AA/WARC Q2 2022: all media recovers, growth under pressure

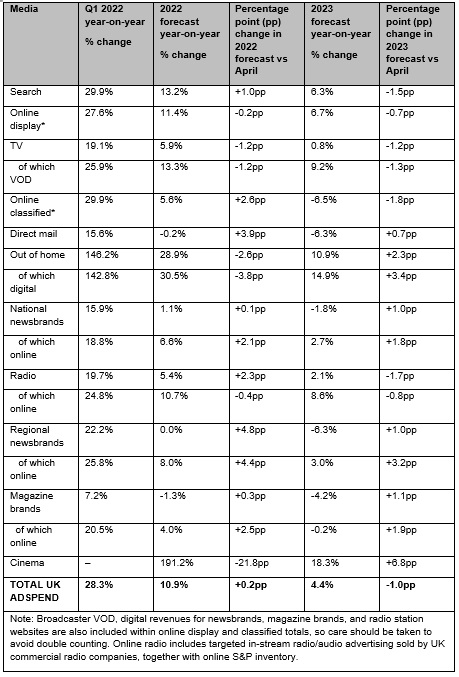

UK adspend in Q1 2022 grew 28.3% year-on-year to reach £8.6bn, according to the latest quarterly Advertising Association/Warc Expenditure Report.

Spend in the first three months of 2022 “outperformed expectations” by 7.7 percentage points as all media recovered in comparison with lockdowns in Q1 2021 which limited advertising activity and revenue across the industry.

James McDonald, director of data, intelligence & forecasting at WARC, called this “a soft landing from the turmoil” of the Covid pandemic and said early budget commitments were translating into a strong start for the year.

However, Alice Enders, head of research at Enders Analysis, warned that “base effects” in the data — comparing them to artificially low bases in 2021 because of the Covid-19 pandemic — show the market is actually “catching up” rather than growing strongly.

Enders told The Media Leader: “Clearly, with lockdown in Q1 2021, the 28% growth in Q1 benefits from base effects. Indeed, we saw this in the results for ITV, already announced, plus those of other media. And these base effects extend into Q2 2022 since the UK emerged from the pandemic in July 2021.”

She added: “These base effects impacting the first half of 2022 obviously greatly impact the forecast for 2022 as a whole, and are to some extent illusory because they are simply catching up what was lost in the pandemic.”

Enders highlighted contrasts in TV and ecommerce spend during the pandemic compared to now as examples of this, specifying that ecommerce reached a high of 36% of retail sales (excluding fuel) in Q1 2021, but fell to 28% in Q1 2022.

Stephen Woodford, CEO of the Advertising Association, called this Q1 growth “encouraging”, leading to “slightly improved outlooks” for the year ahead with an upgrade of 0.2% made to the forecast for the total advertising market, taking it to 10.9% growth in 2022.

2022 adspend forecast to reach ‘a new high’

The report predicted adspend was on course to reach “a new high” of £35.4bn overall this year.

Within these forecasts, AA/WARC highlighted “consistent growth” of online advertising which is expected to make up nearly three quarters of all spend this year (74.3%), a 0.8 percentage point increase on the previous year.

However, real growth in the UK ad market is set to be 1.8% this year when accounting for inflation.

The expenditure report noted an “erosion of margins” resulting from increased costs may affect marketing budgets, predicting inflationary pressures were “likely to continue” into next year.

2023 forecast: inflation starting to bite

Looking further ahead into 2023, the UK’s ad market is forecast to grow by 4.4% to £37bn.

This is a single percentage point downgrade from AA/WARC’s April report and a 0.9% contraction in real terms.

The research pointed to the rising cost of living and geopolitical uncertainties affecting consumers and businesses causing “further headwinds on the horizon” for the UK ad market.

Emma Cranston, client services director at The Ozone Project told The Media Leader: “Despite an encouraging Covid-comparison for Q1, it’s clear there are significant challenges ahead for both our sector and the wider economy. The pressures of rising inflation, soaring energy prices, and the Ukraine conflict will force us all to make spending decisions.”

She added: “We’re already seeing a growing consumer split between ‘the haves’ and ‘the have nots’ in insights derived from our cross-publisher data. We’ve witnessed huge growth in content consumption around financial assistance topics – up +8% in Q1 versus the same Covid-period last year – being accompanied by similar growth in luxury, more aspirational content. This presents a multi-faceted challenge for advertisers in terms of planning and forecasting.”

McDonald echoed this as he commented: “As predicted, however, inflation is now starting to bite; its impact on the consumer is well documented, but the rising cost of servicing government debt leaves the incoming prime minister with less fiscal flex for stimulating flatlining economic activity.

“For advertisers, higher costs will carve into margins, and while a real term rise of 1.8% in ad investment is expected this year — compared to a pre-Covid average of +2.6% — the market is now set to contract in 2023 after accounting for these ongoing inflationary pressures,” he added.

OOH and cinema’s triple and quadruple-digit recoveries

Online formats including search, display (including social) and classified grew the most in absolute terms and online channels combined reached 74.9% market share.

OOH and cinema registered triple and quadruple-digit recoveries respectively with 28.9% and 191.2% growth forecast for 2022.

Publishing, including national and regional newsbrands, magazine brands forecasts for spend in 2023 were all upwardly revised compared to the Q1 2022 report, particularly for online, between 1 and 1.9 percentage points.

Meanwhile, search, online classified, TV and radio, have had their forecasted growth for 2023 slightly downwardly revised compared to April’s forecast, between negative 1.2 and 1.7 percentage points.

Enders said it is not surprising that online continues to be “the star performer” as it allows for tactical and small-scale advertising compared to the large cost of TV ad campaigns and associated production costs.

She said: “The real question is not what the first half reports, it is the trend for the second half, and here you see downgrades for TV in particular. The 2023 forecast for TV is also poor, and this all reflects the worsening economic outlook, with the UK reporting very muted GDP growth in Q2 2022 as the cost-of-living crisis squeezes consumer expenditure.”

“Brands are having their margins squeezed tight by input cost inflation, and they may be able to pass on some of this to consumers, but not all, according to the evidence we have gathered. So it’s obvious that marketing expenditure will be cut back. There are winners and losers from the cost-of-living crisis in medialand, and sadly, TV is a loser and online is the winner,” she added.