Opinion

Radiocentre’s Mark Barber refutes the assertion that, when it comes to measurement, radio could be at a disadvantage compared to digital streamers.

In his article ‘Time for marketers to lead the media measurement debate at Future of Brands’, published in The Media Leader, Omar Oakes highlights how media measurement is a topic which always generates strong views among marketers and media planners, who — entirely understandably — seek greater reassurance that they’re getting what they think they’re buying.

The challenge for media audience measurement suppliers is the constant requirement to adapt with the times, yet maintain robust, transparent, trusted, third-party data that is consistent, comparable, and actionable. Balancing all these requirements is vital in ensuring that everybody’s interests (advertisers and media owners) are best served.

In this context, I must take issue with a “below-the-line commenter”, Nick Drew, referenced in Oakes’ piece that asserts in a comment the single biggest barrier to single-source audio measurement isn’t methodological, but ideological — as illustrated in this quote:

“Radio stakeholders don’t want to measure non-radio content alongside radio content,” he says. “They realise that radio could potentially be at a significant disadvantage when ad buyers are able to see individual stations measured side by side, apples to apples, against digital behemoths like Spotify.”

Now, don’t get me wrong, I think it’s fine for people to be provocative in questioning the status quo… but only if they’ve done their homework first! And that’s particularly important in this instance, because the facts simply don’t support the opinion – which, as I’ll demonstrate, is not just factually incorrect but also highly misleading.

Ideologically sound

So let’s take each of these points in turn, starting with “Radio stakeholders don’t want to measure non-radio content alongside radio content”.

Rajar’s sister survey Midas has been capturing headline listening data for podcasts and on-demand music services in addition to radio for the last decade or so. Rajar makes these findings publicly available via their website. Midas data is also used by the Internet Advertising Bureau as the gold standard by which the scale of — and trends in — digital audio listening are monitored.

So there you have it – assertion number one discounted! The fact is that UK radio operators have been measuring listening to non-radio content in a way that is directly comparable to listening to radio content for almost as long as these other audio services have been available.

As the only single-source UK survey providing comparable listening data and trends over time for the full range of audio services, I can only assume that the commenter (among others) is unaware of Midas. This raises a fair question about whether the audio industry could make better use of this robust and valuable dataset.

We certainly try our best from a radio perspective, using Midas data to understand and report on evolutions in listening behaviour within the overall audio market. However, my sense is that this effort isn’t fairly reciprocated by the pure-play digital audio industry. Having said that, I can understand why the reality of the data revealed by Midas might prevent it from being embraced as enthusiastically by audio suppliers weaned on quantifying audience scale based on, for example, Monthly Active Users.

Listening by numbers

And that leads me neatly onto specifically addressing the second assertion: “… radio could potentially be at a significant disadvantage when ad buyers are able to see individual stations measured side by side, apples to apples, against digital behemoths like Spotify.”

While Midas doesn’t capture radio listening on a station-by-station basis, it does allow us to compare apples with apples by considering all radio listening side-by-side with all listening to streamed music services.

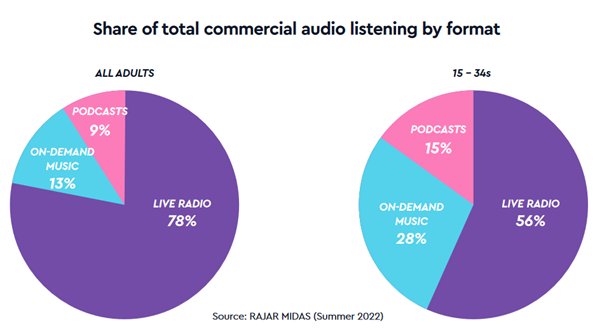

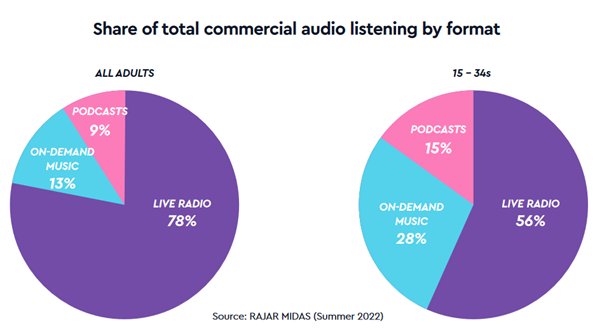

And when we focus on commercial listeners only, i.e. audiences to commercial radio services and non-paying/ad-funded subscribers to streamed music services (audiences available for advertisers to buy), Midas (Summer 2022) reveals the stark reality that total adult listening to live commercial radio is six times greater than all commercial streamed music audiences combined. It’s true that the pattern is different among younger audiences, but even among 15-34s commercial radio listening is double the scale of commercial streamed music services.

