The new economic climate is creating new challenges and opportunities for effectiveness

Opinion: Strategy Leaders

This downturn is different. ‘Economic re-organisation’ is a more helpful description for those looking to tailor their strategies.

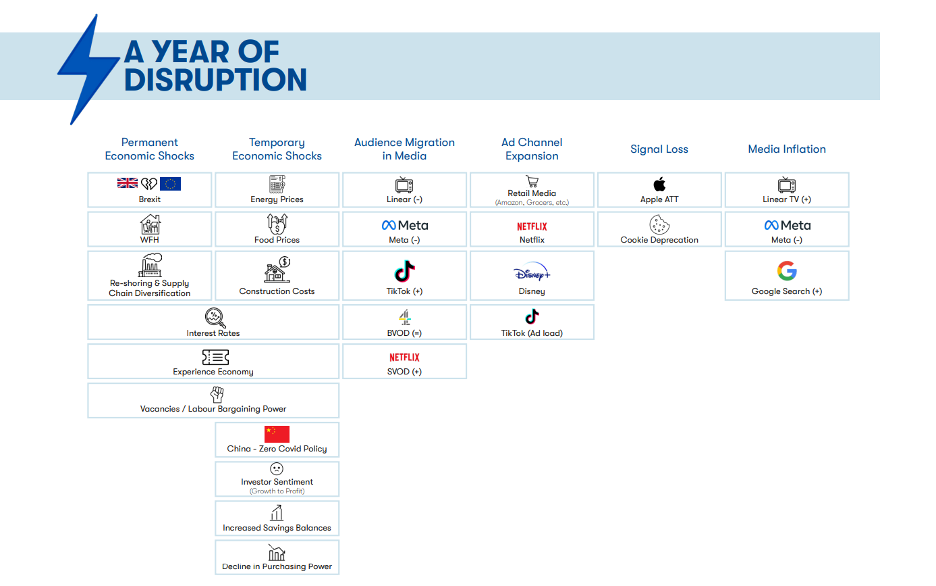

2022 has been defined by unusually independent economic shocks some of which are likely to be permanent, some of which may already have peaked. For advertisers, these have coincided with a media market experiencing significant audience migration, ad channel expansion, cost inflation and signal loss — all taking place against a backdrop of historically low consumer confidence and historically high employment and job vacancies.

A long summer of labour disputes, interest rate rises, political brinkmanship over the cost of living and a historic divergence between Consumer Confidence and Consumer Spending, have characterised an economy that is reeling from competing shocks and how to adapt to them.

The table above summarises more than 20 separate shocks brands must adapt to in the year ahead. The exposure of each of these shocks will be different and will therefore require a unique set of response strategies to be drawn up. The lockdowns of 2020 and 2021 familiarised us with the concept of a ‘K shaped’ recovery and it’s likely the same will be true in reverse as new macroeconomic realities disrupt corporate financing.

What is important to recognise is that while all brands will experience some economic headwinds, these will be felt more heterogeneously than any downturn before and therein – strategic opportunities will be uncovered alongside winners and losers on a new scale.

New challenges and opportunities

On the opposite side of this coin, the incentives have changed for high cash businesses and those with healthy margins. As headline inflation touches double digits, construction commodity and labour costs soar and the stock market outlook remains uncertain, there is a unique set of incentives for cash positive businesses to invest in advertising.

Inflation outstripping interest rates by such a wide margin rewards reinvestment into a business in and of itself but the relative cashflow control and return outlook of advertising vs non advertising investments can put marketers at the top of the queue — if the pitch is right.

Time to re-base marketing’s relationship with finance

The commercial proof for advertising in a downturn is widely acknowledged through various meta analyses, but the difference between theory and practice is significant. Keeping the taps running requires sufficient cashflow or financing to be in place, and for advertisers and agencies to develop close partnerships with their finance teams — creating strategies that are fit for the economic circumstances experienced by the business.

Traditionally, the marketer’s relationship with their finance counterpart is much maligned but economic gravity is such that marketers in many businesses will be pushing at an open door if they can make the right argument. Right now, marketers’ investment pitches enjoy a competitive advantage over other parts of the business with price inflation comparatively moderate and competitors unusually hesitant.

In order to build an irrefutable business case, investment planning rigour is essential. Incumbent approaches such as ‘Advertising as a % of Sales’ and ‘Excess Share of Voice’ have value and have progressed marketing theory — but they are blunt instruments.

Brand and category specific modelling should be considered the cost of entry for investment planning in 2023 and beyond. Profit ROI projections, cashflow forecasts, the cost of going dark, market assumptions and their expected impact as well as risk to plan assessments are all necessary to reassure finance departments and boards in turbulent economic times.

Adopting the language of growth

It has never been more important to position advertising in its rightful place as an investment in future sales. The longer we continue to use self-defeating language such as budget setting and acquisition cost — the longer marketing will be seen by many as a cost centre to be managed and minimised.

In dynamic categories, marketers should adopt the language of growth and demand generation with focus on the breadth of commercial metrics that can be influenced through advertising. In mature or declining categories, marketers should talk directly to the Intangible Asset Value element of the balance sheet and position media investment as an ‘Asset Management’ strategy, necessary to protect and grow the overall value of the business.

Marketers should re-base their competitor sets to take advantage

The scale of current economic shocks is creating new opportunities and threats for marketers across their broad competitor sets. Brands with a first mover advantage on automation will enjoy new competitive advantages versus more labour intensive competitors for example, and brands with resilient supply chains will have a short tactical window in which to grow advertising driven share as constrained competitors scramble to diversify.

Equally, changing investor sentiment and corporate financing is likely to create opportunities for merger and acquisition based growth. It’s a timely exercise to review strengths, weaknesses, opportunities and threats across the broad competitor set and create new share steal and defence strategies as a consequence.

Effectiveness and the channel mix

A changing media landscape on both demand and supply side necessitates new channels and targeting approaches for all advertisers, with signal loss (ATT etc.) amplifying this. In the current climate, there is less margin for error however, and an increased need to de-risk investment through careful testing and experimentation with clear definitions of success. Proper experiment design with a hard link to the business’s strengths, weaknesses, opportunities and threats is essential for preparing evidenced cases for media innovation.

***

We’ve never experienced a combination of factors quite like these before. As advertisers navigate a period of intense economic disruption, opportunities will emerge to compete with new rivals in new ways. The long-term payback of keeping the Share of Voice lights on are well established, but to exploit this, new levels of commerciality are required. Investment planning rigour should be increased and a new level of agility and channel neutrality in trading and planning can help advertisers navigate a downturn like no other.

Billy Ryan is head of analytics at independent media agency the7stars. He writes for The Media Leader each month.

Billy Ryan is head of analytics at independent media agency the7stars. He writes for The Media Leader each month.

Strategy Leaders is our commitment to showcase the media industry’s most important strategy issues and debates, as well as focus on notable ad campaigns and from a media-planning lens.

Sign up for our daily newsletter and receive Strategy Leaders every Thursday.