Amazon Prime Video sees ‘significant’ UK churn following ad tier launch

Amazon Prime Video has experienced “significant” subscriber churn last quarter, new research has found.

Kantar’s quarterly Entertainment on Demand study covers the subscription VOD (SVOD) market from January to March in the UK and found that 19.9m British households have at least one paid video streaming service — “virtually flat” on the previous quarter.

Amazon Prime Video, which launched an ad tier on 29 January that required new and existing users to pay an additional £2.99 to remain ad-free, often experiences a seasonal impact in Q1, as it is bundled with Amazon Prime delivery that tends to spike around the Christmas period.

However, Kantar’s study revealed that Q1 this year was “particularly tough”, as share of new subscribers, total number of subscribers, proportion of Prime users engaging with Prime Video and subscriber advocacy all “fell significantly”.

Subscriber advocacy is measured with a net promoter score and has been the lowest it has been in three years for Prime Video. Meanwhile, subscriber churn as measured in January was at its highest level since Kantar’s study began in 2020.

An Amazon spokesperson disputed the findings and said: “Prime membership continues to grow in the UK, with Q1 2024 membership up year on year and strong customer retention. Prime Video in the UK continues to see high customer engagement, with the number of people streaming growing year on year.”

The study highlighted that other video streaming players like Netflix and Disney+ have introduced ad tiers, but Prime Video was “the only major service whose subscribers display an active net dissatisfaction with the number of ads being served”.

Dominic Sunnebo, global insights director at Kantar Worldpanel, said Prime Video “faced significant challenges” as it introduced an ad-supported tier, resulting in “notable subscriber churn and dissatisfaction”.

He added that Q1 showed “stark contrasts in strategy and subscriber response among major players”.

Most UK consumers ‘unwilling’ to pay more to avoid ads on Amazon Prime Video

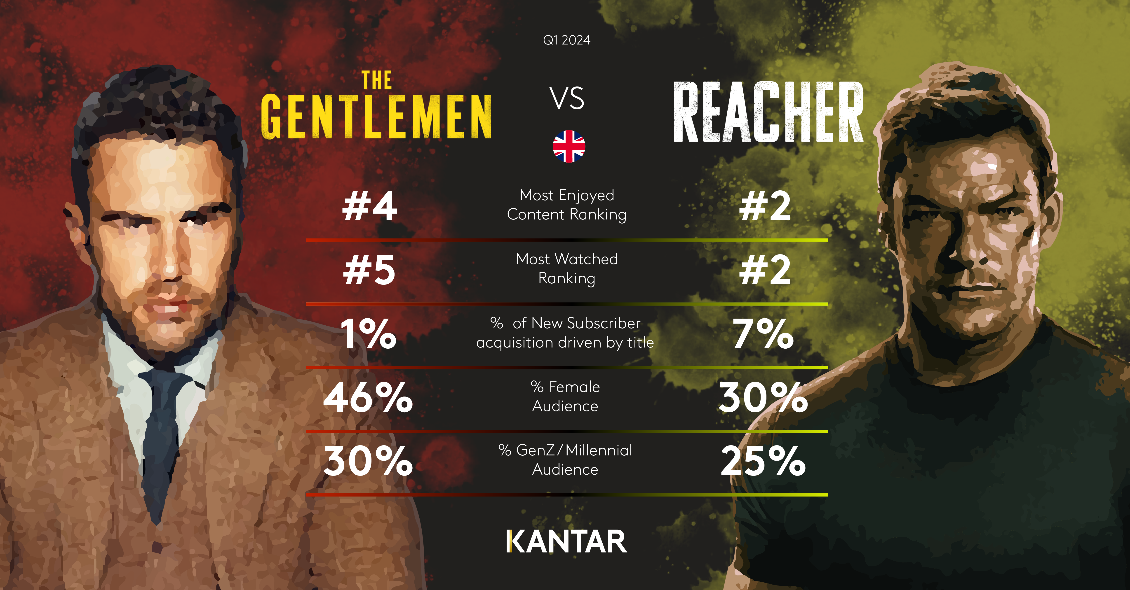

Netflix had the most watched and enjoyed title in March with Guy Ritchie’s The Gentleman and took 15% of all new additions in Q1, up 5% on Q4 2023.

More than half (52%) of British SVOD users list Netflix as their first destination when looking for inspiration for something to watch and 60% of Netflix subscribers with multiple services consider Netflix to be “their most important service”.

Sunnebo explained: “Netflix continues to excel as the first port of call for British consumers seeking new and engaging content, with strong subscriber retention and growth. These trends underscore the critical importance of understanding consumer preferences and the impact of service changes on subscriber behaviour and market positioning.”

Apple TV+ retained its position as the streaming service with the highest share of new SVOD subscriptions in Q1 with 16%.

Sunnebo attributed Apple TV+’s lead to “compelling content and an expanded demographic reach”.

Disney+ registered the second-highest share of new subscriptions.