IPA Bellwether Q3 2022: TV and radio in firing line amid marketer 'retrenchment'

Main media marketing budgets are being revised downwards for the first time since the beginning of 2021, according to the latest Bellwether survey.

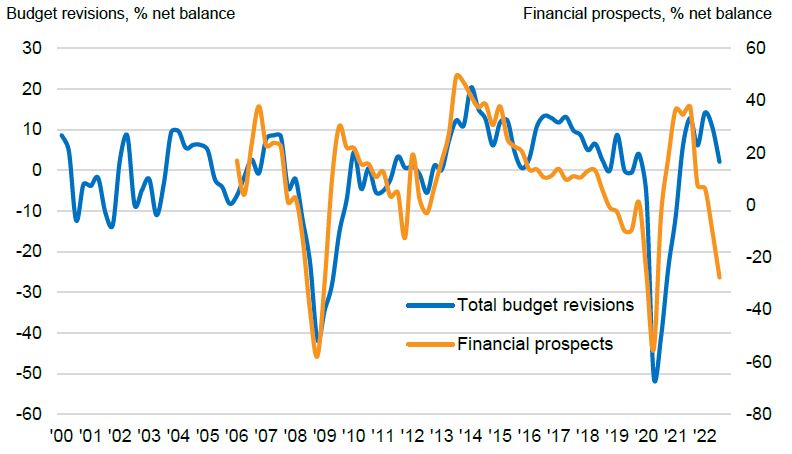

While overall marketing budgets have increased over the last quarter, they did so at the slowest rate since the beginning of last year as the advertisers expect the UK to go into recession.

The latest quarterly IPA Bellwether report revealed rising pressure on costs, energy bills, general prices for goods and services, and profit margins are chief among the challenges faced by businesses, along with high inflation limiting consumers’ purchasing power and suppressing demand.

The imminence of a recession was noted by many participants, however, the Bellwether anticipated it is likely to have started in the third quarter but will be “short and shallow” because of the UK government’s energy support package, resulting in an upgrade in 2022 adspend from 1.6% to 3.7%.

The financial outlook for the respondents’ industry and own companies is more pessimistic than previous quarters, a net balance of -45% and -28% respectively, both at their lowest points since Q2 2020.

Nearly a quarter of companies surveyed (22.2%) had increased their total market budgets in the third quarter of this year, and despite “more challenging economic conditions” some respondents noted efforts to continue investing in “new innovative methods” to promote products or services and retain market share would continue. Visibility in digital channels was highlighted as frequently mentioned.

Joe Hayes, senior economist at report publishers S&P Global Market Intelligence, said: “UK companies were able to squeeze out another round of marketing budget growth in the third quarter, although momentum has faded quite significantly since the first half of 2022 as the broader economic picture has darkened.”

He added: “Budget cuts are being seen across the majority of the monitored segments of marketing spend as companies move into retrenchment mode due to soaring costs and slowing demand. The cost-of-living crisis will continue to weigh on household earnings throughout the winter, meaning discretionary spending cutbacks are inevitable for the UK’s low-to-middle income groups that are at the heart of the economy.”

These reduction in spends clearly point to anxiety and caution in the system, warned the media agency UM’s managing partner Michael Brown. He told The Media Leader: “These are complex and turbulent times: inflation alone, both from an economical and media perspective, represent big challenges.

“Now more than ever, we absolutely must double-down on the role for media and brands to make a difference in society. Key to this is magnifying insight: hearing directly from communities about their experiences and needs, and responding to those in real time, so ensure messages are tailored and tonally sensitive. Media in tough times must have utility of some kind: whether that’s to deliver value, entertainment, or connection.”

‘Encouraging’ that main media budgets will only fall 3%

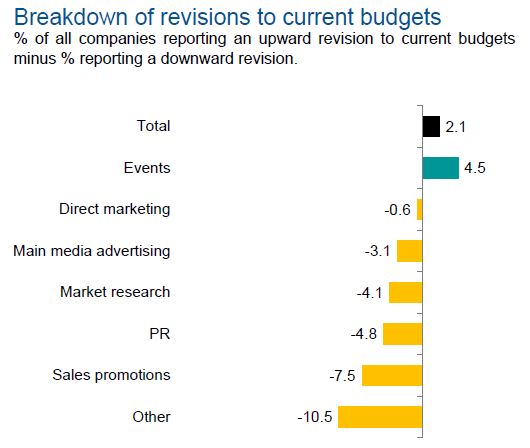

Slightly more than one in five companies (20.1%) recorded budget cuts, which resulted in a “weak” positive net balance of 2.1%, down from 10.8% in the second quarter.

Events was the only section of marketing budgets to register an increase of 4.5%, compared to 22.2% in the last Bellwether report.

Main media marketing budgets, including big-ticket ad campaigns on TV and radio, fell for the first time since Q1 2021 to -3.1%. Within this, published brands registered net balances of -11.2%, out of home -7.6%, audio -2.0%, compared to -2.6%, -15.9% and -16.4% in the previous quarter.

Other online advertising went from a net balance of 9.3% in Q2 2022 to 4.4% in Q3 2022, while growth in video slowed from 8.7% to 0.8%.

Havas Media Group UK’s head of planning Jackie Lyons described the 3.1% fall as “promising”, given that advertisers have faced significant pressure on internal cost and fluctuating consumer demand.

However, a key watch-out is where spend is increasing,” Lyons warned. “Recessionary times can influence a short-term media culture. The 9.3% increase in “other online” could be a knee-jerk reaction to seeking deceptively cheaper reach and diverting budget from more effective channels.

“In signs of greenshoots, though, +8.6% of companies anticipating budget growth in market research and 8.7% in video shows some are investing in both research and measurement and into the right high-attention, highly-effective channels — both of which are key to riding out recessionary environments on top.”

Flat adspend growth expected in 2023

Barry Cupples, group chief executive of Talon Outdoor, said: “It is encouraging to see the Bellwether upwardly revise 2022 adspend growth forecast to 3.7% and pleasing that Out of home (OOH) has gained share compared to last quarter. It’s never been more important to make marketing spend work as hard as possible during this economic instability and with the festive period and the World Cup around the corner, brands will be under more pressure to ensure their messages get cut through during this time.”

Looking forward, companies saw opportunities for products and services in the sustainability and eco-friendly space, like energy-saving goods and services, and other offerings to help mitigate climate change.

Many companies highlighted their concerns around high energy costs and gas prices from Russia’s invasion of Ukraine, and the growing cost-of-living crisis from rising household bills and general inflation affecting consumer purchasing power.

However, the government mishandling of economic policy has also exacerbated the drives behind the latest round of budget cuts, indie agency Bountiful Cow’s head of activation Ian Daly said.

“Still, there are lessons to be learned from the government’s recent actions, not least when it comes to high pressure decision making,” Daly said. “Be it cutting budgets or reallocating spend, marketers should be wary of going ‘too far, too fast’, and should instead focus on the ongoing value of their advertising investment.”

Further ahead, adspend growth predictions in 2023 were slightly decreased from 0.8% to 0.3%, while the report was “slightly more bullish” about 2024 adspend, increasing it from 1.4% to 1.6%.

GDP growth forecast for next year was downgraded from 0.5% to 0.3% because of high inflation.

The Bellwether Report is researched and published by S&P Global on behalf of the IPA based on a survey of 300 UK marketers representing key business sectors mostly from the country’s top 1,000 companies.