Bellwether Q1 2022: growing marketing budgets but lowered adspend forecasts

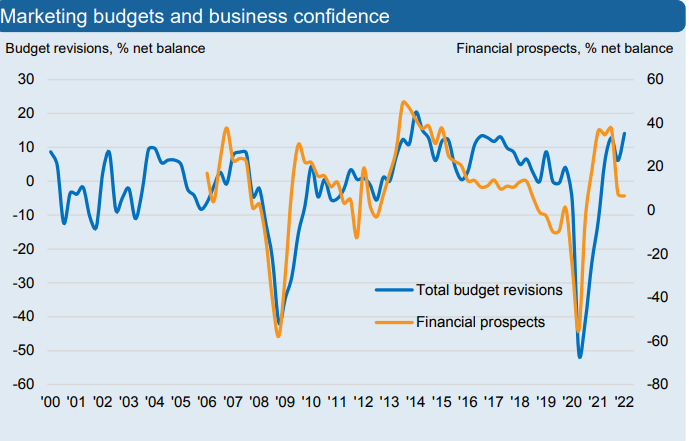

The IPA’s latest Bellwether Report shows the biggest growth in marketing budgets since 2014, despite adspend forecasts being lowered because of growing economic risks.

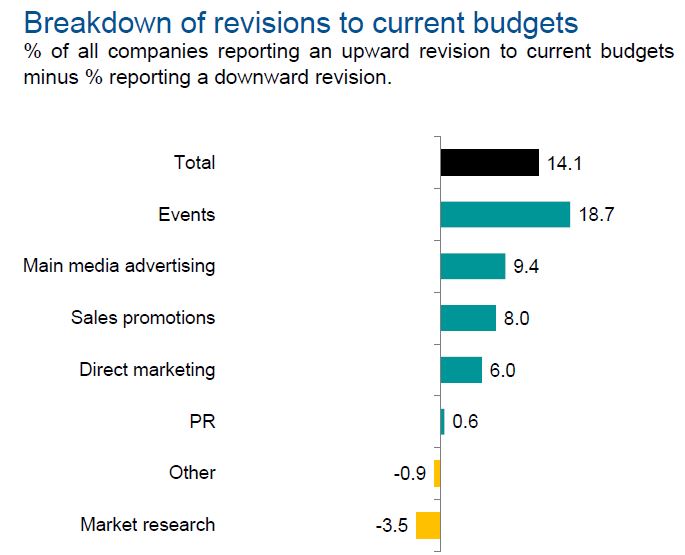

The Q1 2022 survey found total marketing spend grew at a net balance of +14.1%, compared to +6.1% in Q4 2021.

This is the highest percentage since Q2 2014 and makes the fourth consecutive quarter where marketing spend has grown.

Surveyed marketers were “strongly positive” about the outlook for marketing spend in 2022/23 with nearly half (43.8%) of respondents anticipating growth in their available marketing spend in the upcoming 12 months.

Looking forward, events (+22.1), main media (+20.1%), direct marketing (14.0%) and sales promotions (+13.6%) are set for budget growth in 2022/23.

The report found many predicted growth opportunities from “a return to pre-pandemic ways of life”, especially those with links to travel (such as On the Beach which launched at Christmas, pictured- main image), entertainment and hospitality sectors, with more large-scale events and face-to-face opportunities with clients also expected to “boost business activity” over the next year.

Rik Moore, managing partner strategy, The Kite Factory said: “The figures in the latest IPA Bellwether report are great for the industry, but that increased volume in spend (particularly the net +20.1% of increased spend in main media advertising) puts greater emphasis on the need for smart planning.”

Even as pandemic-related risks recede, the report highlighted “strengthening headwinds” such as high inflation squeezing household budgets, supply chain disruption and labour shortages.

Rising living costs and the war in Ukraine were also noted as “key threats to the business outlook” by panellists.

Richard Temple, chief executive of John Ayling & Associates, warned that advertisers need to increase their marketing spends to offset “rampant media inflation” while still being mindful of inflation in their own supply chain.

Temple added: “This [inflation] is fuelled by the impact of macro geo-political events and micro issues such as venture capital-fuelled high octane categories spending heavily.

