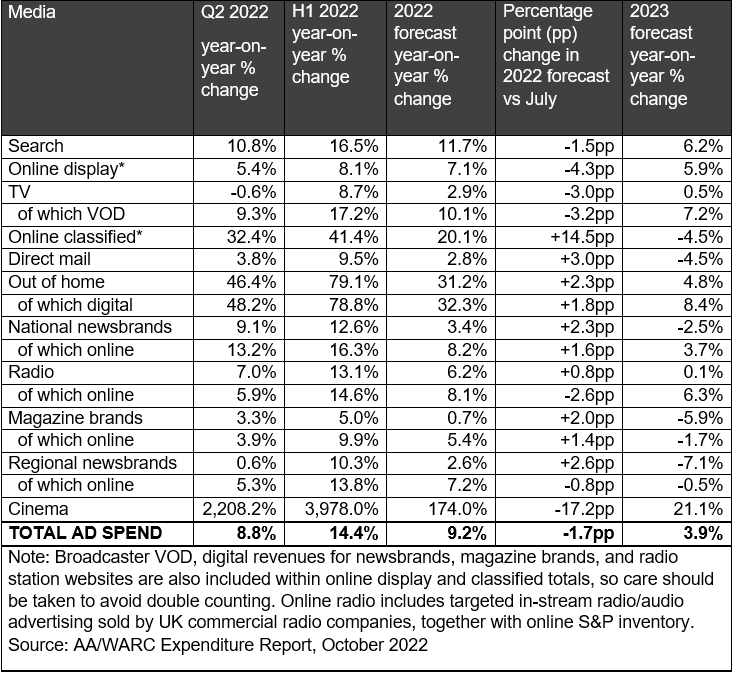

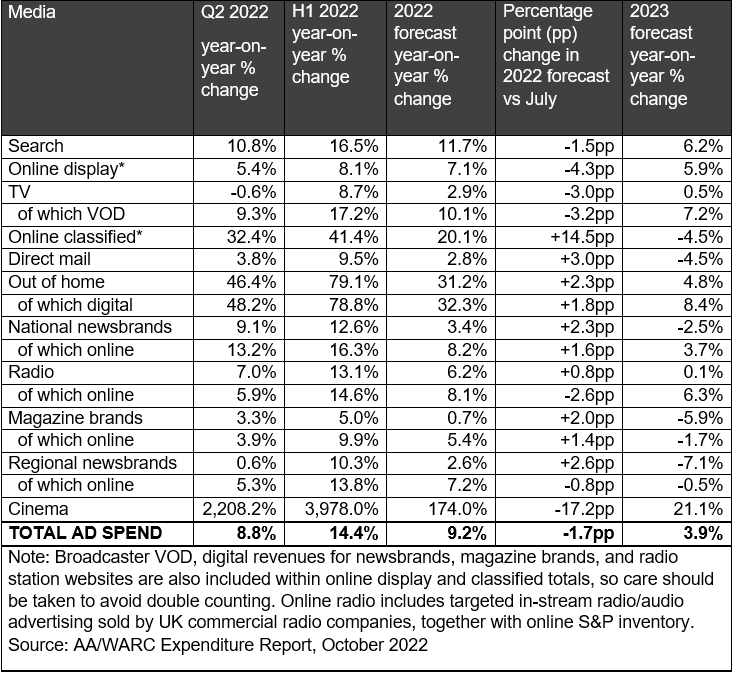

The UK ad market will grow by 9.2% to a total of £34.9bn in 2022, according to the latest quarterly Advertising Association/Warc Expenditure Report.

This is 1.7 percentage points less than the previous forecast due to “high levels of inflation” and “squeezed margins” related to supply chains and the cost of living.

The media sector is also “bearing the brunt” of inflationary pressures as advertisers encounter higher media costs.

Further ahead into 2023, AA/WARC anticipated the UK ad market to expand by 3.9%, a downgrade of 0.5 percentage points.

Online advertising’s share of spend is set to to grow to a total of 74.0% in 2022, and to cross the three-quarter mark in 2023 (75.23%).

James McDonald, director of data, intelligence & forecasting, WARC commented: “With the economic picture worsening amid ongoing political incertitude, the likelihood of a recession is now higher than when we last assessed market prospects in the summer. Indeed, we have downgraded UK ad market growth expectations for this year and next, in large part to reflect the waning climate.”

He added: “Higher costs are carving into advertisers’ margins and household budgets alike, and trading conditions are at their worst since the Covid outbreak, leading to muted expectations for the Christmas quarter. Against this deteriorating economic backdrop, a 9.2% rise in advertising investment this year would be impressive given that it is near double the average rate of expansion recorded prior to the pandemic.”

OOH and cinema lead sector rebounds after Covid shocks

In Q2 2022, UK adspend grew by 8.8% to £8.6bn, making the total for the first half of the year £16.7bn, an increase of 14.4% year-on-year.

OOH and cinema have rebounded strongly, with 46.4% and 2,208.2% growth respectively over the same period. Cinema’s growth is extraordinary because movie theatres had to stay shut for most of 2021 due to the pandemic.

National newsbrands, magazine brands, and regional newsbrands also recorded positive results with 9.1%, 3.3% and 0.6% growth each.

Meanwhile, TV, which rebounded strongly in 2021 as advertisers began to spend again follow the pandemic crash in 2020, was the only medium that experienced a slight drop in investment during Q2 2022 period (-0.6%). However, spend in broadcaster video-on-demand (BVOD) grew by 9.3%.

A mixed Q4

Looking forward into Q4, where Christmas and the World Cup will fall together for the first time, the report anticipated spend to increase by 4.5% to £9.5bn, a “new record level of investment” after last year’s high.

Within this, search, including ecommerce, will grow the quickest by 7.3% over the quarter, while TV will remain flat and video-on-demand investment is expected to increase by 4.2%.

Adwanted UK is the trusted delivery partner for three essential services which deliver accountability, standardisation, and audience data for the out-of-home industry.

Playout is Outsmart’s new system to centralise and standardise playout reporting data across all outdoor media owners in the UK.

SPACE is the industry’s comprehensive inventory database delivered through a collaboration between IPAO and Outsmart.

The RouteAPI is a SaaS solution which delivers the ooh industry’s audience data quickly and simply into clients’ systems.

Contact us for more information on SPACE, J-ET, Audiotrack or our data engines.