMs.

Using AU data, these brands were able to uncover value in previously underpriced media assets. The most obvious benefit of obtaining higher-AU media, that is more likely to drive outcomes, at lower CPMs is improved campaign efficiency from a cost perspective. Specifically, lower CPMs enables buyers to procure more units for the same media investment, which leads to greater reach and/or frequency. That incremental reach and frequency is amplified by higher quality, more attentive media.

One way to quantify this impact is to look at the Total AUs captured across these campaigns, which underscores how higher AUs and lower CPMs play into each other. Even modest improvements in both AU and CPM can compound into fairly significant total impact.

***

Today, the evidence indicates that there’s plenty of opportunities for arbitrage remaining, and advertisers can easily eliminate waste from overpriced media and capture the benefits of underpriced placements.

Longer-term, leveraging attention metrics to create a currency will afford advertisers and publishers a different set of benefits and efficiencies. As better metrics replace existing digital media currencies, they level the playing field between buyers and sellers, enabling advertisers to increase the certainty of access to quality media and publishers to gain confidence in their ability to monetize it.

The big picture here is a healthier and more transparent media market that benefits buyers and sellers alike thanks to the positive incentives created by buyers who use better proxies for media quality for arbitrage.

Karl Sjulsen is director, product & client success, at attention measurement company Adelaide.

Karl Sjulsen is director, product & client success, at attention measurement company Adelaide.