“It’s tricky to compete if you want to hit an annual profit target against VC-backed companies that are awash with cash in order to just ‘get big’ and attract even more investment. Remember the IPA Bellwether survey only started in 2000 and the model hasn’t seen an inflationary economy before!”

Warnings of inflation were echoed by James Bailey, CEO, iProspect UK, who described it to The Media Leader as “the major unknown that is impacting the industry in waves.”

Bailey explained: “Wave one was increasing staff costs associated with that battle for talent. Wave two was the mitigation against rising costs of media. Wave three, by far the most impactful on client confidence, is the impact of inflation on consumer sentiment.

“This is playing out now and having a dramatic effect on disposable incomes, thus shortening horizons for clients.”

Adspend growth forecasts were revised down for 2022 and 2023 as a result, to 3.5% and 1.8% from 5.2% and 2.5%.

GDP growth forecasts were also lowered for 2022 and 2023 to 2.8% and 1.2% from 4.0% and 1.8%.

Michelle Sarpong, trading director at independent media agency the7stars, pointed out that, despite the impact of inflation, the stronger levels of investment in end of 2021 has carried over into early 2022.

However, she added: “Despite increased advertiser confidence, market changes could force reduced investment naturally.”

Sarpong explained: “The privatisation of Channel 4 is bound to change programming, scheduling which in turn will change the demographic of their audience going forward. Sequentially this will impact the blend of advertisers on the channel going forward.

“In addition, factors such as new regulations that come into play along with heightened HFSS restrictions in digital and OOH, certain categories may see a downward turn in investment, but overall will still outperform 2021 spend levels.”

Events rebound in Q1 2022 with switch to ‘living with Covid-19’

Events saw the strongest uplift out of any sector in Q1 2022, with a net balance of +18.7% versus -3.9% in the previous quarter.

Bellwether found that many panellists surveyed had “confidence to plan ahead” with events in the coming 2022/23 financial period, with a net balance of +22.1% of companies expect to see additional resources for events in the forthcoming year.

Main media advertising experienced budget growth of +9.4% which included budgets related to “other online”, video, audio, published brands, out-of-home and any other method of advertising online.

“Other online”, video advertising and published brands drove the upturn in main media advertising budget with +18.6%, +9.0% and +1.3% growth each.

The Kite Factory’s Moore added: “The upward revisions to Online and Video show that the behaviours adopted during the lockdowns are very much here to stay. The smart advertisers will be best served by using their media planning buying to engage favourably amongst these new habits.”

Out-of-home and audio budgets continued to decrease with net balances of -4.6% (compared to -8.3% previously) and -8.5% (compared to -6.3% previously).

Sales promotions (+8.0%), direct marketing (+6.0%), and PR (+0.6%) budgets also increased.

Ian Daly, head of AV at Bountiful Cow described the commercial media market as “moving from a position of value”.

“Over the last two years advertiser revenues and media consumption have been majorly disrupted by Covid, leading to volatility in media pricing,” Daly said. “As both have started to stabilise, an underlying growth in advertiser revenue has emerged, causing inflation in media similar to that being experienced by homes up and down the country.

“With this in mind, it’s more important than ever for agencies and brands to evaluate what they truly consider to be good value. Ultimately, one brand’s trash is another brand’s treasure.”

This instalment of the Bellwether report also found many businesses are focussing more on the ESG (environmental, social and governance) space, with net zero carbon emission targets and providing greener goods and services to curb utility bills expected to benefit businesses.

Enyi Nwosu, chief strategy officer at UM UK commented on this trend, telling The Media Leader: “The last two years have brought about a sea change in support for causes like equality and the environment, with clients and talent leading the charge and pushing for change.”

He added: “Expect to see even more investment directed intentionally towards publishers and platforms with progressive values, who are making a positive difference in the world. They’ll be well placed to weather the storms as costs rise and supply chains tighten.”

The Bellwether Report is researched and published by S&P Global on behalf of the IPA based on a survey of 300 UK marketers representing key business sectors mostly from the country’s top 1,000 companies.