Where the media R&D cuts are likely to fall this recession

Opinion: Strategy Leaders

Budgets for research and experimentation in emerging platforms might now face the chop, warns Omnicom Media Group’s chief market analyst.

The 2007-2009 Great Recession witnessed the development and launch of many new businesses — some of which are today deemed the most valuable and recognised brands in the world.

WhatsApp, Airbnb, Uber, Instagram and Pinterest — amongst many others — all laid their roots in that economically turbulent era. And although some large brands started using Facebook as early as 2005, it was only at the very end of 2007 that the Facebook Ads platform launched, helping create the behemoth that would dominate the subsequent decade.

Knowing this, and knowing that other downturns have produced similar results throughout history, begs the questions: which fledgling businesses launching today — during a period of record inflation and looming recession — will be household names in future? Which might redefine how we use tech? And which will be indispensable to marketers in just a few years from now?

It’s hard to tell, but it’s one of the reasons marketers use discretionary budgets with which to experiment and learn. No savvy marketer will risk not having already dabbled early in a potential platform, and will shudder at the idea of arriving at the party late and under-prepared.

Yet marketing budgets — like all budgets — are under pressure. And although board rooms now appear to view marketing spend as an investment rather than a cost, sticking with sound marketing theory and best practice, it’s perhaps not true of every aspect of the marketing budget.

The slivers left for research and experimentation in untested and emerging platforms and technologies might now face the chop as all fat is cut for a recession most economists expect to last until at least mid-2023.

Yet in 2022 countless new businesses took flight, be it social media platforms, publisher brands, tech, or anything in between. The path was also paved for new ways of working, such the arrival of cross media measurement, or new media metrics.

Therefore marketers need to forensically understand which emerging trends will be useful for their needs, what impact they might have on their target audiences, and what opportunities might be available to leverage as they grow.

Investment trends

Such a requirement for understanding comes as more than two-thirds of the UK’s largest advertisers state that — despite maintaining some spend in line with best recessionary practice — they will still cut budgets on certain channels next year as the gloomy outlook fuels a strategy shift.

Indeed, last month’s ISBA and Ebiquity survey of 59 UK advertisers found that almost 70% agree or strongly agree that next year’s budget decisions are influenced by the recession, with ISBA director general Phil Smith stating there was a general shift towards more flexibility in spending commitment.

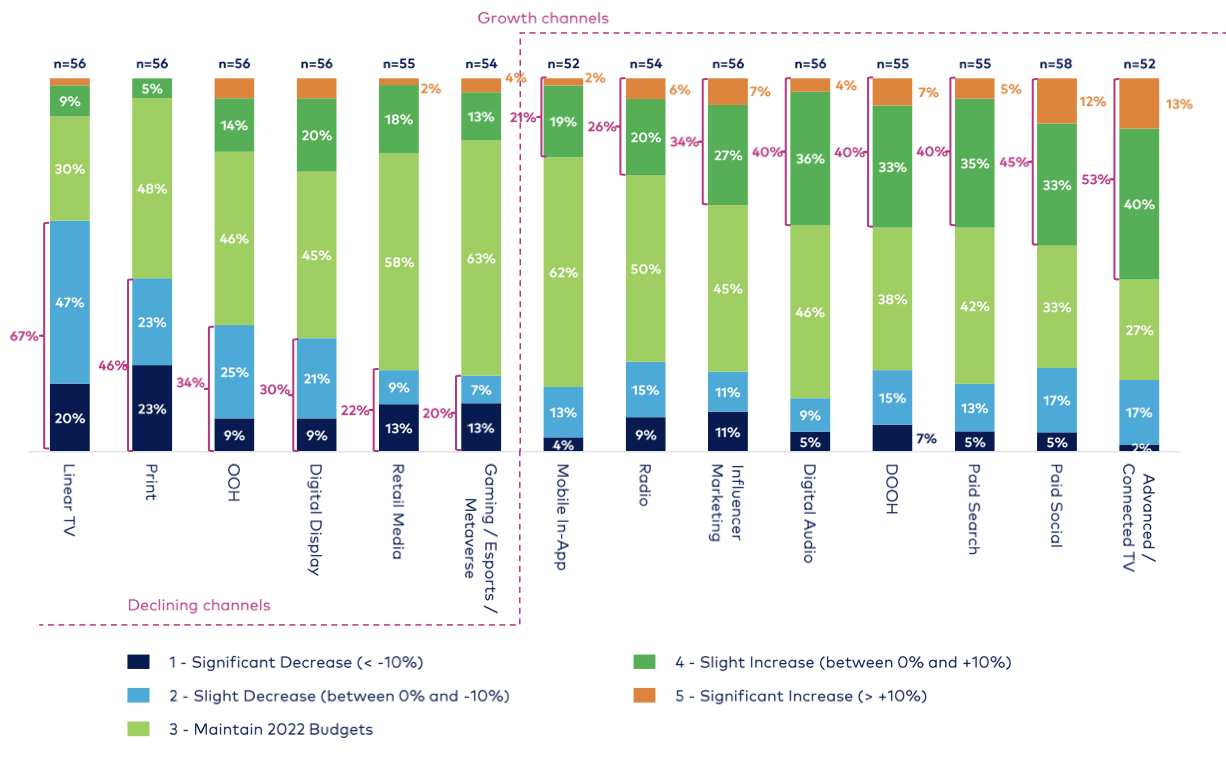

What that translates to is more than 40% of brands stating they intend to cut spend in offline media, with 67% making the deepest cuts in linear TV, while increasing spend in video-on-demand (VOD), radio and some online channels.

This certainly generated headlines, and reveals the very real pressure brands are under, but what was less well covered was the news that experimental channels such as the metaverse and gaming, are also seeing budgets cut in 2023 — by 20% (13% ‘significantly’, 7% ‘slightly’).

Yet OMG’s business intelligence unit has already identified both the metaverse and gaming as significant opportunities for marketers over the medium term. Indeed, in our analysis of 75 evolving themes predicted to rise to prominence by 2025, shows both would scale significantly.

Alongside other areas where brands might cut experimental budgets — such as trialling attention metrics, which we also expect to scale next year — we can quite easily build a picture of where markets are heading alongside current ad investment trends. It suggests marketing teams should be especially cautious in ensuring they are making the right decisions, and at the right time.

What is required, therefore, is a highly judicious approach in detailing the risks of making budgetary strategy shifts. Brands must be certain that if they’re cutting budgets today, they’re trimming the right parts — and that they understand how that might influence future returns.

Good marketing involves a certain level of risk taking, and that is why brands experiment with discretionary budgets in normal times. However, to ensure budget cuts today don’t make any undue strategic mistakes that could impact future gains, it’s best to take advice, don’t make hunches, and try to map future trends and assess their likely impact on consumption habits and business performance.

With so many moveable parts set to redefine the future marketing landscape, and with procurement teams demanding evidence of performance in any investment, it’s vital to allocate budgets with real conviction. Just ensure you’re convinced it’s the right choice — and remember that the world can change drastically after a recession, so be prepared to meet it on the front foot.

Bhavin Balvantrai is chief market analyst at OMG UK