Bellwether: main media budgets grow despite looming UK recession

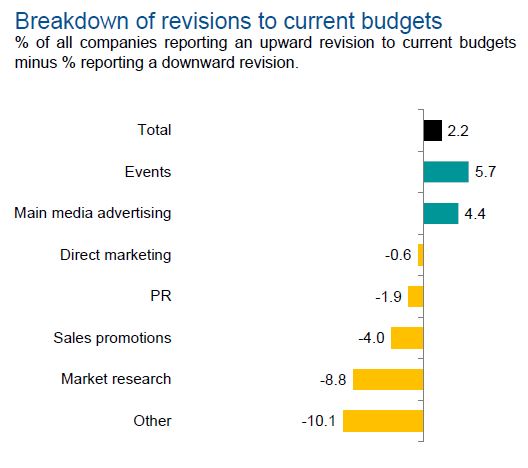

Total marketing budgets were revised upward 2.2% in the IPA’s latest Bellwether report, led by a return to growth for main media marketing (+4.4%) and the continued growth in events (+5.7%).

It is a welcome change from the previous quarter, which saw main media marketing budgets decline (-3.1%). It is the first time since Q1 2022 that main media marketing budgets have been upwardly revised.

Growth in main media in Q4 2022 was driven primarily by upward revisions in video (+13.7%) and other online (+6.3%), whereas audio budgets were unchanged after falling 2.0% in Q3.

Meanwhile, published brands and out-of-home (OOH) saw declines of -3.9% and -11.2%, respectively. That is a deceleration of decline for published brands (-11.2% in Q3 2022 vs. -3.9% in Q4) and an acceleration for OOH (-7.6% in Q3 2022 vs. -11.2% in Q4).

Negative budgeting trends continued outside of main media and events. Direct marketing saw a marginal reduction (-0.6%); PR budgets saw a modest cut (-1.9%); sales promotions budgets dropped (-4.0%); and market research (-8.8%) and other marketing activities (-10.1%) saw larger contractions.

‘A generally held belief that this recession will be short and sharp’

However, in an optimistic sign for the media industry, preliminary marketing budgets for 2023-2024 were strongly positive. Nearly four in 10 (39.5%) companies surveyed by the IPA said they expect their total marketing budgets to increase, while 15.3% anticipate spending cuts (net +24.2%).

Optimism was particularly high for the continued growth of events (+18.0%) as companies continue to re-engage with clients face-to-face, as well as main media marketing (+13.4%).

Phil Hall, CEO of Ocean Outdoor UK, noted that such positivity in the face of a recessionary environment feels unique.

“It’s a truism that the advertising market moves in tandem with the macroeconomic market, but currently, for the first time in living memory, there seems to be a disconnect between the two,” he said.

Hall added that “a generally held belief that this recession will be short and sharp and that growth will return in H2” may be helping to buoy the ad market, and that “any dissipation of the headwinds of Ukraine and inflation would likely spark a surge in spend, not just for OOH but for the whole market.”

The OOH market saw impressive year-over-year growth in Q3 2022, despite Q4’s reported budget contractions.

Though companies reported the cost-of-living crisis as a major potential threat, the report highlighted that some companies are planning to take a more pro-active approach during the currently uncertain macroeconomic environment, hoping that doing so will present an opportunity to obtain market share from more hesitant competitors.

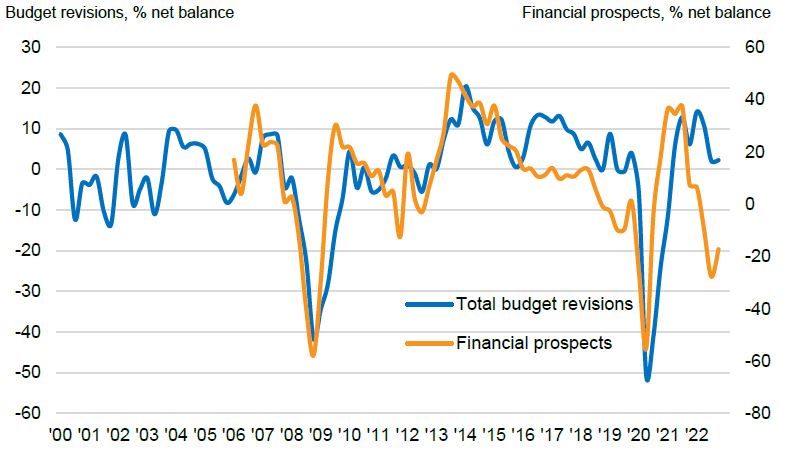

That comes despite general pessimism about business sentiment: 41.8% of respondents said their industry’s financial prospects have worsened in Q4 2022 compared to the prior quarter.

This dwarfed the number of companies (8.7%) that were optimistic about the outlook of their sector. However, it does represent a marked net improvement on negativity from Q3 (-33.2% net negative vs. -44.3% net negative in Q3 2022).

Touching on the negative business sentiment, Havas Media Group’s head of planning Jackie Lyons noted that “behind the (relative) headline optimism is the more pressing fact that this is the second most pessimistic bellwether report since Q2 2020 – peak pandemic. […] The good news is that advertisers are planning to hold their nerve and continue to invest in advertising despite pressures from prices rise and decreasing purchase power.”

“All the same, the bigger question will be which comms they invest in. At times like this it can be tempting to build media plans with cheaper media plans that ‘keep the lights on’, so to speak. For many brands with price increases a high equity strategy centred in lasting effects rather than short-term cheap reach will have the greatest impact. On squeezed budgets this might mean fewer but better, braver campaigns – and a leaner, more innovative and effective industry might be a positive legacy to come out of all of this.”

‘Apparent tension’

Paul Bainsfar, the IPA’s director general added that companies that are concerned about losing market share to competitors have either maintained or increased their spend accordingly, indicating that marketing is “being used both defensively and offensively”.

Elliott Millard, head of planning at Wavemaker UK, commented on the uncertainty shown in the report: “There is an apparent tension in the Bellwether data; respondents are simultaneously pessimistic about the financial situation of the UK and their own businesses whilst optimistic about their ability to invest in marketing.”

However, he added that such tension can be reconciled by looking at the areas of forecasted investment.

“The industry is so often focused on topline growth that we forget the power of marketing to impact price sensitivity. When consumer spending is squeezed at the same time as supply chain constraints and increasing cost of production, it is arguably more important to defend price premium for profit than topline growth.

“This is reflected in the mediums that are seeing the most growth. Events, for example, help to drive trial and maintain a premium proposition. Broadcast media, especially video, can create a shared belief in a brand’s power, making downtrading or private label alternatives less appealing. In this way, that apparent tension is actually a pragmatic and strategic approach to maintaining overall profitability in tough times.”

The Bellwether Report is researched and published by S&P Global on behalf of the IPA, and is based on a survey of 300 UK marketers representing key business sectors mostly from the country’s top 1,000 companies.