Retail Media Networks: A tale of growth and uncertainty (ANA)

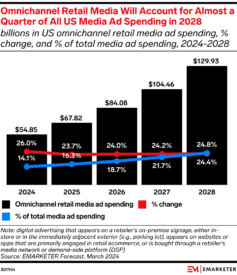

The retail media landscape is experiencing a whirlwind of growth, with ad spending projected to reach nearly $55 billion in the U.S. alone this year, up 26 percent versus last year, according to emarketer. Retail media will represent nearly 1 in every 3 dollars spent on digital advertising by 2028.

However, a new report from the Association of National Advertisers (ANA) reveals a complex picture of a market full of challenges and opportunities. While the temptation of reaching targeted shoppers with rich first-party data is undeniable, marketers are expressing growing concerns about the lack of standardization, measurement, and transparency within the retail media ecosystem. The ANA’s survey, “Retail Media Networks: Optimism Tempered with Caution,” highlights a shift in sentiment compared to previous years.

Marketers cautious amidst rapid growth

Despite the rapid expansion of retail media networks, with over 50 platforms currently operating in the U.S. – including more than 30 launched since 2021 – marketers are becoming more selective in their approach. The report found that the number of marketers adding new RMNs to their plans has plateaued, and there’s even evidence of budget reallocations away from industry leader Amazon Advertising. The number of survey respondents spending on Amazon Advertising, the industry’s leading RMN (accounting for some 77 percent of all retail media spending), has declined since the last survey from 82 percent to just 61 percent.

The primary reason for this caution is the ongoing challenges related to measurement and attribution. Marketers are struggling to accurately measure the impact of their RMN campaigns and compare performance across different platforms. The ANA explains that “when asked about the biggest challenges with retail media, the number one concern in our survey (a big challenge) was lack of standardization across platforms (55 percent), followed by sales attribution (48 percent) and timeliness of data/analytics (40 percent).” The ANA is working closely with the Media Rating Council (MRC) to develop standardized measurement metrics to address this issue.

Beyond the bottom line

While sales remain the primary objective for most RMN campaigns, there’s a growing recognition of the potential for these platforms to drive brand awareness and consideration. The report found that 68% of marketers are already using RMNs for mid- and upper-funnel objectives. And with that, more than half of those surveyed (57 percent) are now spending from 10 to 39 percent of their marketing budgets on retail media, versus 48 percent surveyed a year ago.

This shift in focus is partly driven by the increasing influence of brand marketing teams in RMN planning and execution. As marketers seek to integrate RMNs into their overall marketing strategies, they are demanding more from these platforms.

The future of retail media

The future of retail media is bright, but it’s clear that significant challenges remain. To fully realize the potential of this channel, retailers and platforms must prioritize data transparency, standardized measurement, and address concerns around ad safety.

As the industry continues to evolve, marketers will be looking for RMNs that can deliver measurable results across the entire marketing funnel. Those that can successfully navigate these challenges will be well-positioned to capitalize on the immense growth opportunities in this space.