TV advertising shown to make search work harder for online brands

Online-born businesses are increasingly taking to TV advertising as it makes brands more clickable and drives cheaper online journeys, according to a study.

Thinkbox commissioned Magic Numbers, the consultancy founded by economist Dr Grace Kite, to carry out an econometric study of ten anonymised online-born businesses currently using TV advertising to drive growth.

This category of businesses will invest £1bn in TV advertising in the UK, now making them the biggest category of advertiser on TV, Magic Numbers’ research said.

These businesses have increased their investment in advertising on TV by 37% since 2019, according to Nielsen 2021 ad spend data.

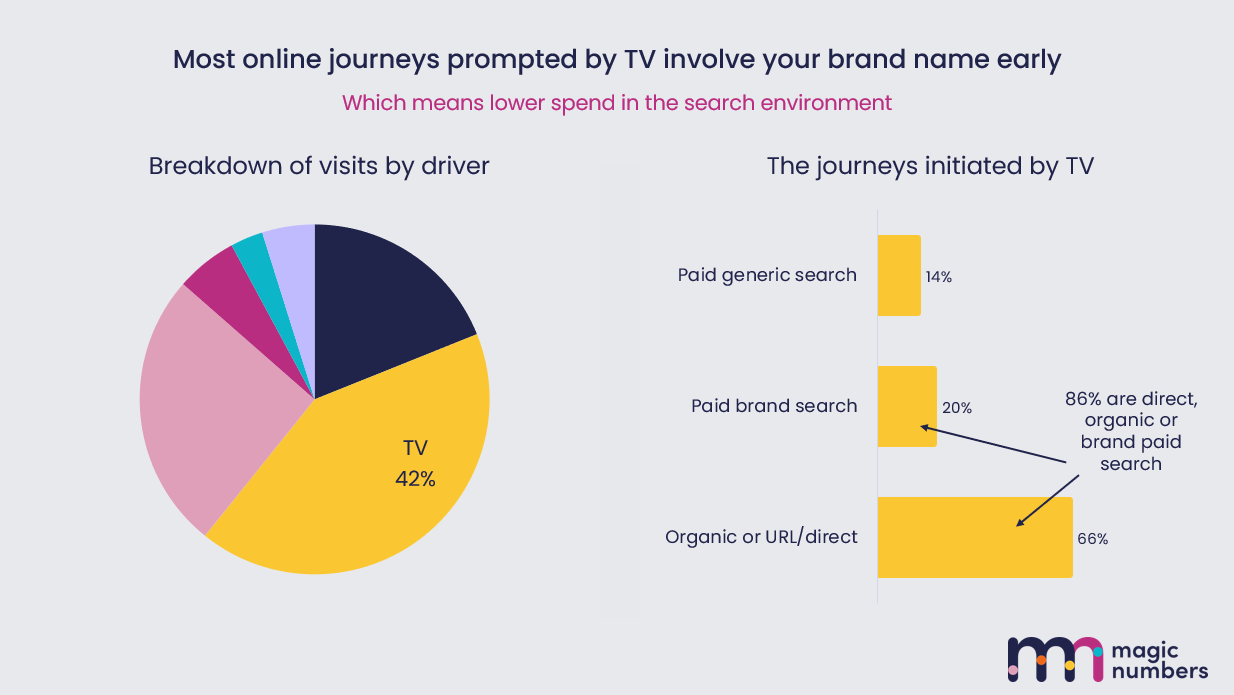

Magic Numbers found through these brands that TV advertising prompts people to search for a brand directly or specifically rather than a category as a whole and has a positive effect on click-through rates on organic and paid search.

The study discovered that, out of all online search journeys started by TV advertising in its research, 66% were direct/URL or organic search visits (with no cost to advertisers). Meanwhile, 20% were paid brand search clicks (with a small cost to advertisers) and 14% were for paid generic searches (with the highest search cost to advertisers).

As for improved click-through rate in organic and paid search, a furniture retailer cited in the report demonstrated that, as TV investment continued over three years, the brand search click rate improved from 37.4% to 38.8%.

Kite said: “Online-born businesses know the importance of marketing. They’ve grown up on search and social and seen in their dashboards just how many sales those channels contribute.

“But even though many of them are now big, most aren’t yet fully comfortable with big-brand marketing strategies like going on TV. And many haven’t started to use econometrics to measure the effect of marketing that isn’t easily trackable.

“That journey is important because, without it, marketing can only contribute so much growth. This study provides the blueprint for success.”

Magic Numbers isolated three signs that an online native brand should next look at TV advertising:

- A brand needs to scale first and fast

- A brand needs to make people understand a new proposition so they are more likely to buy

- A brand has run out of efficient online buys.

The report says individual brand data consistently demonstrated a relationship between TV activity and web traffic.

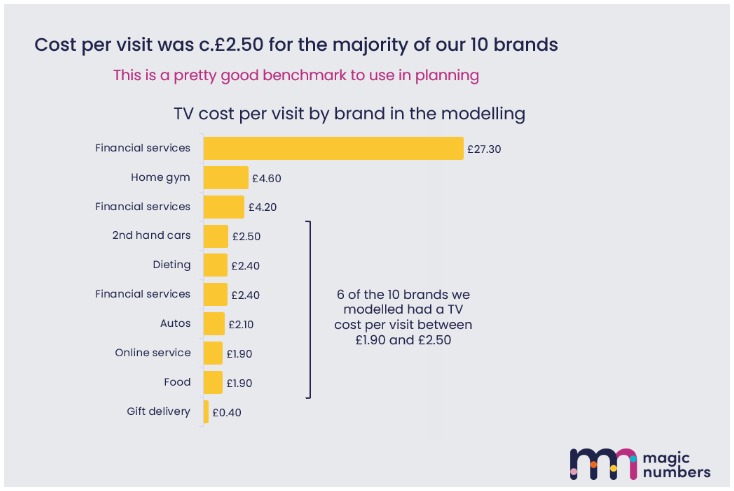

Across the 10 brands modelled, TV was behind 42% of all visits, making up 50 million in total, with an average cost per visit of £2.11.

Six out of 10 brands had a TV cost-per-visit between £1.90 and £2.50 with generic search costs varying from gift delivery to £1- £3 and financial services higher at £5- £11.

Out-of-home advertising, along with brand-focused TV advertising, were found in the study to have the longest-lasting effects on sales with half of sales seen in the first 14 weeks after activation and half seen in the following two years.

“The only way we’re going to get out of this trap of having to keep pushing money in, of 60% of our sales being driven by marketing, is by generating underlying brand awareness, underlying brand strength. The long-term strategic play is that base sales layer to fall back on” said Cheryl Calverley, CEO of direct-to-consumer bedding brand Eve Sleep.

The study also featured qualitative interviews with marketers who have used TV advertising to drive the growth of online brands such as Tom Beardmore, founder of Chamber, Lucas Bergmans, brand director at Cazoo, Xabi Izaguirre, marketing director at Gene; Abba Newbery, CMO of Habito, Chris Seigal, senior director of Harry’s.