Click to enlarge

Many digital-first thinkers find facts such as these difficult to digest. To help address the cognitive dissonance experienced by many who aren’t steeped in the world of radio/audio, Radiocentre worked with independent research agency Differentology to help move audio insight on from just numbers on a page to reveal the thoughts, feelings, and faces of those who matter most: the listeners.

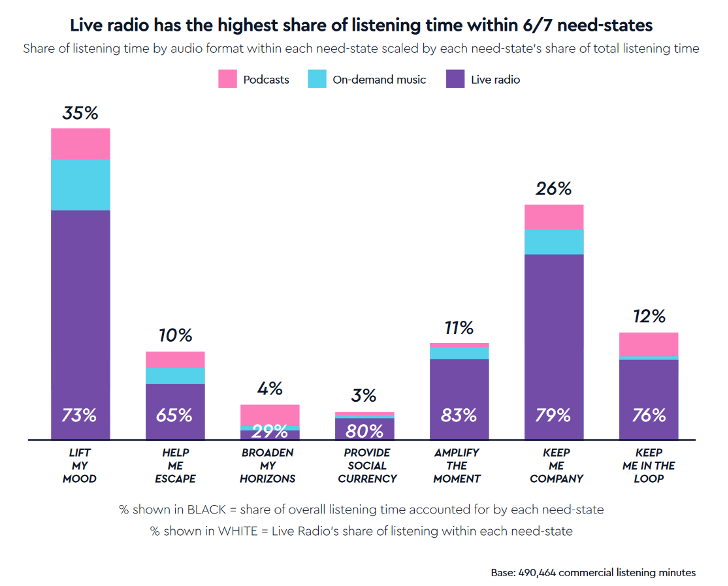

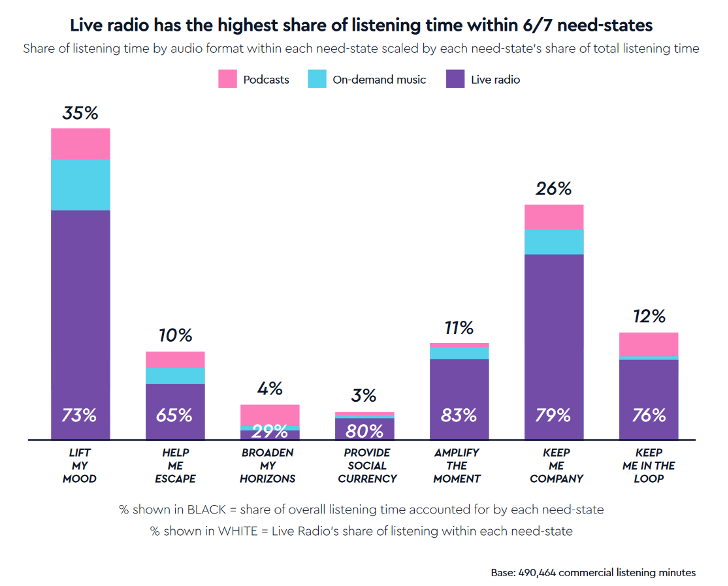

Beyond highlighting the impressive headline growth in (and critical mass of) total commercial audio listening, Generation Audio explored people’s reasons for listening, revealing seven emotional need-states that audio entertainment fulfils. The analysis reaffirms how live radio and on-demand audio services aren’t directly competing for share-of-ear but playing complementary roles in listeners’ lives – which in turn is helping to grow the overall commercial audio audience. Happy days for advertisers!

The data reveals that Live Radio leads listening time and delivers the highest audience reach within six of these seven audio need-states, underpinning why it remains the most widely listened-to form of audio entertainment at a headline level – and, therefore, why it continues to play a crucial role for audio advertisers.

Click to enlarge

Sounding off

In summary, the UK radio industry has been investing in comparable audience data for new audio services almost as long as they’ve been around, and this data highlights how dominant live radio remains within the audio mix.

Based on the facts and data outlined in this article, if there are any issues with provision of robust, transparent, trusted, third party-supplied, consistent, and comparable, audio audience data, then it’s not unreasonable to conclude that these reside with the pure-play audio suppliers, not radio broadcasters.

Mark Barber is planning director at Radiocentre.

Mark Barber is planning director at Radiocentre.

Adwanted UK are the audio experts operating at the centre of audio trading, distribution and analytic processing. Contact us for

more information on J-ET, Audiotrack or our RAJAR data engine. To access our audio industry directory, visit

audioscape.info and to find your new job in audio visit

The Media Leader Jobs, a dedicated marketplace for media, advertising and adtech roles.

Mark Barber is planning director at Radiocentre.

Mark Barber is planning director at Radiocentre.