Retail Media Networks are making big retail even bigger

Opinion

Tech giants will soon have to share their advertising domination with those who have a heritage in the physical world.

Much has been written about Retail Media Networks (RMNs) in the last 12 months. However, little attention has been given to how the ripple effects of this growing medium could reshape the relationships and power dynamics of the media industry at large.

What’s clear is that RMNs are bolstering big retailers’ power. And with this nascent digital market worth €25bn by 2026 in Europe alone, the tech giants will soon have to share their advertising domination with those who have a heritage in the physical world. Predictions reveal that by the end of 2024, Walmart, one of the US brick and mortar giants, will generate more digital ad revenue than Snap, Twitter, and Yahoo, becoming the 8th biggest media company in the US.

As the American author Marilyn Ferguson said, “Power is changing hands, from dying hierarchies to living networks” and Retail Media is a living and breathing example of this.

Buyers become sellers. Sellers become buyers

Negotiations between retailers and suppliers have long existed to gain prime shelf positions and promotions. Traditionally, both have developed a symbiotic relationship for buying and selling, guided by their annual Joint Business Plans (JBP). However, although helpful, it can restrict agility as establishing shelf space, margins, and promotions are agreed upon months in advance of a product landing in store.

The best RMNs allow retailers to sell visibility on their digital shelves with the incredible advantage of real-time, automated bidding on available ad inventory. It gives retailers more leverage and flexibility and gives brands selling on their sites less guarantee of visibility, whilst the introduction of self-serve platforms ensure a longer tail of inventory is filled.

And as marketers face increasing pressure to find the consumers they want to target, we’re seeing this manifest in brands shifting existing budgets towards RMNs to drive sales, despite some concerns over long-term brand building and creativity. According to the ANA, 85% of marketers are already feeling this pressure to invest, whilst 42% of advertisers remain ‘reluctant buyers.’

In the 2000s, many brands worried about their overreliance on retailers, and invested in D2C channels. But it became clear early on that reduced clicks and convenience remained key in the consumer’s mind. As brands tried to take some of the power back, the likes of Amazon ascended the throne, maintaining their grip on consumer demand. Now, this grip is tightening in the post-pandemic world as RMNs bring content and commerce closer together, shortening the path to purchase for customers like never before to become increasingly customer-centric. It is a reign that shows no sign of ending.

The data gold rush

The reality for most consumer packaged goods (CPG) companies is that they don’t have a strong commerce relationship with their consumers. The relationship and its data are often owned by retailers, who have people engaging physically and virtually to discover, shop, rate, and review. Here again, RMNs will only serve to reinforce that.

It’s no coincidence that most retailers have been revamping their loyalty programs and launching apps and new features—the importance of first-party data and having direct relationships with consumers has hit the top of the agenda. Because of this, retailers are already sitting on a pile of gold and are now consolidating this advantage.

Soon we will see them offer highly accurate targeting and be able to show what has been bought, when, and where, and tie it back to a specific campaign to support measurement. The retailers that can harness this wealth, whilst battling concerns over the walled-gardens around data collection and software between each retailer, will become the most sought-after partners.

A digital leapfrog

Frankly, little differentiates most of the mid-tier RMN players. Other than by vertical, they have similar stacks and basic search and offsite offerings—especially at launch. And with 70% of Retail Media linked to on-site search, i.e. sponsored listings on retailers’ search results, the market is still relatively one-dimensional.

But the rapidly growing demand driven by CPG companies focusing their efforts (and money) on the biggest opportunities will put them in pole positions to lead industry-defining evolution with new revenue streams to invest in innovation.

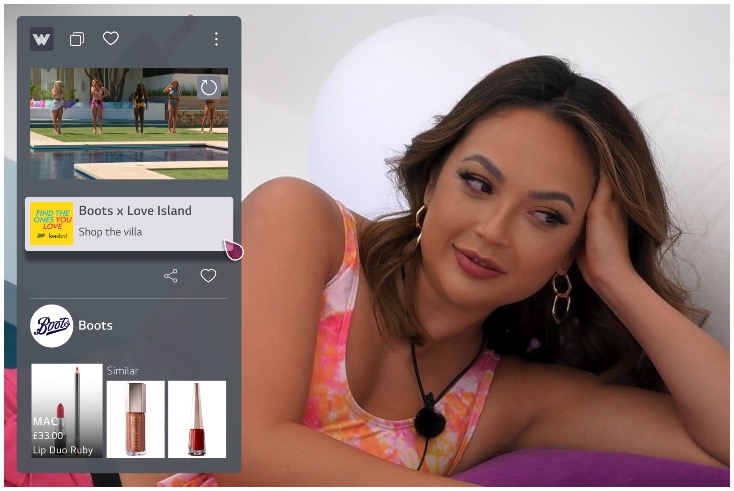

We will soon see more off-platform partnerships, much like the ITV collaborations with Tesco and Boots, to bring better targeting and measurement to its ITVX platform, as well as the creation of connected experiences through social as demonstrated by the latest partnership between Walmart Connect, TikTok, and Snapchat, among others.

Retailers should see this moment as an opportunity to reinvest their Retail Media revenue in enhancing their digital experiences. We will likely see a future where retailers create virtual try-ons of their suppliers’ merchandise, becoming part of a connected experience curated by RMNs to further increase their share of marketers’ budgets. And, ultimately, it is this investment in sophisticated creative ad products that will prove RMNs are worth their brand-building salt and give marketers the technology and access to focus on long term loyalty, not just short term sales.

We are, however, only at the start of this power play. Like the early days of digital advertising when the industry got excited about the seemingly endless opportunities to target consumers, RMNs have a long way to go to fulfil their ambitious promises. For them, it starts with tackling concerns over complexity and establishing standardised metrics. And for us, it starts with not underestimating the change they can have in our industry’s future.

David Muldoon is VP Strategic Advisory at media and marketing consultancy MediaLink

David Muldoon is VP Strategic Advisory at media and marketing consultancy MediaLink