CTV market grows by a quarter in Europe but lags behind US in size

Connected TV (CTV) usage grew 10% in the US and 24% in Europe in H2 2023, but viewership is still larger in the US, where broadcast and cable account for less than half of total TV usage.

The latest Video Marketplace Report by Comcast ad platform company FreeWheel found that digital viewing continued to expand even as macroeconomic conditions softened the broader TV ad market.

Ad views across digital premium video grew 6% in the US and 17% in Europe. Even higher growth occurred for programmatic ad viewership (up 17% in the US and 50% in Europe), with the US remaining the wider adopter of programmatic transactions.

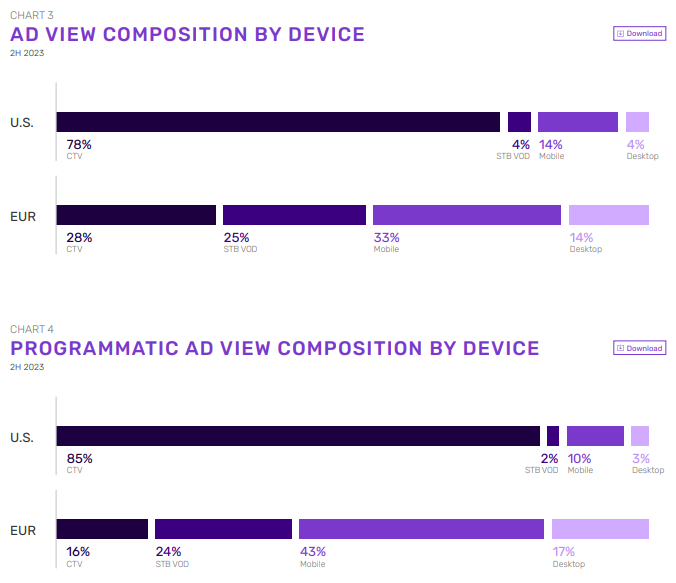

Whereas large-screen watching, particularly via CTV, has become a dominant viewing experience for Americans, set-top boxes remain prevalent in Europe.

The types of CTV devices that are popular also vary significantly by region. Whereas Roku is the main CTV device provider in the US (43%) over Amazon Fire TV (15%) and smart TVs (14%), the opposite is true in Europe, where Roku (8%) lags behind Amazon Fire TV (26%) and smart TVs (25%) in terms of usage.

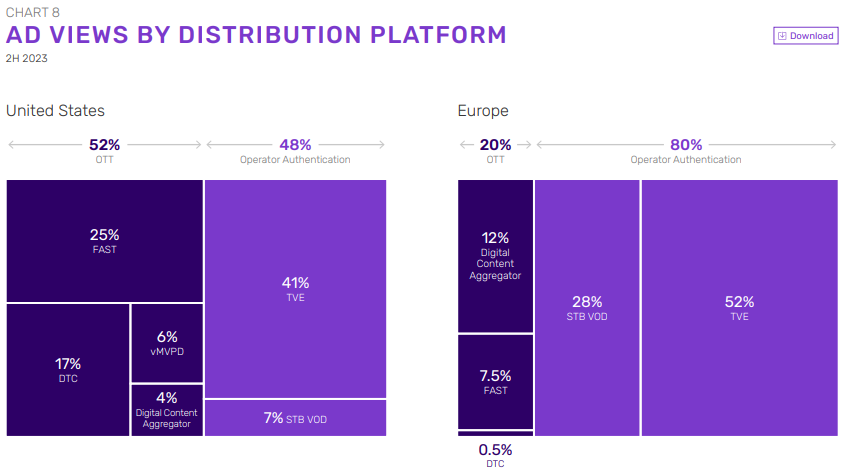

According to the research, free ad-supported streaming television (FAST) channels account for just 7.5% of European distribution platforms, remaining flat from H1 2023. This is dwarfed by the US FAST market, which is responsible for 25% of distribution platforms.

In fact, Europe’s overall over-the-top (OTT) market is less than half the size of that in the US. OTT ad viewership had just a 20% share in Europe compared with 52% in the US.

Breaking down ad viewership by content type, live digital premium viewing is also more popular (59%) than VOD (41%) in the US. This is not the case in Europe, where it is 19% for live versus 81% for VOD.